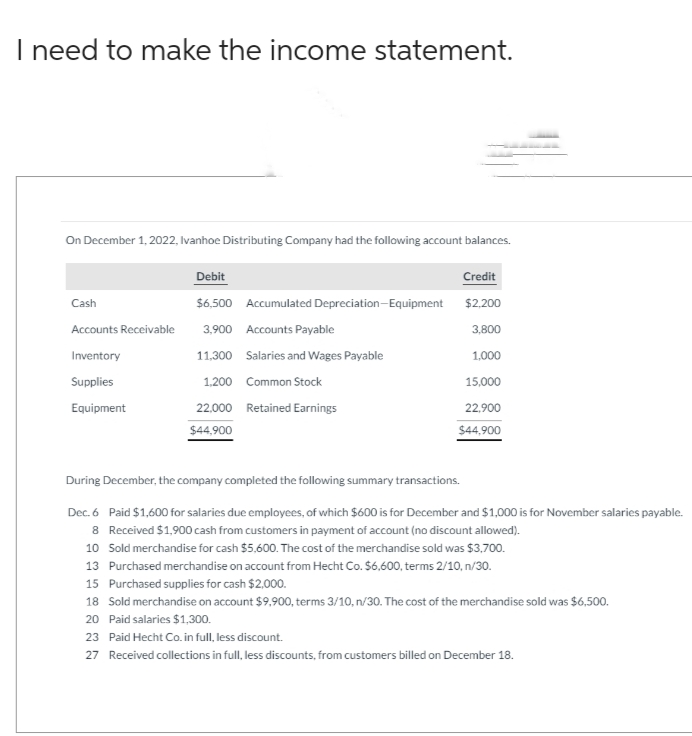

I need to make the income statement. On December 1, 2022, Ivanhoe Distributing Company had the following account balances. Debit Credit $6,500 Accumulated Depreciation Equipment $2,200 3,900 Accounts Payable 3,800 11,300 Salaries and Wages Payable 1,000 1,200 Common Stock 15,000 22,000 Retained Earnings 22,900 $44,900 $44,900 Cash Accounts Receivable Inventory Supplies Equipment During December, the company completed the following summary transactions. Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable. 8 Received $1,900 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $5,600. The cost of the merchandise sold was $3,700. 13 Purchased merchandise on account from Hecht Co. $6,600, terms 2/10, n/30. 15 Purchased supplies for cash $2,000. 18 Sold merchandise on account $9.900, terms 3/10, n/30. The cost of the merchandise sold was $6,500. 20 Paid salaries $1,300. 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18.

I need to make the income statement. On December 1, 2022, Ivanhoe Distributing Company had the following account balances. Debit Credit $6,500 Accumulated Depreciation Equipment $2,200 3,900 Accounts Payable 3,800 11,300 Salaries and Wages Payable 1,000 1,200 Common Stock 15,000 22,000 Retained Earnings 22,900 $44,900 $44,900 Cash Accounts Receivable Inventory Supplies Equipment During December, the company completed the following summary transactions. Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable. 8 Received $1,900 cash from customers in payment of account (no discount allowed). 10 Sold merchandise for cash $5,600. The cost of the merchandise sold was $3,700. 13 Purchased merchandise on account from Hecht Co. $6,600, terms 2/10, n/30. 15 Purchased supplies for cash $2,000. 18 Sold merchandise on account $9.900, terms 3/10, n/30. The cost of the merchandise sold was $6,500. 20 Paid salaries $1,300. 23 Paid Hecht Co. in full, less discount. 27 Received collections in full, less discounts, from customers billed on December 18.

Chapter16: Statement Of Cash Flows

Section: Chapter Questions

Problem 1PA: Provide journal entries to record each of the following transactions. For each, also identify *the...

Related questions

Topic Video

Question

Please do not give solution in image format thanku

Transcribed Image Text:I need to make the income statement.

On December 1, 2022, Ivanhoe Distributing Company had the following account balances.

Cash

Accounts Receivable

Inventory

Supplies

Equipment

Debit

$6,500 Accumulated Depreciation Equipment

3,900 Accounts Payable

11,300

Salaries and Wages Payable

1,200

Common Stock

22,000 Retained Earnings

$44,900

Credit

$2,200

3,800

1,000

15,000

22,900

$44,900

During December, the company completed the following summary transactions.

Dec. 6 Paid $1,600 for salaries due employees, of which $600 is for December and $1,000 is for November salaries payable.

8 Received $1,900 cash from customers in payment of account (no discount allowed).

10 Sold merchandise for cash $5,600. The cost of the merchandise sold was $3,700.

13 Purchased merchandise on account from Hecht Co. $6,600, terms 2/10, n/30.

15 Purchased supplies for cash $2,000.

18 Sold merchandise on account $9,900, terms 3/10, n/30. The cost of the merchandise sold was $6,500.

20 Paid salaries $1,300.

23 Paid Hecht Co. in full, less discount.

27 Received collections in full, less discounts, from customers billed on December 18.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub