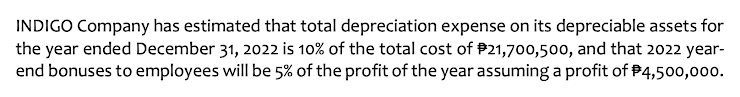

How much should be the total expenses to be included in BLUE's quarterly income statement for the quarter ended September 30, 2022?

Q: How would overall corporate profits be affected if it sells 4,000 units to the Computer Division at…

A: The overall profit is the profit which a company earns from a period when all the profits and losses…

Q: 4.... Joan earned $90,000 in salary in 2021. She contributes $7,500 in 2022 to an RRSP belonging to…

A: RRSP is Registered Retirement Saving Plan in Canada which help the employees…

Q: John's Tees sells only fully taxable t-shirts to customers in Ontario where the HST rate is 13%. In…

A: HST is Harmonized sales tax in canada. Prevailing rate is 15% and in ontario it is 13 %. Quick…

Q: To keep track of customers' behavior, a grocery store chain invests $75,000 in a CRM system. This…

A: Depreciation expense refers to the fall in the value of the asset due to time usage, wear and tear,…

Q: ital accounts at 9.5 % on the balance of their partner capital at the end of the budget year. The…

A: The calculation of taxable income of each partner requires calculating the income from the income…

Q: On January 13, at the end of the second weekly pay period of the year, a company's payroll register…

A: Payroll includes all employee expenses and taxes and insurance related to employees

Q: Beatty Solutions is determining the ending cash and cash equivalents for the December 31, 2020…

A: Cash and cash equivalents states the balance sheet line items that records the company assets value…

Q: For each property type below, find the correct property class and enter the number of years the…

A: The Internal Revenue Service or IRS has provided different depreciation methods for assets of…

Q: Use the information below for questions 7-11 $ 380 July 1 Beginning inventory Purchases 20 units at…

A: Inventory Valuation can be done by the First In First Out (FIFO) method and the Last In First…

Q: Comprehensive support department allocations (Need answers for parts C, D, and E please. Thank you!)…

A: Cost allocation is a process by which the cost incurred to produce goods or services are allocated…

Q: Quality Cleaning Corp. issued 50 no-par-value common shares for land with a market value of $4,000.…

A: The Shares can be issued by the company for cash or non cash assets. The non cash assets can be…

Q: Machine A has a fixed cost of P40,000 per year and a variable cost of P6 per unit. Machine B has an…

A: At break even point Fixed cost = contribution

Q: An examination of Hutton Corporation’s accounting records indicates that all receivables are being…

A: Journal entry is the act of recording the financial transaction in table format which have the debit…

Q: Jacques is an alien assigned in the Philippines to manage the regional area headquarters of Deli…

A: The Non Resident Aliens in Philippines are subject to income tax on the incomes…

Q: Ava Inc. had the following transactions on its inventory during 2021. Ava uses perpetual inventory…

A: The inventory can be valued using various methods as FIFO, LIFO and weighted average method. Using…

Q: I have the exact same question but it says that general journal entries g and j are incorrect

A: Cost bifurcation of Gymnasium Building and Value of Gym Equipment: Total Cost= $56000

Q: Patel and Sons Incorporated uses a standard cost system to apply factory overhead costs to units…

A: A budget is a spending plan based on income and expenditure. In other words, it is a measure of how…

Q: avage Rapide is a Canadian company that owns and operates a large automatic car wash facility near…

A: The flexible budget is prepared on the basis of standard cost and actual output.

Q: Goodwill Bobby’s Donuts Donuts & Coffee opened its doors in 2018 on the corner of Geary and…

A: Here asked for multi sub part question we will solve first three sub part question for you. If you…

Q: Neely Systems Corporation manufactures and sells various high-tech office automation products. Two…

A: Lets understand the basics. Transfer price needs to calculate when there is transfer of manufacture…

Q: Required: 1. Allocate indirect expenses to the two departments using the allocation method used in…

A: Indirect expenses are those that are unrelated to production and cannot be linked to the number of…

Q: the partners plan to expand by opening a retail sales shop. They have decided to form the business…

A: Cash A/c PARTICULARS AMOUNT PARTICULARS AMOUNT Beg. Balance $0 (b) $100,000 (a) $188,000…

Q: Why are special revenue funds restricted and what would happen if they were used for other purposes?

A: As the special revenue fund is a special revenue that are specific or specified to a project in…

Q: On J anuary 1, 2019, kelly Corporation acquired bonds wiili a face value of $500,000 for $483841.79,…

A: A journal entry is the technique through which a firm records every individual financial…

Q: Portions of the financial statements for Myriad Products are provided below.

A: 1. Depreciation, patent amortization, loss on sale of land are non cash expenses . So, added…

Q: Required: a. Calculate the operating income for Manahan Co. for the year ended December 31, 2019.…

A: Solution:- a)Calculation of operating income as follows under:-

Q: Given the following: LIFO method: 250 units left in ending inventory. 1/1/2018 Beginning inventory…

A: As per LIFO method, the ending inventory would consist of the first most items that were received…

Q: corporate governance principles

A: Corporate governance is an important aspect in accounting. We can say that corporate governance…

Q: Question 2: is it more profitable to receive $1000 at the end of each month for 10 years, or to…

A: The question is based on the concept of Financial Management. Annuity refers to the series of equal…

Q: Which of the following is true about a partnership? The old partnership ends only upon the…

A: The partnership comes into existence when two or more persons agree to do the business and further…

Q: TarHeel Corporation reported pretax book income of $1,034,000. During the current year, the net…

A: The effective tax is hypothetical tax rate = 21% Which is to be adjusted for permanent differences

Q: If impairment exists what would be the journal entry ?

A: Impairment loss refers to the amount of loss that occurs when the carrying value of an asset is more…

Q: The following information is available for Metloc Rock Corporation: Common Stock ($5 par)…

A: The stock dividend is a method of capitalizing the retained earning. Generally the large stock…

Q: The following selected transactions relate to liabilities of United Insulation Corporation. United’s…

A: Solution:- Preparation of appropriate journal entries through the maturity of each liability as…

Q: Hazel Company owns three properties which are classified as investment properties. Details of the…

A: As per IAS 40- Investment property, the investment can be accounted either in Cost model or Fair…

Q: acques is an alien assigned in the Philippines to manage the regional area headquarters of Deli…

A:

Q: 2 pounds e $9) 5 hours @ $34) $18 17 based on direct labor hours. The variable vel of activity) i is…

A: Profit variance analysis refers to the concept which evaluates the difference between actual profit…

Q: Cassels Corp. (a C-Corporation) generated a Net Operating Loss (NOL) in 2021 of ($80,000). Cassels…

A: Net Operating Loss: A net operating loss (NOL) is the outcome of a company's permitted deductions…

Q: Rosie's Company has three products, P1, P2, and P3. The maximum Rosie's can sell is 66,700 units of…

A: The question is based on the concept of Cost Accounting. In order to select the most profitable…

Q: 2. Maverick Sdn Bhd The following is the trial balance of Maverick Sdn Bhd at 31 March 2021. Dr…

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred…

Q: You plan on starting a lawn mowing business by investing $700 of your own money and purchasing $500…

A: Schedule of Cash collection First month Second month Hours worked 170 340 Rate per hour $17…

Q: What Are The Consequences That The Multinational Companies Are Facing In Tax Evasion And Tax…

A: Answer:- Tax Evasion definition:- Tax evasion can be defied as the illegal way of avoiding tax…

Q: The contribution format income statement for Huerra Company for last year is given below: Total Unit…

A: Solution 1: Particulars Amount Sales $998,000.00 Operating income $80,000.00 Average…

Q: Glant Co's motor vehicles at cost account at 30 June 20X6 is as follows: MOTOR VEHICLES - COST…

A: The trial balance is prepared to record the final balance of each account as debit and credit.

Q: In the current year, Megan invests $50.000 for a 10% partnership interest in an Alaskan fishing boat…

A: It is given that of a 10% profit share, Megan had invested in $50,000. It is seen that in the…

Q: You want to purchase a common stock at $50 from your broker using as little of your own money as…

A: Initial margin: Initial margin is the required amount of invested value which an investor has to…

Q: All of the following would be considered "intellectual property" except: A.…

A: Intellectual property means the creation of the minds i.e. inventions, arts, designs, images,…

Q: Petalo Company borrowed $20 million cash on December 1, 2021, to provide working capital for year-…

A: Issuance of promissory notes raises the current liability portion of the company. Sometimes, in…

Q: Ali Inc. is a manufacturer of custom furniture, which was incorporated on January 3, 2019. The…

A: Journal entries are the basis for all accounting and financial data. It starts here as real world…

Q: %24 %24 %24 At the end of the current year, Accounts Receivable has a balance of $735,000; Allowance…

A: Net realizable value of accounts receivable = Accounts Receivable - Allowance for Doubtful Accounts…

How much should be the total expenses to be included in BLUE's quarterly income statement for the quarter ended September 30, 2022?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Pinecone Company has plan assets of 500,000 at the beginning of the current year and expects to earn 12% on its plan assets during the year. Pinecones service cost is 230,000, and its interest cost is 55,000. Compute Pine-cones pension expense for the current year.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.Borat Company gives annual bonuses after the end of the year. Borat computes the bonuses based on the companys net income after deducting the bonuses but before deducting income taxes. Borats income before bonuses and income taxes is 565,000 for the current year. The effective income tax rate is 21%, and the bonus rate is 12%. Calculate Borats bonuses and income taxes for the current year. Round your final answer to two decimal places.

- LOSLOS Company has estimated that total depreciation expense for the year ending December 31, 2021 will amount to P300,000 and that 2021 year-end bonuses to employees will total P60,000. In LOSLOS interim income statement for the six-month period ended June 30, 2021, how much is the total amount of expenses relating to these two items that should be reported?Vilma Company has estimated that total depreciation expense for the yearended December 31, 2020 will amount to P250,000. As of the beginningof the year, the company had fixed assets amounting to P2,000,000 andacquired additional fixed assets of P1,000,000 on July 1, 2020. Theestimated useful life is for 10 years. The 2020 year-end bonuses toemployees will total P600,000. In Vilma’s interim income statement for thesix months ended June 30, 2020, what total amount of expense relating tothese two items should be reported?Ascension Company has estimated that total depreciation expense for the year ending December 31, 2019 will amount to P2,000,000, and the 2019 year-end bonuses to employees will total P4,000,000. Ascension paid P500,000 property taxes assessed for the year 2019. On June 30, 2019, Ascension incurred a permanent inventory loss from a market decline of P800,000 and an extraordinary loss of P200,000. In the interim income statement for the six months ended June 30, 2019, what total amount of expense relating to these items should be reported? 4,250,000 3,850,000 3,750,000 3,450,000

- For the year ending December 31, 2018 Lomi Inc has calculated that total depreciation expense will amount to P60,000, and that 2018 year-end bonuses to employees total P150,000. In Lomi’s interim statement of comprehensive income for the six months ended June 30, 2018, the total amount of expense relating to these two items should be reported as?Rambo Manufacturing Co. purchased $2,885,000 in new production equipment during 2022. All of the equipment was purchased in June. What is the maximum depreciation deduction Rambo can take this year (assuming Rambo elected out of taking bonus depreciation)? TABLE 1 MACRS Half-Year ConventionSuppose a company spends $100,000 on research and development in 2021. As a result of the products developed, additional revenue is generated over the next five years totaling $600,000. When is the cost of the research and development in 2021 recognized as an expense? Multiple Choice Evenly over the period 2022-2026. Full amount in 2026. Evenly over the period 2021-2025. Full amount in 2021.

- XYZ Company, a 'for-profit' business, had revenues of $60 million in 2019. Expenses other than depreciation totaled 55 percent of revenues, and depreciation expense was $5.0 million. XYZ Company, must pay taxes at a rate of 25 percent of pretax (operating) income. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Depreciation originally was $5 million; however, now the company has decided to be more conservative in its depreciation of its capital assets. XYZ now has $2.5 million in depreciation expense instead of $5 million. Based on this change in depreciation expense, what would XYZ's total profit margin Please don't provide solutions in imageAndy McDowell Co. establishes a $100 million liability at the end of 2020 for the estimated site-cleanup costs at two of its manufacturing facilities. All related closing costs will be paid and deducted on the tax return in 2021. Also, at the end of 2020, the company has $50 million of temporary differences due to excess depreciation for tax purposes, $7 million of which will reverse in 2021. The enacted tax rate for all years is 20%, and the company pays taxes of $32 million on $160 million of taxable income in 2020. McDowell expects to have taxable income in 2021. Instructions a. Determine the deferred taxes to be reported at the end of 2020. b. Indicate how the deferred taxes computed in (a) are to be reported on the balance sheet. c. Assuming that the only deferred tax account at the beginning of 2020 was a deferred tax liability of $5,000,000, draft the income tax expense portion of the income statement for 2020, beginning with the line “Income before income taxes.”…Aluminium Manufacturing Co., income for the year 2018 and 2019 were OMR 400,000 and 600,000 respectively. The following pretax earnings are depreciation on plant and machinery every year OMR 200,000 and extraordinary gain 2019 OMR 150,000. What is the expected average future earnings. Select one: a. OMR 325,000 b. OMR 275,000 c. OMR 375,000 d. OMR 225,000