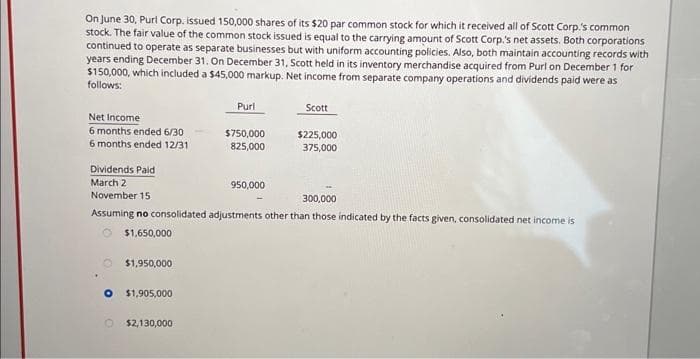

On June 30, Purl Corp. issued 150,000 shares of its $20 par common stock for which it received all of Scott Corp.'s common stock. The fair value of the common stock issued is equal to the carrying amount of Scott Corp.'s net assets. Both corporations continued to operate as separate businesses but with uniform accounting policies. Also, both maintain accounting records with years ending December 31. On December 31, Scott held in its inventory merchandise acquired from Purl on December 1 for $150,000, which included a $45,000 markup. Net income from separate company operations and dividends paid were as follows: Net Income 6 months ended 6/30 6 months ended 12/31 $1,950,000 Purl O $1,905,000 $750,000 825,000 Dividends Paid March 2 November 15 300,000 Assuming no consolidated adjustments other than those indicated by the facts given, consolidated net income is $1,650,000 Scott 950,000 $225,000 375,000

On June 30, Purl Corp. issued 150,000 shares of its $20 par common stock for which it received all of Scott Corp.'s common stock. The fair value of the common stock issued is equal to the carrying amount of Scott Corp.'s net assets. Both corporations continued to operate as separate businesses but with uniform accounting policies. Also, both maintain accounting records with years ending December 31. On December 31, Scott held in its inventory merchandise acquired from Purl on December 1 for $150,000, which included a $45,000 markup. Net income from separate company operations and dividends paid were as follows: Net Income 6 months ended 6/30 6 months ended 12/31 $1,950,000 Purl O $1,905,000 $750,000 825,000 Dividends Paid March 2 November 15 300,000 Assuming no consolidated adjustments other than those indicated by the facts given, consolidated net income is $1,650,000 Scott 950,000 $225,000 375,000

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 36P

Related questions

Question

4.

Subject :- Accounting

Transcribed Image Text:On June 30, Purl Corp. issued 150,000 shares of its $20 par common stock for which it received all of Scott Corp.'s common

stock. The fair value of the common stock issued is equal to the carrying amount of Scott Corp.'s net assets. Both corporations

continued to operate as separate businesses but with uniform accounting policies. Also, both maintain accounting records with

years ending December 31. On December 31, Scott held in its inventory merchandise acquired from Purl on December 1 for

$150,000, which included a $45,000 markup. Net income from separate company operations and dividends paid were as

follows:

Net Income

6 months ended 6/30

6 months ended 12/31

$1,950,000

O $1,905,000

Purl

O $2,130,000

$750,000

825,000

Dividends Paid

March 2

November 15

300,000

Assuming no consolidated adjustments other than those indicated by the facts given, consolidated net income is

$1,650,000

Scott

950,000

$225,000

375,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College