How much is the previously held equity interest in the acquiree? a. 0.00 b. 150,000.00 c. 310,000.00 d. 500,000.00 2. How much is the fair value of the net identifiable assets acquired?

Q: Problem 25 Davao Bank loaned P7,500,000 to a borrower on January 1, 2018. The terms of the payment i...

A: Loan Amount = P7,500,000 Interest Rate = 12% Accrued Interest = 12% of P7,500,000 = P900,000 To...

Q: Pasay Manufacturing Company manufactures fire extinguishers and uses FIFO method for process and inv...

A: Introduction Cost of goods sold is the cost of producing goods that is sold by company during a part...

Q: Checks Balance 18,500 Date Deposits Other une 1 3 440 18,060 4 1,200 16,860 16,360 15,160 8 500 10 1...

A:

Q: Which of the following encompass many general best practices: Using as few worksheets and workbooks...

A: Using as few worksheets and workbooks as possible Grouping together inputs as well as calculated ite...

Q: If you received 8% annual interest rates on the above loans and each of your projects was late B mon...

A: Solution Given Loan amounts are A $5 million B $2.8 million C $350000 Interest...

Q: On February 3, Smart Company sold merchandise in the amount of $4,800 to Truman Company, with credit...

A: Note: I have provide you the correct Journal entry, but I guess the correct option is not uploaded. ...

Q: Compute for the balance of the Retained Earnings account be if USD60,000 in arrears dividends and US...

A: Retained earnings refers to that portion of the after-tax profit of the company which the company de...

Q: (a) Indicate the missing amount for each letter. Case 1 Direct materials used $9,700 24 Direct labor...

A: Total Manufacturing Cost = Direct Material + Direct Labour + Factory Overheads Cost of Goods Manufac...

Q: You are auditing Crown Corporation for the year ended 2022. Its reported net income for the year 202...

A: Net Income Net income which is considered to be one of the important source of liquidity which are d...

Q: ournal Entries (Note Issued, Renewed, and Paid) May 1 Purchased $5,000 worth of equipment from a sup...

A: Solution Concept Journal book is a book where the business transaction are recorded primarily These ...

Q: Assume that the custodian of a $450 petty cash fund has $59.50 in coins and currency plus $385.00 in...

A: About Petty cash is a little amount of money that is keep on the company premises to pay for needs...

Q: A man bought a lot worth P2424737 if paid in cash. By installment, he paid a down payment of P250,00...

A: Total Amount to be paid = P2424737 Down Payment made = P250000 Net Amount Payable = P2424737 - P2500...

Q: Problem 2 Bella Company had an overdue 8% note payable to Marimar Bank at Php8,000,000 with acrrued ...

A: Journal entry is the practice of recording financial activity for the first time in the books of acc...

Q: Give any three types of examples in each of operating activities, financing activities and investing...

A: Cash Flow from Operating Activities: Cash flow from operating activities includes items of Cash infl...

Q: The Sino-Fizer Company is concerned about the cash flow of the company. They consulted you to prepar...

A: Budgeting is the method to forecast the future cashflows, sales, production and other important area...

Q: Todd has a capital balance of $170,600 after adjusting assets to fair market value. Zanetti contribu...

A: Lets understand the basics. In bonus method, all the partners contributions is totaled to calculate ...

Q: Henry Company had sales revenue of USD1,200,000, gross profit of USD749,000, operating expenses of U...

A: Income tax expense refers to the expense amount which company records in the accounting period for t...

Q: Exercise 6-13 (Algo) Depreciation calculation methods LO 3 Millco Inc., acquired a machine that cost...

A: Depreciation is considered as an expense charge on the value of the Asset. It can be calculated by u...

Q: ABC Corporation has the following information about its single product: Selling Price per unit ₱ 20 ...

A: Lets understand the basics. Degree of operative leverage indicates the change in net income if chang...

Q: Holt Co. discovered that in the prior year, it failed to report P40,000 of depreciation related to a...

A: Lets understand the basics. When there is error happened in previous year in recording the transacti...

Q: Using the indirect method, calculate the amount of cash flows from operating activities from the fol...

A: Cash flow from operating activities indicates the cash inflow or outflow transactions related to the...

Q: On December 30, 2015, Ella Thornes Inc has 2,000 8% preference stocks issued w/ USD200 par value and...

A: Annual Dividend to Preferred shareholders = No. of preferred share outstanding x Par value per share...

Q: Can A recognize the $25,000 loss in 2016? How much loss will A recognize on the IBM calls in 2017? W...

A: Here, in the example, A has made loss on two counts. The 1st loss is incurred when the shares acquir...

Q: Hardy Man, Inc., acquired a machine in 2021 for P 400,000 and erroneously charged the cost to an exp...

A: Depreciation means the amount fixed assets written off due to normal wear and tear , normal usage , ...

Q: GLO701 - Based on Problem 7-5A LO C2, C3, P4 The following selected transactions are from Turner Com...

A: Note: Only the calculation of interest has been answered as it has been selected/highlighted. F...

Q: Love Inc. believes that at its current share price of P16.00 the firm is undervalued. Makeover plans...

A: Market capitalization = Current share price x Shares outstanding = 16 x 20,000,000 ...

Q: Cushman Company had $824,000 in sales, sales discounts of $12,360, sales returns and allowances of $...

A: Calculation of gross profit are as follows:

Q: Using ABC, compute the total cost per case for each product type if the direct labor and direct mate...

A: Calculation of Overhead Cost Per Unit of Cost Driver: Department Activity Cost Driver Cost Driver...

Q: Raceway Motor Sports Co. Bank Reconciliation Statement July 31, 20-- Task 2: Prepare a bank reconcil...

A: A bank reconciliation statement reconciles an entity's bank account with its financial records by su...

Q: 11. Statement 1. An industrial partner is not exempted from sharing in the loss of the partnership i...

A: Let's understand the basics Partnership is an agreement between two or people to run and monitor bu...

Q: bank is generally valued at face amount b.Cash in foreign currency is valued at Philippine peso usin...

A: A bank statement refers to the statement which reflects the transactions that are not being reflecte...

Q: See the attached photo for the problem Required: a. Compute the total current liabilities on Decem...

A: Current Liabilities Current Liabilities of the business which can be determined by within one year p...

Q: preferred shares, both payable on 30 October 20X5, to shareholders of record on 10 October 20X5. (Re...

A: Journal Entry The purpose of preparing the journal entry which kept the recording of the transaction...

Q: is used to spread the cost of an asset across its useful life rather than recognizing it all at once...

A: Let's understand the basics, Asset is an item of property owned by a person or company, regarded as ...

Q: Give any three types of examples in each of operating activities, financing activities and investing...

A: Cash Flow statement has been used to identify amount of cash which was earned and spent on activitie...

Q: Morrissey Technologies Inc.'s 2019 financial statements are shown here. Suppose that in 2020, sales ...

A: Income statement and balance sheet are prepared in financial accounting to get the true and fair wor...

Q: The standard costs and actual costs for direct materials for the manufacture of 2,600 actual units o...

A: Direct materials price variance = ( Standard rate of material - Actual rate of material ) x Actual q...

Q: Ryan Company deposits all cash recelpts on the day they are received and makes all cash payments by ...

A: Bank reconciliation statement shows the reconciliation of bank statement with its cash books.

Q: Executive compensation packages often tie performance to bonus and incentive awards, supplemental re...

A: The correct answers for the above mentioned questions is given in the following steps for your refer...

Q: Warner Company's year-end unadjusted trial balance shows accounts receivable of $105,000, allowance ...

A: If Allowance for doubtful accounts has credit balance then the Bad debt expense that should be recog...

Q: Which company is more reliant on equity to fund their assets based on the ratios you have? What are ...

A: The Decision regarding the Capital Structure of a Company is a very important aspect. A company can...

Q: A company purchased $9,900 of merchandise on June 15 with terms of 3/10, n/45. On June 20, It return...

A: Lets understand the basics. For attracting early payments, seller gives the discount to the buyer. T...

Q: Accounting for By-products Happy Tree Lumber produces one main product (lumber) and one by-product ...

A: Journal Entry Here to prepare the Journal entry for both production method and sales method while us...

Q: For the year: Percent of capacity Direct labor hours Variable factory overhead Fixed factory overhea...

A: Variable Cost - The total cost of production of a good comprises of the total fixed cost of producti...

Q: PB&J Eatery has a monthly target operating income of $6,300. Variable expenses are 60% of sales and ...

A: Operating leverage = Contribution margin / Operating income where, Contribution margin = Operating i...

Q: Net income $127,530 Enterest expense 11,093 Average total assets 2,069,000

A: Return on assets is calculated by dividing Earning before interest and taxes by average total assets...

Q: es on the income statement woul

A: To determine the Net sales value...we have to be deducted some items from Gross Sales. Net Sales V...

Q: Provide cash-flow (time) diagrams if applicable. In the year 2020, the stock market fell because of...

A: Definition of Cash Flow: Cash flow refers to the net balance of cash moving into and out of a busine...

Q: company's inventory records report the following: Beginning balance August 1 August 5 August 12 24 u...

A: Calculation of value of inventory under FIFO method are as follows.

Q: George 49 and Jean 36 a married couple with no dependents have AGI of 2348000. They have 213000 of m...

A: Taxable Income: It is the part of gross income that is subject to IRS taxes. · Alternative minimum...

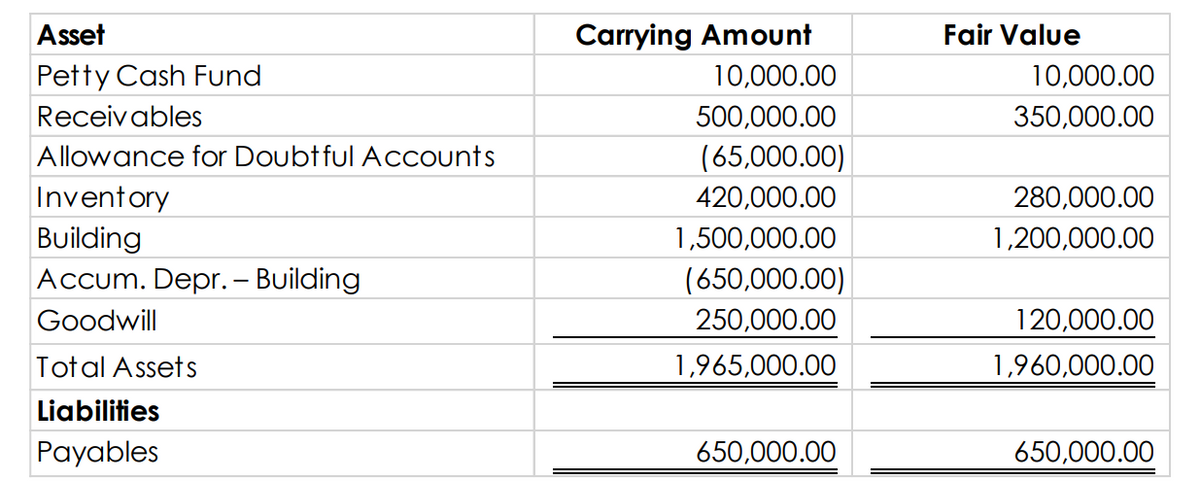

Illustration 1. Measuring

On January 1, 2021, Amahan Co. acquired all of the assets and assumed all of the liabilities of Anak, Inc. As of this date, the carrying amounts and fair values of the assets and liabilities of Anak acquired by Amahan are shown below:

On the negotiation for the business combination, Amahan Co. incurred the following

transaction costs: P25,000.00 for legal fees; P 75,000.00 for accounting fees and P 50,000.00 for consultancy fees.

1. How much is the previously held equity interest in the acquiree?

a. 0.00

b. 150,000.00

c. 310,000.00

d. 500,000.00

2. How much is the fair value of the net identifiable assets acquired?

a. 1,965,000.00

b. 1,315,000.00

c. 1,310,000.00

d. 1,190,000.00

3. How much is the goodwill (gain on bargain purchase) on the business

combination?

a. (465,000.00)

b. 185,000.00

c. (190,000.00)

d. 310,000.00

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Determine the missing amount: cash$239,186;short term investment$353,700;acct receiv$504,944;inventory? Prepaid exp$83,259;total current asset$1,594927; property&equipment? what is the inventory amount and property& equipment amount?Problem BPeter Senen Corporation provided the following account balances as of September 30, 2020: CashP112,000 Accumulated depreciationP 36,000Accounts Receivable64,000Accounts payable 40,000Finished Goods48,000Income tax payable9,000Work in process 36,000 Share Capital500,000Raw materials 52,000 Retained Earnings207,000Property and Equipment480,000The following transactions occurred during October:1. Materials purchased on account, P150,0002. Materials issued to production: direct materials- P90,000, Indirect materials- P10,000.3. Payroll for the month of October 2020 consisted of the following (also paid during the month):Direct labor P62,000Administrative salariesP16,000Indirect Labor 20,000Sales salaries 30,000Payroll deductions were as follows:Withholding taxes P19,800Phil health contributions P2,000SSS contributions 7,100HDMF contributions 2,0004. Employer contributions for the month were accrued:FactorySellingAdministrativeSSS contributionsP5,700P2,000P1,100Philhealth…UTV Corp. have the following account balances for the year ended December 31, 2020:DEBIT BALANCESAmountCash and cash equivalents400,000Accounts receivable900,000Raw materials560,000Goods in process600,000Finished goods1,400,000Financial assets at FVOCI2,500,000Sinking fund200,000Land1,000,000Building6,000,000Plant and equipment2,400,000Patent800,000Goodwill1,400,000Unrealized loss – FVOCI100,000Prepaid benefit cost20,000Treasury shares at cost250,000TOTAL18,530,000 CREDIT BALANCESAmountBank overdraft100,000Due from an officer50,000Allowance for bad debts40,000Accumulated depreciation – building1,600,000Accumulated depreciation – plant and equipment400,000Notes payable, due June 30, 20211,300,000Notes payable, due June 30, 20222,100,000Accounts payable1,000,000Provision180,000Warranty liabilities80,000Income tax payable120,000Finance lease liability180,000Deferred tax liability280,000Actuarial gain300,000Revaluation surplus360,000Share capital6,000,000Share premium2,000,000Retained…

- Refer to the following data of OCT2023CPACompany: Assets to be realized 1,375,000Assets acquired 825,000 Liabilities liquidated 1,875,000Assets realized 1,200,000Liabilities not liquidated 1,700,000 Assets not realized 1,375,000Llabilities assumed 1,625,000Llabilities to be liquidated 2,250,000 Supplementary charges 3,125,000 Supplementary credits 2,800,000 Compute the beginning cash balance assuming that the ending balance of ordinary share and retained earnings are P1,200,000 and (400,000), respectivelySME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…

- SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…SME Balance Sheet 2021 2020 Assets (in millions) Cash 85.960 56.460 Receivables 89.560 80.670 Inventories 55.750 41.260 Other Current Assets 9.950 6.760 Total Current Assets 241.220 185.150 Net Property, Plant, and Equipment 78.970 68.930 Goodwill and Other Intangible Assets 103.110 104.360 Other Non-Current Assets 6.900 4.200 Total Assets 430.200 362.640 Total Liabilities and Shareholders' Equity Payables 83.240 57.48 Current Debt 2.700 2.64 Total Current Liabilities 85.940 60.120 Long-Term Debt 122.000 119.62 Other Liabilities 21.880 22.58 Total Liabilities 229.820 202.320 Common Stock 200.380 160.32 Total Equity 200.38 160.32 Total Liabilities and Equity 430.200 362.640 INCOME STATEMENT 2021 Total Revenue (M) 488.10…