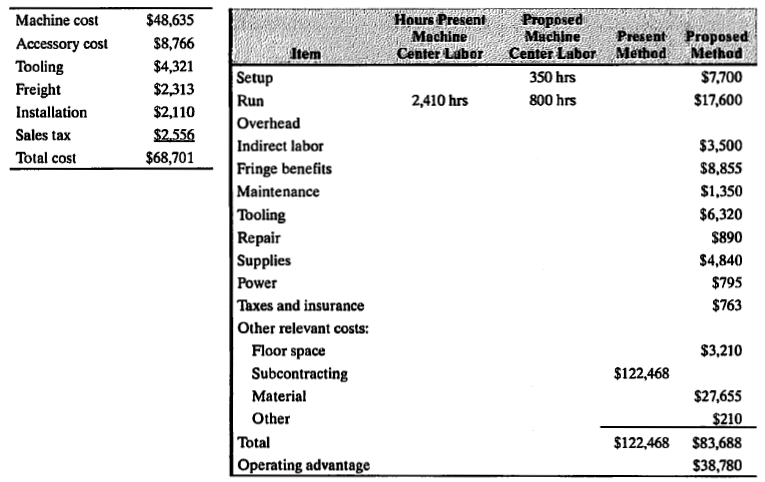

Hours Present Machine Center Labor Proposed Machine Machine cost $48,635 Accessory cost Tooling Present Proposed Method $8,766 Center Labor Method Item Setup Run Overhead Indirect labor Fringe benefits Maintenance Tooling Repair Supplies Power Taxes and insurance $4,321 350 hrs $7,700 Freight $2,313 2,410 hrs 800 hrs $17,600 Installation $2,110 Sales tax $2.556 $3,500 Total cost $68,701 $8,855 $1,350 $6,320 $890 $4,840 $795 $763 Other relevant costs: Floor space Subcontracting $3,210 $122,468 Material $27,655 Other $210 Total $122,468 $83,688 Operating advantage $38,780

Variance Analysis

In layman's terms, variance analysis is an analysis of a difference between planned and actual behavior. Variance analysis is mainly used by the companies to maintain a control over a business. After analyzing differences, companies find the reasons for the variance so that the necessary steps should be taken to correct that variance.

Standard Costing

The standard cost system is the expected cost per unit product manufactured and it helps in estimating the deviations and controlling them as well as fixing the selling price of the product. For example, it helps to plan the cost for the coming year on the various expenses.

The Manufacturing Division of Ohio Vending Machine Company is considering its Toledo plant's request for a half-inch-capacity automatic screw-cutting machine to be included in the division's 2013 capital budget:

1. Name of project: Mazda Automatic Screw Machine

2. Project cost: $68,701

3 Purpose of project: To reduce the cost of some of the parts that are now

being subcontracted by this plant, to cut down on inventory by shortening

lead time, and to better control the quality of the parts. The proposed equipment includes the following cost basis: 4. Anticipated savings: as shown in the accompanying table.

5. Tax

6. Marginal tax rate: 40%.

7 MARR: 15%.

(a) Determine the net after-tax cash flows over the project life of six years. Assume a salvage value of $3.500.

(b) Is this project acceptable based on the PW criterion?

(c) Determine the

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 7 images