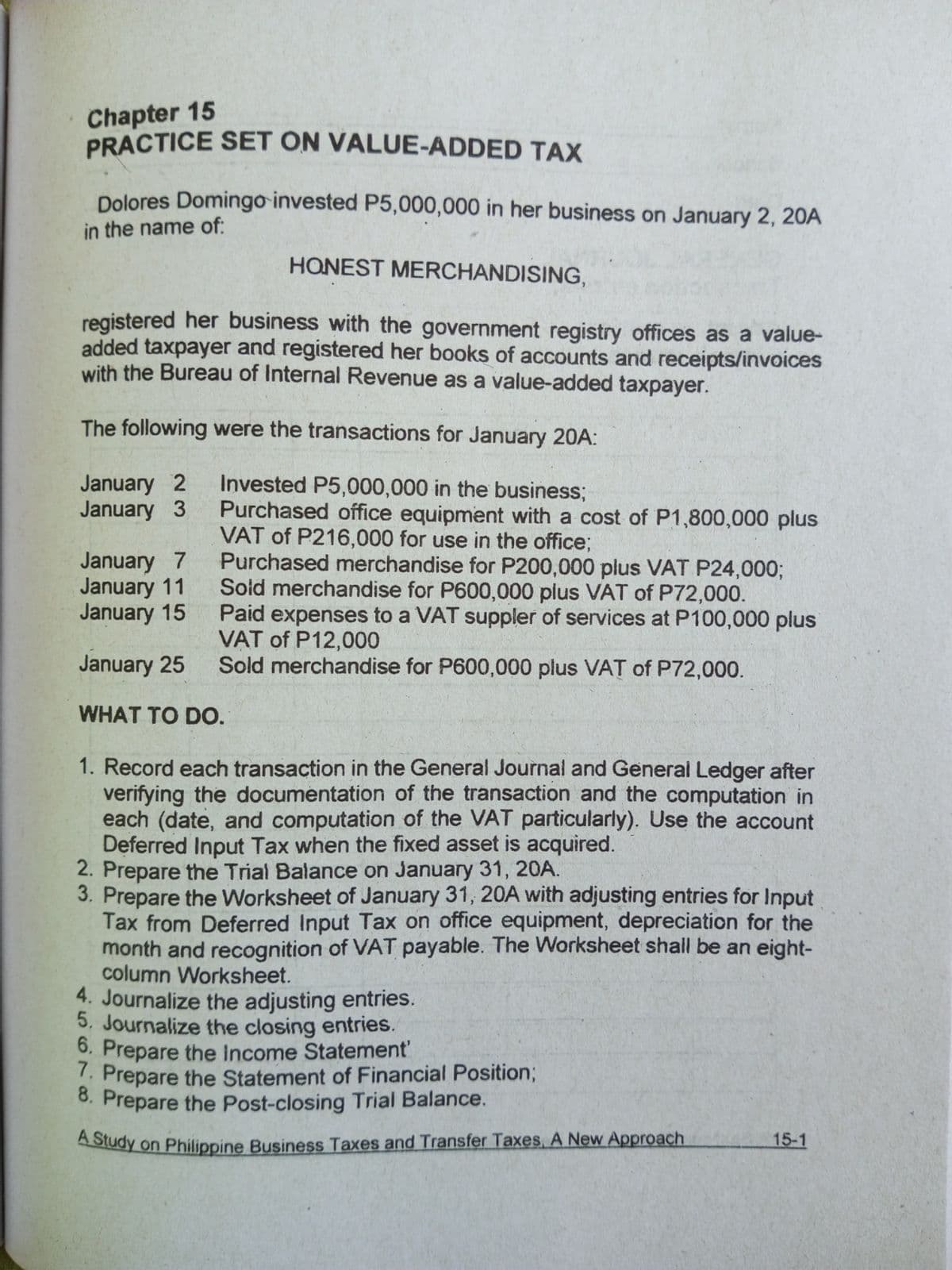

HONEST MERCHANDISING, registered her business with the government registry offices as a value- added taxpayer and registered her books of accounts and receipts/invoices with the Bureau of Internal Revenue as a value-added taxpayer. The following were the transactions for January 20A: January 2 January 3 Invested P5,000,000 in the business; Purchased office equipment with a cost of P1,800,000 plus VAT of P216,000 for use in the office; Purchased merchandise for P200,000 plus VAT P24,000; Sold merchandise for P600,000 plus VAT of P72,000. Paid expenses to a VAT suppler of services at P100,000 plus VAT of P12,000 Sold merchandise for P600,000 plus VAT of P72,000. January 7 January 11 January 15 January 25 WHAT TO DO. 1. Record each transaction in the General Journal and General Ledger after verifying the documentation of the transaction and the computation in each (date, and computation of the VAT particularly). Use the account Deferred Input Tax when the fixed asset is acquired. 2. Prepare the Trial Balance on January 31, 20A. 3. Prepare the Worksheet of January 31, 20A with adjusting entries for Input Tax from Deferred Input Tax on office equipment, depreciation for the month and recognition of VAT payable. The Worksheet shall be an eight- column Worksheet.

HONEST MERCHANDISING, registered her business with the government registry offices as a value- added taxpayer and registered her books of accounts and receipts/invoices with the Bureau of Internal Revenue as a value-added taxpayer. The following were the transactions for January 20A: January 2 January 3 Invested P5,000,000 in the business; Purchased office equipment with a cost of P1,800,000 plus VAT of P216,000 for use in the office; Purchased merchandise for P200,000 plus VAT P24,000; Sold merchandise for P600,000 plus VAT of P72,000. Paid expenses to a VAT suppler of services at P100,000 plus VAT of P12,000 Sold merchandise for P600,000 plus VAT of P72,000. January 7 January 11 January 15 January 25 WHAT TO DO. 1. Record each transaction in the General Journal and General Ledger after verifying the documentation of the transaction and the computation in each (date, and computation of the VAT particularly). Use the account Deferred Input Tax when the fixed asset is acquired. 2. Prepare the Trial Balance on January 31, 20A. 3. Prepare the Worksheet of January 31, 20A with adjusting entries for Input Tax from Deferred Input Tax on office equipment, depreciation for the month and recognition of VAT payable. The Worksheet shall be an eight- column Worksheet.

Chapter26: Tax Practice And Ethics

Section: Chapter Questions

Problem 19P

Related questions

Question

100%

Transcribed Image Text:Chapter 15

PRACTICE SET ON VALUE-ADDED TAX

Dolores Domingo invested P5,000,000 in her business on January 2, 20A

in the name of:

HONEST MERCHANDISING,

registered her business with the government registry offices as a value-

added taxpayer and registered her books of accounts and receipts/invoices

with the Bureau of Internal Revenue as a value-added taxpayer.

The following were the transactions for January 20A:

January 2

January 3

Invested P5,000,000 in the business;

Purchased office equipment with a cost of P1,800,000 plus

VAT of P216,000 for use in the office;

Purchased merchandise for P200,000 plus VAT P24,000;

Soid merchandise for P600,000 plus VAT of P72,000.

Paid expenses to a VAT suppler of services at P100,000 plus

VAT of P12,000

Sold merchandise for P600,000 plus VAT of P72,000.

January 7

January 11

January 15

January 25

WHAT TO DO.

1. Record each transaction in the General Journal and General Ledger after

verifying the documentation of the transaction and the computation in

each (date, and computation of the VAT particularly). Use the account

Deferred Input Tax when the fixed asset is acquired.

2. Prepare the Trial Balance on January 31, 20A.

3. Prepare the Worksheet of January 31, 20A with adjusting entries for Input

Tax from Deferred Input Tax on office equipment, depreciation for the

month and recognition of VAT payable. The Worksheet shall be an eight-

column Worksheet.

4. Journalize the adjusting entries.

5, Journalize the closing entries.

6. Prepare the Income Statement'

. Prepare the Statement of Financial Position3;

8. Prepare the Post-closing Trial Balance.

ASudy on Philippine Business Taxes and Transfer Taxes, A New Approach

15-1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you