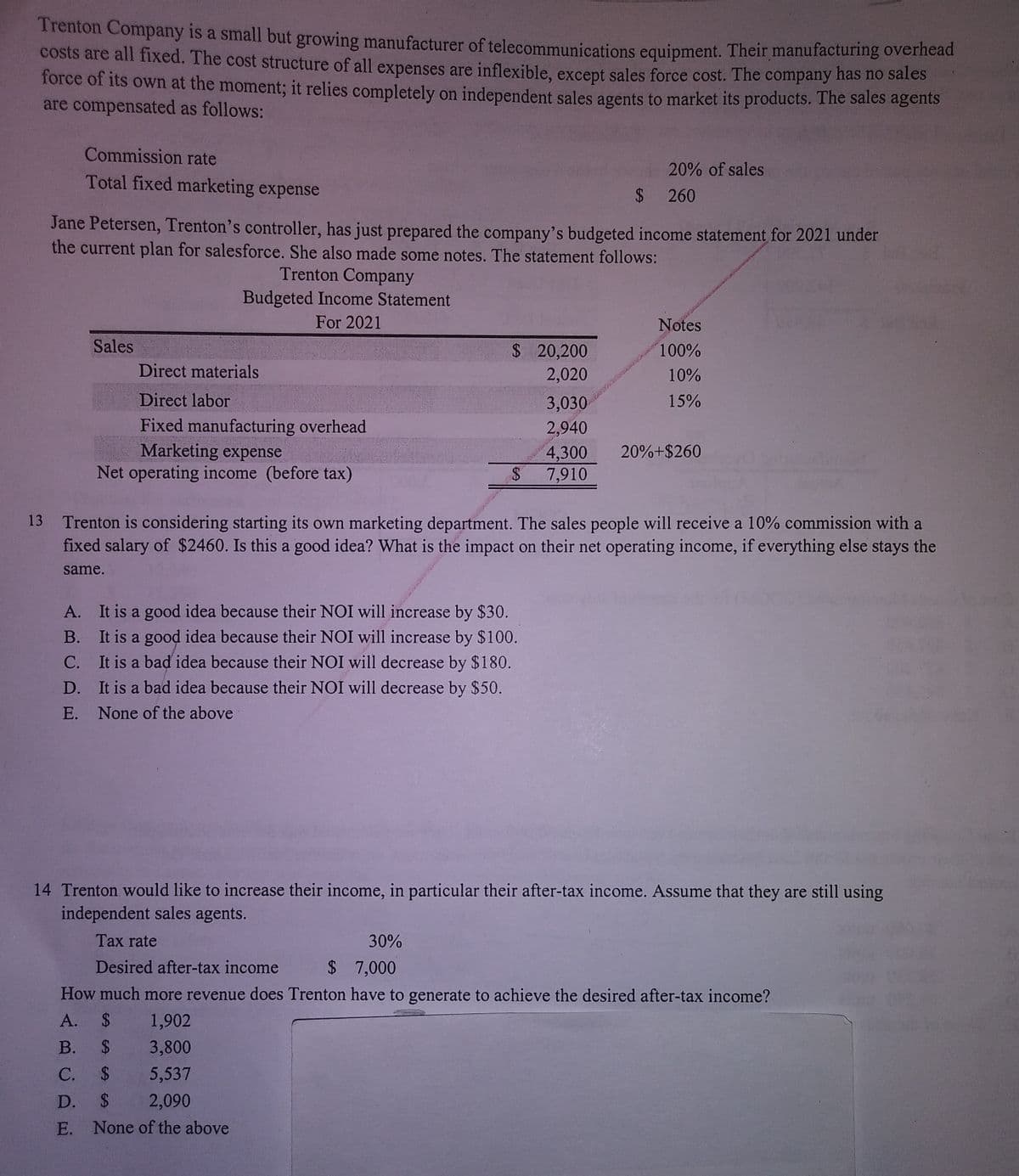

Trenton Company is a small but growing manufacturer of telecommunications equipment. Their manufacturing overhead costs are all fixed. The cost structure of all expenses are inflexible, except sales force cost. The company has no sares force of its own at the moment; it relies completely on independent sales agents to market its products. The sales agents are compensated as follows: Commission rate 20% of sales Total fixed marketing expense 2$ 260 Jane Petersen, Trenton's controller, has just prepared the company's budgeted income statement for 2021 under the current nlan for coloofougg Ch

Trenton Company is a small but growing manufacturer of telecommunications equipment. Their manufacturing overhead costs are all fixed. The cost structure of all expenses are inflexible, except sales force cost. The company has no sares force of its own at the moment; it relies completely on independent sales agents to market its products. The sales agents are compensated as follows: Commission rate 20% of sales Total fixed marketing expense 2$ 260 Jane Petersen, Trenton's controller, has just prepared the company's budgeted income statement for 2021 under the current nlan for coloofougg Ch

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 8PA: Jakarta Company is a service firm with current service revenue of $400,000 and a 40% contribution...

Related questions

Question

Please I want to learn how to make these problems with a good explanation. One of those there is the possible answer.

Thank you

Transcribed Image Text:Trenton Company is a small but growing manufacturer of telecommunications equipment. Their manufacturing overnead

Costs are all fixed. The cost structure of all expenses are inflexible, except sales force cost. The company has no sales

force of its own at the moment; it relies completely on independent sales agents to market its products. The sales agents

are compensated as follows:

Commission rate

20% of sales

Total fixed marketing expense

2$

260

Jane Petersen, Trenton's controller, has just prepared the company's budgeted income statement for 2021 under

the current plan for salesforce. She also made some notes. The statement follows:

Trenton Company

Budgeted Income Statement

For 2021

Notes

Sales

$ 20,200

100%

Direct materials

2,020

10%

Direct labor

3,030

2,940

15%

Fixed manufacturing overhead

Marketing expense

Net operating income (before tax)

4,300

20%+$260

$4

7,910

13

Trenton is considering starting its own marketing department. The sales people will receive a 10% commission with a

fixed salary of $2460. Is this a good idea? What is the impact on their net operating income, if everything else stays the

same.

A. It is a good idea because their NOI will increase by $30.

B. It is a good idea because their NOI will increase by $100.

C. It is a bad idea because their NOI will decrease by $180.

D. It is a bad idea because their NOI will decrease by $50.

E. None of the above

14 Trenton would like to increase their income, in particular their after-tax income. Assume that they are still using

independent sales agents.

Tax rate

30%

Desired after-tax income

$ 7,000

How much more revenue does Trenton have to generate to achieve the desired after-tax income?

А.

$

1,902

В.

$4

3,800

С.

%24

5,537

D.

24

2,090

E. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning