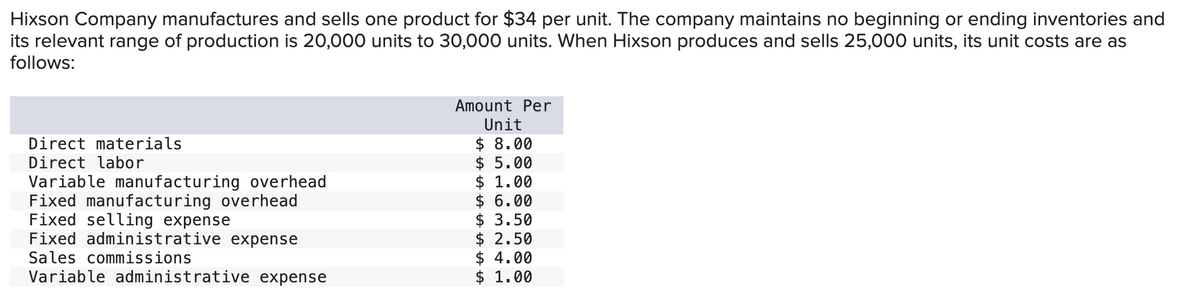

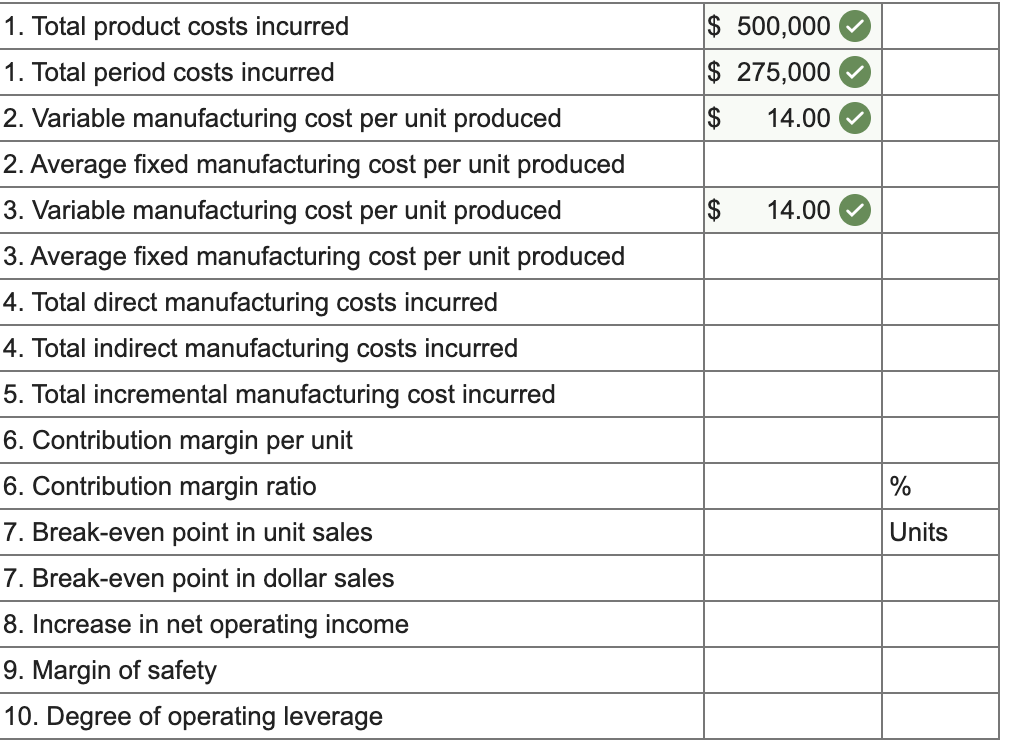

Hixson Company manufactures and sells one product for $34 per unit. The company maintains no beginning or ending inventories and its relevant range of production is 20,000 units to 30,000 units. When Hixson produces and sells 25,000 units, its unit costs are as follows: Amount Per Unit Direct materials $ 8.00 Direct labor $ 5.00 Variable manufacturing overhead $ 1.00 Fixed manufacturing overhead $ 6.00 Fixed selling expense $ 3.50 Fixed administrative expense $ 2.50 Sales commissions Variable administrative expense $ 4.00 $ 1.00 1. Total product costs incurred 1. Total period costs incurred 2. Variable manufacturing cost per unit produced 2. Average fixed manufacturing cost per unit produced 3. Variable manufacturing cost per unit produced 3. Average fixed manufacturing cost per unit produced 4. Total direct manufacturing costs incurred 4. Total indirect manufacturing costs incurred 5. Total incremental manufacturing cost incurred 6. Contribution margin per unit 6. Contribution margin ratio 7. Break-even point in unit sales 7. Break-even point in dollar sales 8. Increase in net operating income 9. Margin of safety 10. Degree of operating leverage $ 500,000 $ 275,000 $ 14.00 14.00 % Units

1. For financial accounting purposes, what is the total amount of product costs incurred to make 25,000 units? What is the total amount of period costs incurred to sell 25,000 units?

2. If 24,000 units are produced, what is the variable manufacturing cost per unit produced? What is the average fixed manufacturing cost per unit produced? (Round your answers to 2 decimal places.)

3. If 26,000 units are produced, what is the variable manufacturing cost per unit produced? What is the average fixed manufacturing cost per unit produced? (Round your answers to 2 decimal places.)

4. If 27,000 units are produced, what are the total amounts of direct and indirect

5. What total incremental manufacturing cost will Hixson incur if it increases production from 25,000 to 25,001 units? (Round your answer to 2 decimal places.)

6. What is Hixson’s contribution margin per unit? What is its contribution margin ratio? (Round "Contribution margin per unit" to 2 decimal places and "Contribution margin ratio" to 1 decimal place.)

7. What is Hixson’s break-even point in unit sales? What is its break-even point in dollar sales? (Do not round your intermediate values.)

8. How much will Hixson’s net operating income increase if it can grow production and sales from 25,000 units to 26,500 units?

9. What is Hixson’s margin of safety at a sales volume of 25,000 units? (Do not round your intermediate values.)

10. What is Hixson’s degree of operating leverage at a sales volume of 25,000 units?

Unlock instant AI solutions

Tap the button

to generate a solution