Park Miischner own Times Buttons, which employs twenty-lour people. Par the employees, Arnold Bower, for the year. Arnold's benefits package is as follows: wants to perform a benefits adnalysis report for o Annual salary: $58,000 401(k) contribution: 6 percent of annual salary. The company match is 75 percent of employee contribution up to 4 percent employ annual salary. Medical insurance deduction: $230 per month Dental insurance: $15 per month Required: Complete the following Benefits Analysis Report for Arnold Bower for the year. Do not include FUTA and SUTA taxes. (Round your answers to 2 decimal places. Enter all amounts as positive values.) Vearly Renefit Ceste Comp Cont Arnold'e Cont

Park Miischner own Times Buttons, which employs twenty-lour people. Par the employees, Arnold Bower, for the year. Arnold's benefits package is as follows: wants to perform a benefits adnalysis report for o Annual salary: $58,000 401(k) contribution: 6 percent of annual salary. The company match is 75 percent of employee contribution up to 4 percent employ annual salary. Medical insurance deduction: $230 per month Dental insurance: $15 per month Required: Complete the following Benefits Analysis Report for Arnold Bower for the year. Do not include FUTA and SUTA taxes. (Round your answers to 2 decimal places. Enter all amounts as positive values.) Vearly Renefit Ceste Comp Cont Arnold'e Cont

Chapter15: Choice Of Business Entity—other Considerations

Section: Chapter Questions

Problem 55P

Related questions

Question

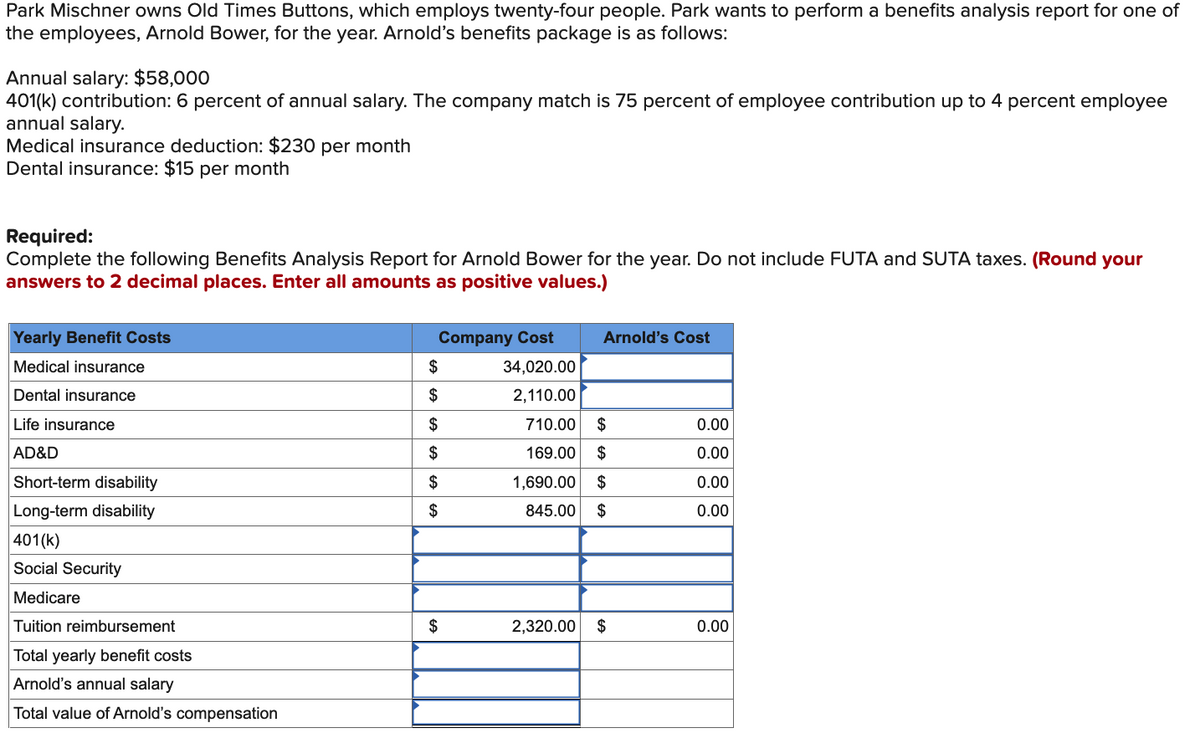

Transcribed Image Text:Park Mischner owns Old Times Buttons, which employs twenty-four people. Park wants to perform a benefits analysis report for one of

the employees, Arnold Bower, for the year. Arnold's benefits package is as follows:

Annual salary: $58,000

401(k) contribution: 6 percent of annual salary. The company match is 75 percent of employee contribution up to 4 percent employee

annual salary.

Medical insurance deduction: $230 per month

Dental insurance: $15 per month

Required:

Complete the following Benefits Analysis Report for Arnold Bower for the year. Do not include FUTA and SUTA taxes. (Round your

answers to 2 decimal places. Enter all amounts as positive values.)

Yearly Benefit Costs

Company Cost

Arnold's Cost

Medical insurance

2$

34,020.00

Dental insurance

$

2,110.00

Life insurance

$

710.00

$

0.00

AD&D

2$

169.00

$

0.00

Short-term disability

$

1,690.00

$

0.00

Long-term disability

401(k)

2$

845.00

2$

0.00

Social Security

Medicare

Tuition reimbursement

2$

2,320.00

$

0.00

Total yearly benefit costs

Arnold's annual salary

Total value of Arnold's compensation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage