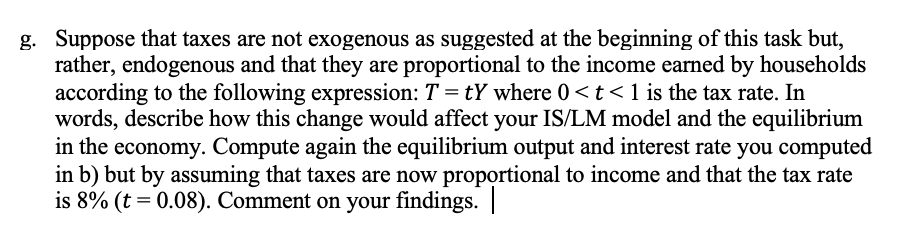

g. Suppose that taxes are not exogenous as suggested at the beginning of this task but, rather, endogenous and that they are proportional to the income earned by households according to the following expression: T = tY where 0 < t < 1 is the tax rate. In words, describe how this change would affect your IS/LM model and the equilibrium in the economy. Compute again the equilibrium output and interest rate you computed in b) but by assuming that taxes are now proportional to income and that the tax rate is 8% (t=0.08). Comment on your findings.

g. Suppose that taxes are not exogenous as suggested at the beginning of this task but, rather, endogenous and that they are proportional to the income earned by households according to the following expression: T = tY where 0 < t < 1 is the tax rate. In words, describe how this change would affect your IS/LM model and the equilibrium in the economy. Compute again the equilibrium output and interest rate you computed in b) but by assuming that taxes are now proportional to income and that the tax rate is 8% (t=0.08). Comment on your findings.

Chapter15: Monetary Policy

Section: Chapter Questions

Problem 4WNG

Related questions

Question

Transcribed Image Text:g. Suppose that taxes are not exogenous as suggested at the beginning of this task but,

rather, endogenous and that they are proportional to the income earned by households

according to the following expression: T=tY where 0 < t < 1 is the tax rate. In

words, describe how this change would affect your IS/LM model and the equilibrium

in the economy. Compute again the equilibrium output and interest rate you computed

in b) but by assuming that taxes are now proportional to income and that the tax rate

is 8% (t=0.08). Comment on your findings.

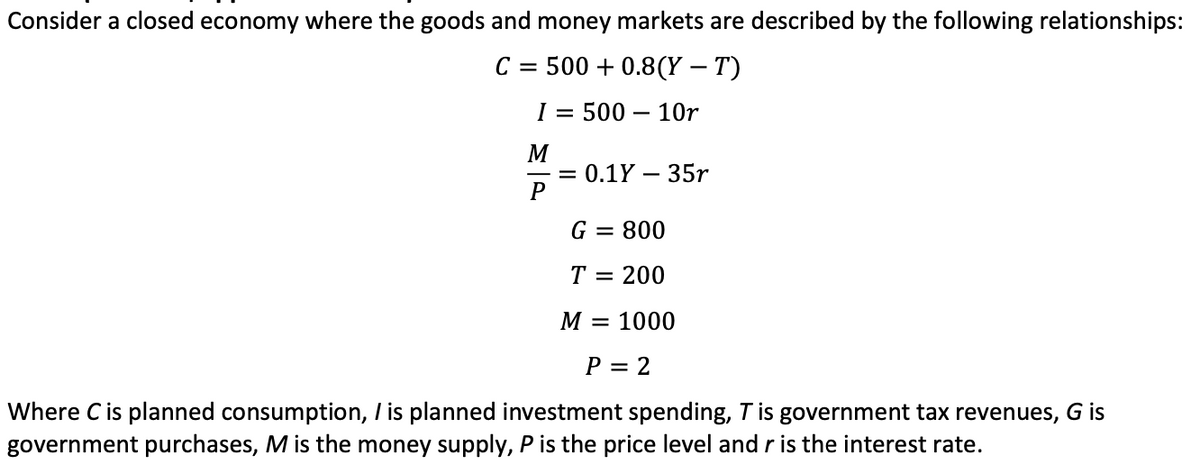

Transcribed Image Text:Consider a closed economy where the goods and money markets are described by the following relationships:

C = 500+ 0.8(Y – T)

I = 500 10r

M

P

= 0.1Y - 35r

G = 800

T =

200

M = 1000

P = 2

Where C is planned consumption, I is planned investment spending, T is government tax revenues, G is

government purchases, M is the money supply, P is the price level and r is the interest rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning