How would this affect its price, dividend, yield, and capital gains yield? Find the price today. D₂ Year Dividend "V of dividends $1.7455 $1.9041 $2.0772 $2.2661 $2.4721 $59.5547 $70.0197 $1.60 10.0% 20% $1.60 D $1.920 2.74% Short-rung; for Years 1-5 only. Long-run g; for Year 6 and all following years. $1.92 art 2. Finding the expected dividend yield. vidend yield- ividend yield = ividend yield 1 $2.30 105.5048 15 years rather than yea P₁ $70.020 3 $2,76 $3.32 Terminal value $3,98 4.2202 4.0% $4.22

How would this affect its price, dividend, yield, and capital gains yield? Find the price today. D₂ Year Dividend "V of dividends $1.7455 $1.9041 $2.0772 $2.2661 $2.4721 $59.5547 $70.0197 $1.60 10.0% 20% $1.60 D $1.920 2.74% Short-rung; for Years 1-5 only. Long-run g; for Year 6 and all following years. $1.92 art 2. Finding the expected dividend yield. vidend yield- ividend yield = ividend yield 1 $2.30 105.5048 15 years rather than yea P₁ $70.020 3 $2,76 $3.32 Terminal value $3,98 4.2202 4.0% $4.22

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter7: Corporate Valuation And Stock Valuation

Section: Chapter Questions

Problem 24P: Conroy Consulting Corporation (CCC) has a current dividend of D0 = $2.5. Shareholders require a 12%...

Related questions

Question

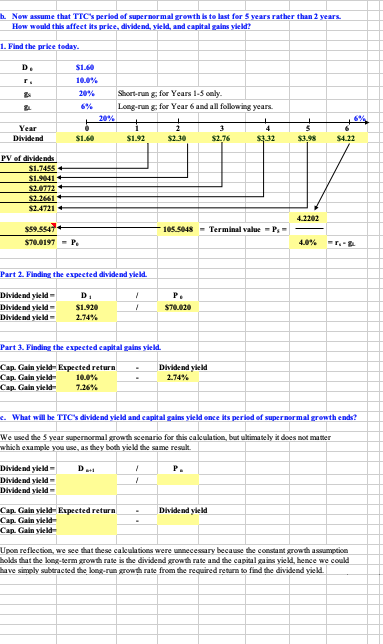

Transcribed Image Text:b. Now assume that TTC's period of supernormal growth is to last for 5 years rather than 2 years.

How would this affect its price, dividend, yield, and capital gains yield?

1. Find the price today.

D₂

2

2

Year

Dividend

PV of dividends

$1.7455

$1.9041

$2.0772

$2.2661

$2.4721

$1.60

10.0%

$59.5547+

$70.0197 - P

Dividend yield-

Dividend yield-

Dividend yield

$1.60

Part 2. Finding the expected dividend yield.

Dividend yield-

Dividend yield-

Dividend yield-

D₁

$1.920

2.74%

Short-run g; for Years 1-5 only.

Long-run g; for Year 6 and all following years.

10.0%

7.26%

$1.92

Part 3. Finding the expected capital gains yield.

Cap. Gain yield-Expected return

Cap. Gain yield

Cap. Gain yield-

Cap. Gain yield Expected return

Cap. Gain yield

Cap. Gain yield

1

$2.30

"

1

P₁

$70.020

105.5048 Terminal value = Ps=

Dividend yield

2.74%

3

$2.76

P.

4

$3.32

Dividend yield

5

$3.98

4.2202

c. What will be TTC's dividend yield and capital gains yield once its period of supernormal growth ends?

We used the 5 year supernormal growth scenario for this calculat but ultimately it does not matter

which example you use, as they both yield the same result.

Da+

6%

to

$4.22

-F.-B

Upon reflection, we see that these calculations were unnecessary because the constant growth assumption

holds that the long-term growth rate is the dividend growth rate and the capital gains yield, hence we could

have simply subtracted the long-run growth rate from the required return to find the dividend yield.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT