Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2CMA: Staten Corporation is considering two mutually exclusive projects. Both require an initial outlay of...

Related questions

Question

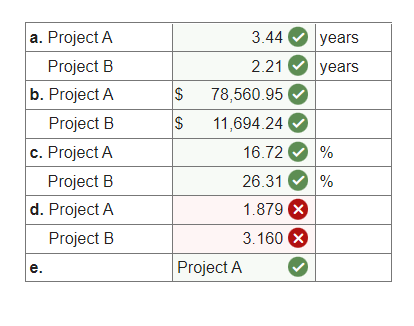

I need help finding the Profitability index for each project (D) using Excel

Transcribed Image Text:a. Project A

Project B

b. Project A

Project B

c. Project A

Project B

d. Project A

Project B

e.

$

$

3.44 years

2.21

years

78,560.95

11,694.24

16.72

26.31

1.879 X

3.160 X

Project A

%

%

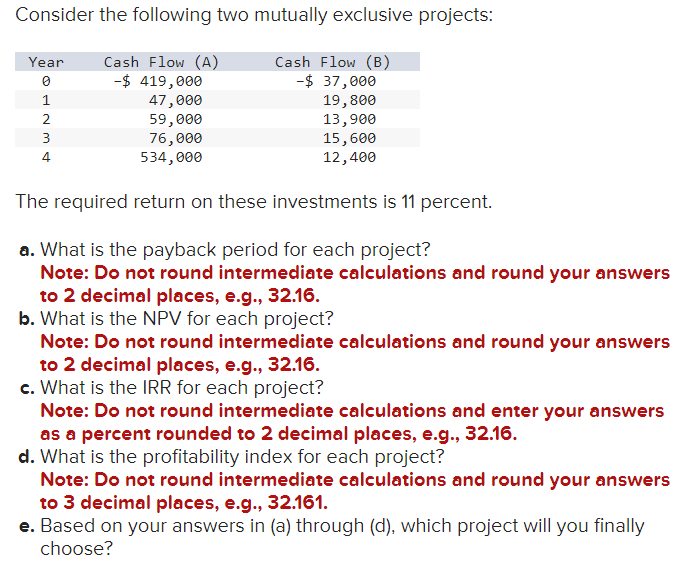

Transcribed Image Text:Consider the following two mutually exclusive projects:

Cash Flow (A)

Cash Flow (B)

-$ 419,000

-$ 37,000

19,800

13,900

15,600

12,400

Year

0

1

2

3

4

47,000

59,000

76,000

534,000

The required return on these investments is 11 percent.

a. What is the payback period for each project?

Note: Do not round intermediate calculations and round your answers

to 2 decimal places, e.g., 32.16.

b. What is the NPV for each project?

Note: Do not round intermediate calculations and round your answers

to 2 decimal places, e.g., 32.16.

c. What is the IRR for each project?

Note: Do not round intermediate calculations and enter your answers

as a percent rounded to 2 decimal places, e.g., 32.16.

d. What is the profitability index for each project?

Note: Do not round intermediate calculations and round your answers

to 3 decimal places, e.g., 32.161.

e. Based on your answers in (a) through (d), which project will you finally

choose?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning