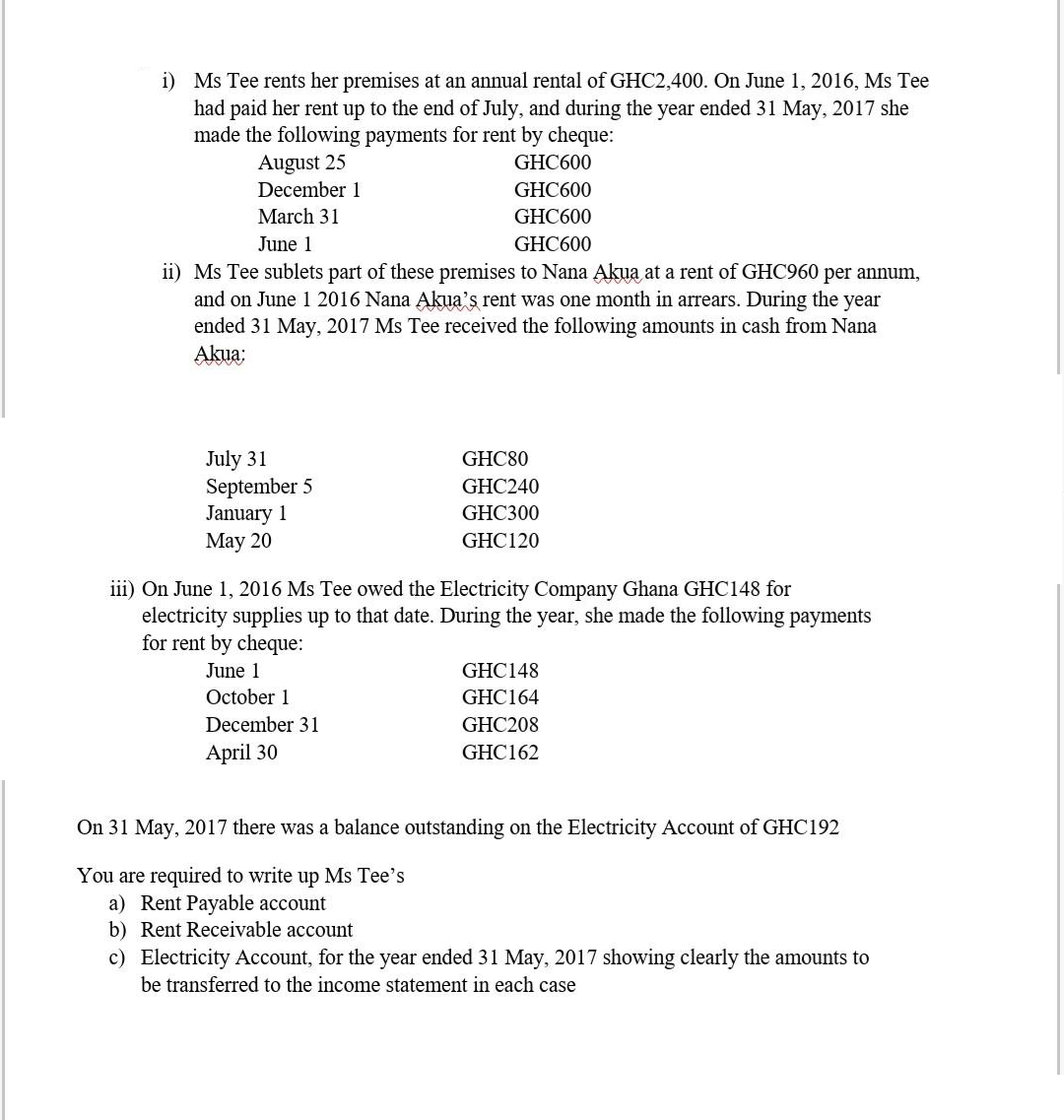

i) Ms Tee rents her premises at an annual rental of GHC2,400. On June 1, 2016, Ms Tee had paid her rent up to the end of July, and during the year ended 31 May, 2017 she made the following payments for rent by cheque: August 25 December 1 GHC600 GHC600 March 31 GHC600 June 1 GHC600 ii) Ms Tee sublets part of these premises to Nana Akua at a rent of GHC960 per annum, and on June 1 2016 Nana Akua's rent was one month in arrears. During the year ended 31 May, 2017 Ms Tee received the following amounts in cash from Nana Akua; July 31 September 5 January 1 May 20 GHC80 GHC240 GHC300 GHC120 iii) On June 1, 2016 Ms Tee owed the Electricity Company Ghana GHC148 for electricity supplies up to that date. During the year, she made the following payments for rent by cheque: June 1 GHC148 October 1 GHC164 December 31 GHC208 April 30 GHC162 On 31 May, 2017 there was a balance outstanding on the Electricity Account of GHC192 You are required to write up Ms Tee's a) Rent Payable account b) Rent Receivable account c) Electricity Account, for the year ended 31 May, 2017 showing clearly the amounts to be transferred to the income statement in each case

i) Ms Tee rents her premises at an annual rental of GHC2,400. On June 1, 2016, Ms Tee had paid her rent up to the end of July, and during the year ended 31 May, 2017 she made the following payments for rent by cheque: August 25 December 1 GHC600 GHC600 March 31 GHC600 June 1 GHC600 ii) Ms Tee sublets part of these premises to Nana Akua at a rent of GHC960 per annum, and on June 1 2016 Nana Akua's rent was one month in arrears. During the year ended 31 May, 2017 Ms Tee received the following amounts in cash from Nana Akua; July 31 September 5 January 1 May 20 GHC80 GHC240 GHC300 GHC120 iii) On June 1, 2016 Ms Tee owed the Electricity Company Ghana GHC148 for electricity supplies up to that date. During the year, she made the following payments for rent by cheque: June 1 GHC148 October 1 GHC164 December 31 GHC208 April 30 GHC162 On 31 May, 2017 there was a balance outstanding on the Electricity Account of GHC192 You are required to write up Ms Tee's a) Rent Payable account b) Rent Receivable account c) Electricity Account, for the year ended 31 May, 2017 showing clearly the amounts to be transferred to the income statement in each case

Chapter14: Property Transactions: Determination Of Gain Or Loss And Basis Considerations

Section: Chapter Questions

Problem 31P: Nissa owns a building (adjusted basis of 600,000 on January 1, 2019) that she rents to Len, who...

Related questions

Question

Transcribed Image Text:i) Ms Tee rents her premises at

had paid her rent up to the end of July, and during the year ended 31 May, 2017 she

made the following payments for rent by cheque:

annual rental of GHC2,400. On June 1, 2016, Ms Tee

August 25

December 1

GHC600

GHC600

March 31

GHC600

June 1

GHC600

ii) Ms Tee sublets part of these premises to Nana Akua at a rent of GHC960 per annum,

and on June 1 2016 Nana Akua's rent was one month in arrears. During the year

ended 31 May, 2017 Ms Tee received the following amounts in cash from Nana

Akua:

July 31

September 5

January 1

Мay 20

GHC80

GHC240

GHC300

GHC120

iii) On June 1, 2016 Ms Tee owed the Electricity Company Ghana GHC148 for

electricity supplies up to that date. During the year, she made the following payments

for rent by cheque:

June 1

GHC148

October 1

GHC164

December 31

GHC208

April 30

GHC162

On 31 May, 2017 there was a balance outstanding on the Electricity Account of GHC192

You are required to write up Ms Tee's

a) Rent Payable account

b) Rent Receivable account

c) Electricity Account, for the year ended 31 May, 2017 showing clearly the amounts to

be transferred to the income statement in each case

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT