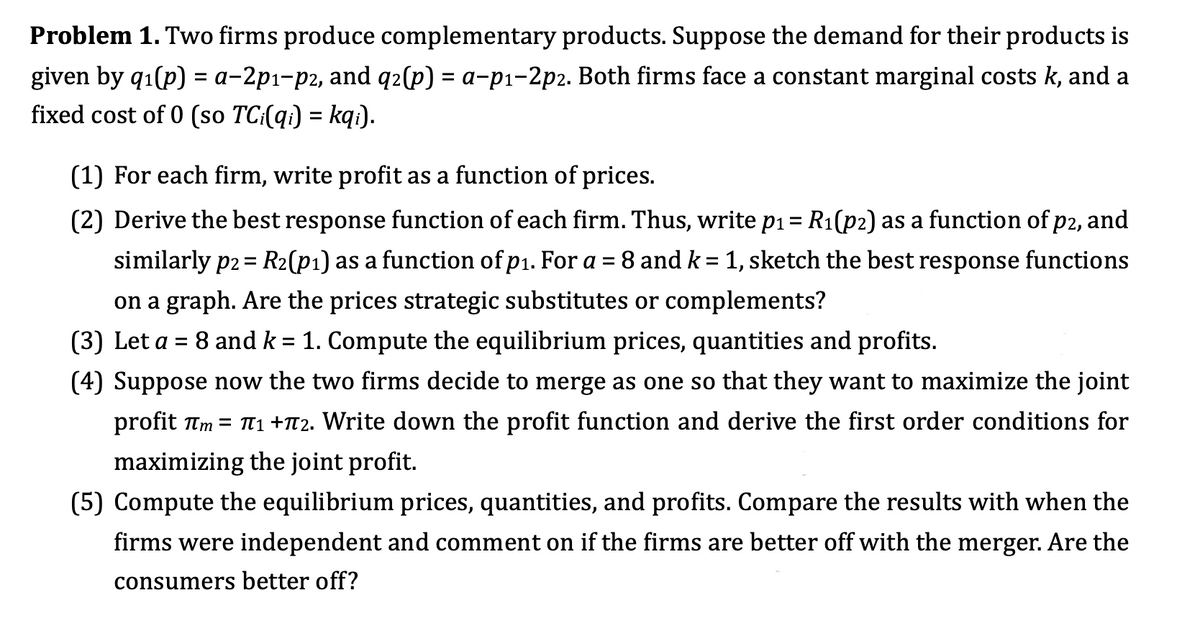

Two firms produce complementary products. Suppose the demand for their products is given by q1(p) = a−2p1−p2, and q2(p) = a−p1−2p2. Both firms face a constant marginal costs k, and a fixed cost of 0 (so TCi(qi) = kqi). . For each firm, write profit as a function of prices. Derive the best response function of each firm. Thus, write p1 = R1(p2) as a function of p2, and similarly p2 = R2(p1) as a function of p1. For a = 8 and k = 1, sketch the best response functions on a graph. Are the prices strategic substitutes or complements? Let a = 8 and k = 1. Compute the equilibrium prices, quantities and profits.

Two firms produce complementary products. Suppose the demand for their products is given by q1(p) = a−2p1−p2, and q2(p) = a−p1−2p2. Both firms face a constant marginal costs k, and a fixed cost of 0 (so TCi(qi) = kqi). .

For each firm, write profit as a function of

- Derive the best response function of each firm. Thus, write p1 = R1(p2) as a function of p2, and similarly p2 = R2(p1) as a function of p1. For a = 8 and k = 1, sketch the best response functions on a graph. Are the prices strategic substitutes or complements?

- Let a = 8 and k = 1. Compute the

equilibrium prices, quantities and profits. - Suppose now the two firms decide to merge as one so that they want to maximize the joint profit πm = π1 +π2. Write down the profit function and derive the first order conditions for maximizing the joint profit.

- Compute the equilibrium prices, quantities, and profits. Compare the results with when the firms were independent and comment on if the firms are better off with the merger. Are the consumers better off?

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 1 images

How do you know that the equillibrium prices are lower, the quantities produced are higher and the profits produced are lower in the merged scenario

Let a = 8 and k = 1. Compute the

Suppose now the two firms decide to merge as one so that they want to maximize the joint profit πm = π1 +π2. Write down the profit function and derive the first order conditions for maximizing the joint profit.

and

Compute the