hignment 42 pd Adobe Acrobat Reader DC (32-b Edit View Sign Window Help Home Tools assignment 4-1.pdf assignment 4-2.pdf x 1/1 Prepare adjusting journal entries for the year ended December 31, 2011, for each of the inde. pendent situations in (a) to (f). Assume that prepaid expenses are initially recorded in asset accounts. Assume that fees collected in advance of work are initially recorded as liabiities. a. Depreciation on the company's equipment for 2011 was estimated to be $32,000. b. The Prepaid Insurance account had a $14,000 debit balance at December 31, 2011, before adjusting for the costs of any expired coverage. An analysis of the company's insurance poli- cies showed $2,080 of unexpired insurance remaining. c. The Office Supplies account had a $600 debit balance on January 1, 2011; $5,360 of office supplies were purchased during the year; and the December 31, 2011, count showed that $708 of supplies are on hand. d. Two-thirds of the work for a $30,000 fee received in advance has now been performed. e. The Prepaid Insurance account had an $11,200 debit balance at December 31, 2011, before adjusting for the costs of any expired coverage. An analysis of the cies showed that $9,200 of coverage had expired. f. Wages of $8,000 have been earned by workers but not paid as of December 31, 2011. g. Record the January 6, 2012, payment of $20,000 in wages, inclusive of the $8,000 December 31, 2011, accrual in (f) above. mpany's insurance poli- Enviro Wacto'r una- ASUS

hignment 42 pd Adobe Acrobat Reader DC (32-b Edit View Sign Window Help Home Tools assignment 4-1.pdf assignment 4-2.pdf x 1/1 Prepare adjusting journal entries for the year ended December 31, 2011, for each of the inde. pendent situations in (a) to (f). Assume that prepaid expenses are initially recorded in asset accounts. Assume that fees collected in advance of work are initially recorded as liabiities. a. Depreciation on the company's equipment for 2011 was estimated to be $32,000. b. The Prepaid Insurance account had a $14,000 debit balance at December 31, 2011, before adjusting for the costs of any expired coverage. An analysis of the company's insurance poli- cies showed $2,080 of unexpired insurance remaining. c. The Office Supplies account had a $600 debit balance on January 1, 2011; $5,360 of office supplies were purchased during the year; and the December 31, 2011, count showed that $708 of supplies are on hand. d. Two-thirds of the work for a $30,000 fee received in advance has now been performed. e. The Prepaid Insurance account had an $11,200 debit balance at December 31, 2011, before adjusting for the costs of any expired coverage. An analysis of the cies showed that $9,200 of coverage had expired. f. Wages of $8,000 have been earned by workers but not paid as of December 31, 2011. g. Record the January 6, 2012, payment of $20,000 in wages, inclusive of the $8,000 December 31, 2011, accrual in (f) above. mpany's insurance poli- Enviro Wacto'r una- ASUS

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 1.5C

Related questions

Question

Transcribed Image Text:Agnment 4-2pdl - Adobe Acrobat Reader DC (32-bit)

File Edit View Sign Window Help

Tools

assignment 4-1.pdf

assignment 4-2.pdf x

Home

玩,日

日2 在》

1/1

180%

回☆ 日Q

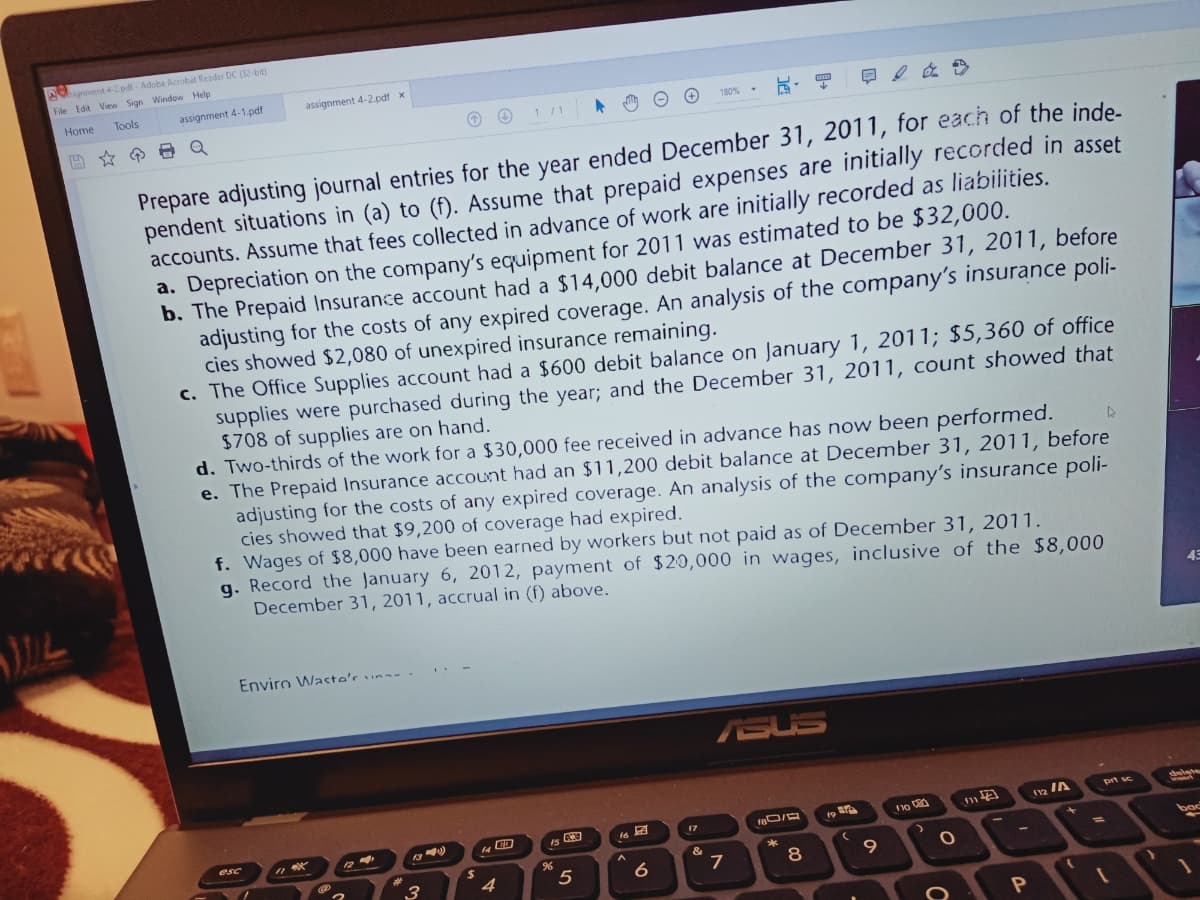

Prepare adjusting journal entries for the year ended December 31, 2011, for each of the inde.

pendent situations in (a) to (f). Assume that prepaid expenses are initially recorded in asset

accounts. Assume that fees collected in advance of work are initially recorded as liabilities.

a. Depreciation on the company's equipment for 2011 was estimated to be $32,000.

b. The Prepaid Insurance account had a $14,000 debit balance at December 31, 2011, before

adjusting for the costs of any expired coverage. An analysis of the company's insurance poli-

cies showed $2,080 of unexpired insurance remaining.

c. The Office Supplies account had a $600 debit balance on January 1, 2011; $5,360 of office

supplies were purchased during the year; and the December 31, 2011, count showed that

$708 of supplies are on hand.

d. Two-thirds of the work for a $30,000 fee received in advance has now been performed.

e. The Prepaid Insurance account had an $11,200 debit balance at December 31, 2011, before

adjusting for the costs of any expired coverage. An analysis of the company's insurance poli-

cies showed that $9,200 of coverage had expired.

f. Wages of $8,000 have been earned by workers but not paid as of December 31, 2011.

g. Record the January 6, 2012, payment of $20,000 in wages, inclusive of the $8,000

December 31, 2011, accrual in (f) above.

Enviro Waste's una-

ASUS

prt sc

12 IA

17

esc

bac

3

5

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage