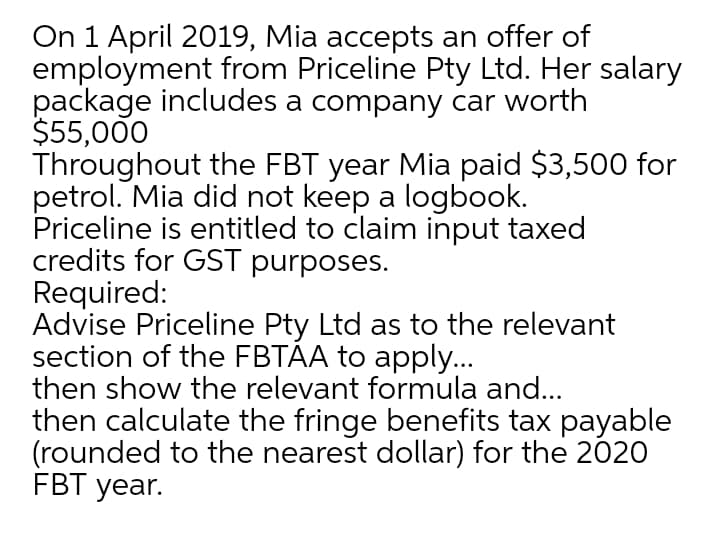

On 1 April 2019, Mia accepts an offer of employment from Priceline Pty Ltd. Her salary package includes a company car worth $55,000 Throughout the FBT year Mia paid $3,500 for petrol. Mia did not keep a logbook. Priceline is entitled to claim input taxed credits for GST purposes. Required: Advise Priceline Pty Ltd as to the relevant section of the FBTÁA to apply... then show the relevant formula and... then calculate the fringe benefits tax payable (rounded to the nearest dollar) for the 2020 FBT year.

On 1 April 2019, Mia accepts an offer of employment from Priceline Pty Ltd. Her salary package includes a company car worth $55,000 Throughout the FBT year Mia paid $3,500 for petrol. Mia did not keep a logbook. Priceline is entitled to claim input taxed credits for GST purposes. Required: Advise Priceline Pty Ltd as to the relevant section of the FBTÁA to apply... then show the relevant formula and... then calculate the fringe benefits tax payable (rounded to the nearest dollar) for the 2020 FBT year.

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 5DQ

Related questions

Question

Transcribed Image Text:On 1 April 2019, Mia accepts an offer of

employment from Priceline Pty Ltd. Her salary

package includes a company car worth

$55,000

Throughout the FBT year Mia paid $3,500 for

petrol. Mia did not keep a logbook.

Priceline is entitled to claim input taxed

credits for GST purposes.

Required:

Advise Priceline Pty Ltd as to the relevant

section of the FBTAA to apply...

then show the relevant formula and...

then calculate the fringe benefits tax payable

(rounded to the nearest dollar) for the 2020

FBT year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT