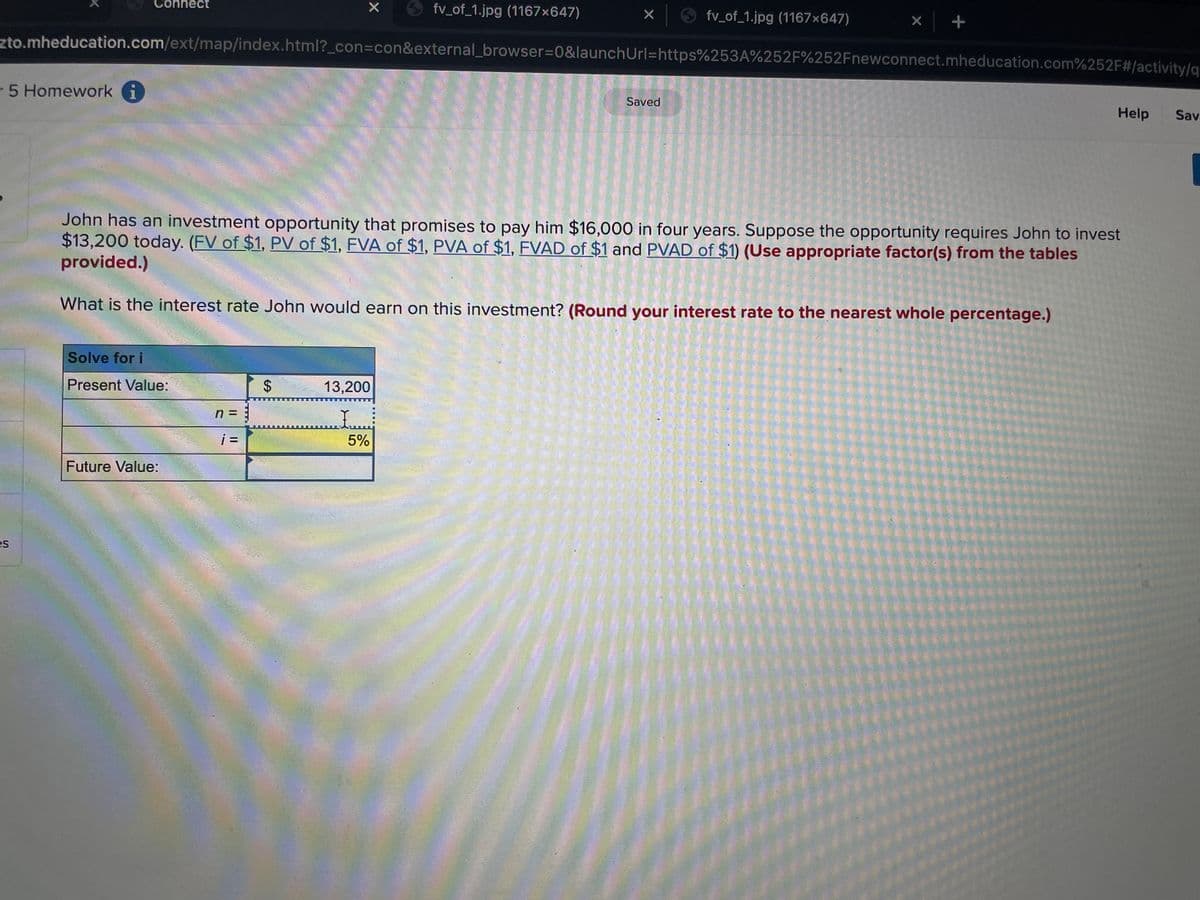

Homework Saved Help John has an investment opportunity that promises to pay him $16,000 in four years. Suppose the opportunity requires John to invest $13,200 today. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) What is the interest rate John would earn on this investment? (Round your interest rate to the nearest whole percentage.) Solve for i Present Value: 2$ 13,200 n = 5% Future Value:

Homework Saved Help John has an investment opportunity that promises to pay him $16,000 in four years. Suppose the opportunity requires John to invest $13,200 today. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) What is the interest rate John would earn on this investment? (Round your interest rate to the nearest whole percentage.) Solve for i Present Value: 2$ 13,200 n = 5% Future Value:

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 2.1C

Related questions

Question

Transcribed Image Text:Connect

fv_of_1.jpg (1167x647)

O fv of_1.jpg (1167×647)

zto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/g

-5 Homework i

1

Saved

Help

Sav

John has an investment opportunity that promises to pay him $16,000 in four years. Suppose the opportunity requires John to invest

$13,200 today. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables

provided.)

What is the interest rate John would earn on this investment? (Round your interest rate to the nearest whole percentage.)

Solve for i

Present Value:

13,200

n = :

i =

5%

Future Value:

es

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you