htiman resource manager for ationål, å čéllulaär phone company with 800 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost PHP260 per employee per quarter. The legal plan will cost PhP156 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the balance through payroll deductions from their biweekly paychecks. In addition, they will be charged 4% of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of PHP500,000 to build the center. This expense will be spread over 5 years. a. What total amount should be deducted per paycheck for these new fringe benefits for an employee earning PHP41,600 per year? b. What is the total annual cost of the new fringe benefits to ABD International?

htiman resource manager for ationål, å čéllulaär phone company with 800 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost PHP260 per employee per quarter. The legal plan will cost PhP156 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the balance through payroll deductions from their biweekly paychecks. In addition, they will be charged 4% of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of PHP500,000 to build the center. This expense will be spread over 5 years. a. What total amount should be deducted per paycheck for these new fringe benefits for an employee earning PHP41,600 per year? b. What is the total annual cost of the new fringe benefits to ABD International?

Chapter6: Business Expenses

Section: Chapter Questions

Problem 71IIP

Related questions

Question

100%

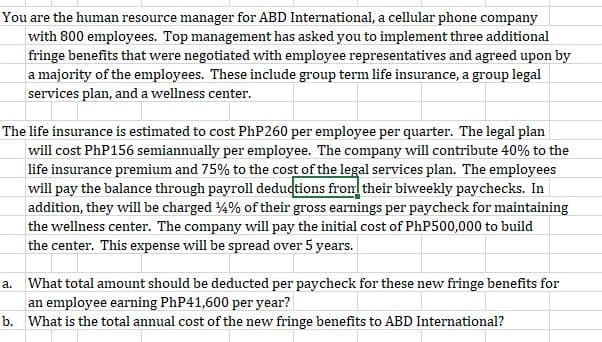

Transcribed Image Text:You are the human resource manager for ABD International, a cellular phone company

with 800 employees. Top management has asked you to implement three additional

fringe benefits that were negotiated with employee representatives and agreed upon by

a majority of the employees. These include group term life insurance, a group legal

services plan, and a wellness center.

The life insurance is estimated to cost PhP260 per employee per quarter. The legal plan

will cost PHP156 semiannually per employee. The company will contribute 40% to the

life insurance premium and 75% to the cost of the legal services plan. The employees

will pay the balance through payroll dedudtions from their biweekly paychecks. In

addition, they will be charged 4% of their gross earnings per paycheck for maintaining

the wellness center. The company will pay the initial cost of PHP500,000 to build

the center. This expense will be spread over 5 years.

a. What total amount should be deducted per paycheck for these new fringe benefits for

an employee earning PHP41,600 per year?

b. What is the total annual cost of the new fringe benefits to ABD International?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning