You are a new hire at Laurel Woods Real Estate, which specializes in selling foreclosed homes via public auction. Your boss has asked you to use the following

You are a new hire at Laurel Woods Real Estate, which specializes in selling foreclosed homes via public auction. Your boss has asked you to use the following

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Topic Video

Question

100%

You are a new hire at Laurel Woods Real Estate, which specializes in selling foreclosed homes via public auction. Your boss has asked you to use the following data (mortgage balance, monthly payments, payments made before default, and final auction price) on a random sample of recent sales to estimate what the actual auction price will be.

| Loan ($) | Payments ($) | Payments Made | Auction ($) |

| 85600 | 985.87 | 1 | 16900 |

| 115300 | 902.56 | 33 | 75800 |

| 103100 | 736.28 | 6 | 43900 |

| 84600 | 945.45 | 9 | 16600 |

| 97600 | 821.07 | 24 | 40700 |

| 104400 | 983.27 | 26 | 63100 |

| 113800 | 1075.54 | 19 | 72600 |

| 116400 | 1087.16 | 35 | 72300 |

| 100000 | 900.01 | 33 | 58100 |

| 92800 | 683.11 | 36 | 37100 |

| 105200 | 915.24 | 34 | 52600 |

| 105900 | 905.67 | 38 | 51900 |

| 94700 | 810.7 | 25 | 43200 |

| 105600 | 891.33 | 20 | 52600 |

| 104100 | 864.38 | 7 | 42700 |

| 85700 | 1074.73 | 30 | 22200 |

| 113600 | 871.61 | 24 | 77000 |

| 119400 | 1021.23 | 58 | 69000 |

| 90600 | 836.46 | 3 | 35600 |

| 104500 | 1056.37 | 22 | 63000 |

GIVEN - ALL CORRECT:

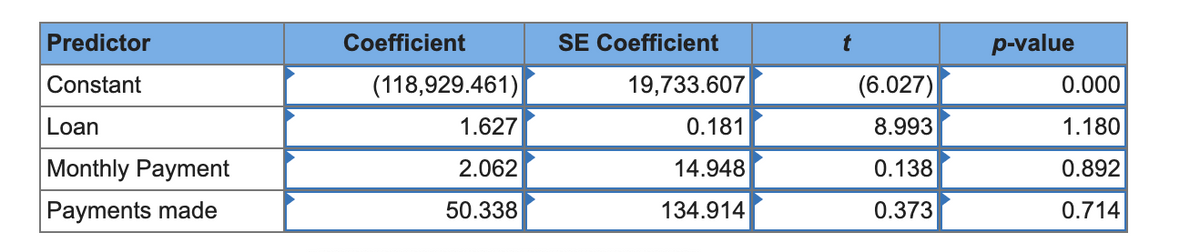

- Auction price =(118,929.46)+1.63 Loan +2.06 Monthly payment +50.34 Payments Made.

-

ANOVA

Source DF SS MS F p-value Regression 3 5,966,725,061 1,988,908,354 39.83 0 Residual Error 16 798,944,439 49,934,027 Total 19 6,765,669,500 - The excel data table is attached at the bottom (It is also correct).

FIND:

State the decision rule to test the significance of each regression coefficient. Use α = 0.05.

- Reject t< _____________ or t> ______________

Transcribed Image Text:Predictor

Coefficient

SE Coefficient

p-value

Constant

(118,929.461)

19,733.607

(6.027)

0.000

Loan

1.627

0.181

8.993

1.180

Monthly Payment

2.062

14.948

0.138

0.892

Payments made

50.338

134.914

0.373

0.714

Expert Solution

Step 1

From the given information, the estimated auction price is,

Auction price =(118,929.46)+1.63 Loan +2.06 Monthly payment +50.34 Payments Made.

The Anova table is displayed below .

-

ANOVA

Source DF SS MS F p-value Regression 3 5,966,725,061 1,988,908,354 39.83 0 Residual Error 16 798,944,439 49,934,027 Total 19 6,765,669,500

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman