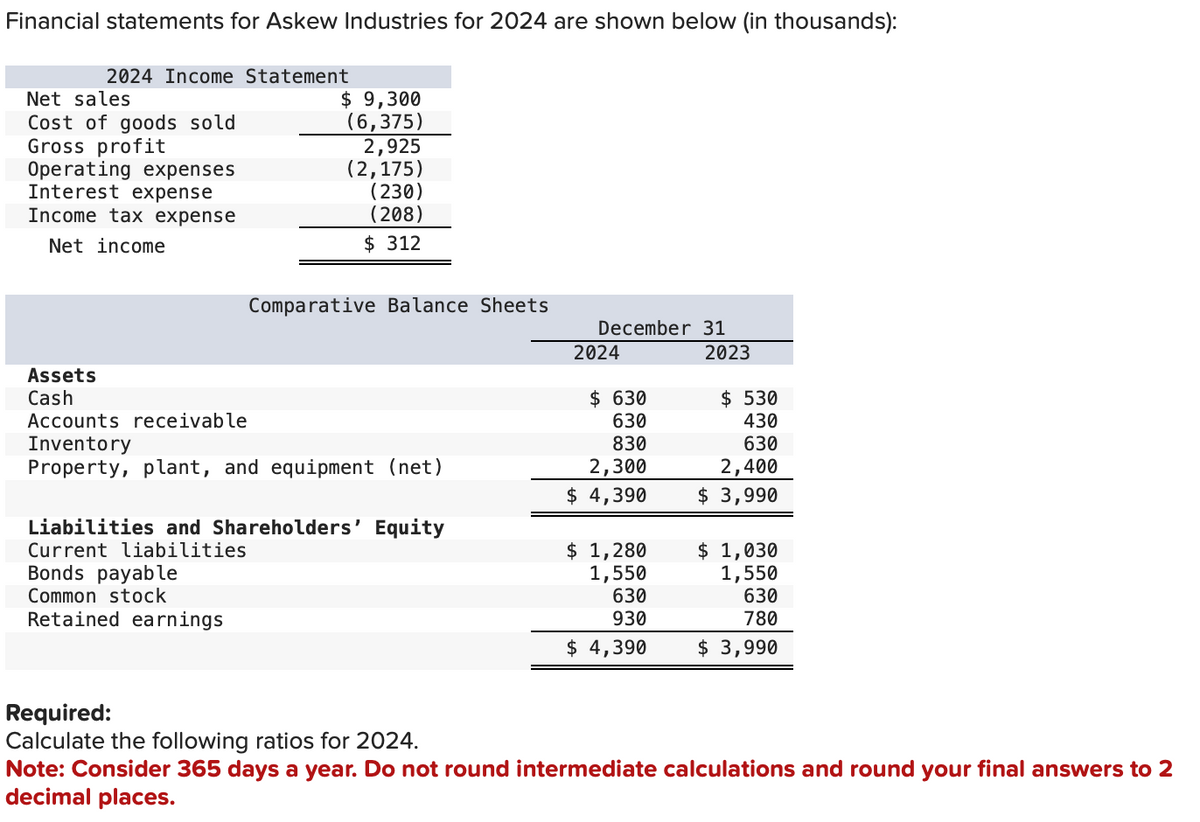

Financial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income Statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 9,300 (6,375) 2,925 (2,175) (230) (208) $312 Bonds payable Common stock Retained earnings Comparative Balance Sheets Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 $630 630 830 2,300 $ 4,390 $ 1,280 1,550 630 930 $4,390 2023 $530 430 630 2,400 $ 3,990 $ 1,030 1,550 630 780 $ 3,990 Required: Calculate the following ratios for 2024. Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.

Financial statements for Askew Industries for 2024 are shown below (in thousands): 2024 Income Statement Net sales Cost of goods sold Gross profit Operating expenses Interest expense Income tax expense Net income Assets Cash $ 9,300 (6,375) 2,925 (2,175) (230) (208) $312 Bonds payable Common stock Retained earnings Comparative Balance Sheets Accounts receivable Inventory Property, plant, and equipment (net) Liabilities and Shareholders' Equity Current liabilities December 31 2024 $630 630 830 2,300 $ 4,390 $ 1,280 1,550 630 930 $4,390 2023 $530 430 630 2,400 $ 3,990 $ 1,030 1,550 630 780 $ 3,990 Required: Calculate the following ratios for 2024. Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1FSA: Financial statement analysis The financial statements for Nike, Inc., are presented in Appendix D at...

Related questions

Question

Please help me with all answers thanku

Transcribed Image Text:Financial statements for Askew Industries for 2024 are shown below (in thousands):

2024 Income Statement

Net sales

Cost of goods sold

Gross profit

Operating expenses

Interest expense

Income tax expense

Net income

Assets

Cash

$9,300

(6,375)

2,925

(2,175)

Bonds payable

Common stock

Retained earnings

(230)

(208)

$312

Comparative Balance Sheets

Accounts receivable

Inventory

Property, plant, and equipment (net)

Liabilities and Shareholders' Equity

Current liabilities

December 31

2024

$ 630

630

830

2,300

$ 4,390

$ 1,280

1,550

630

930

$ 4,390

2023

$530

430

630

2,400

$ 3,990

$ 1,030

1,550

630

780

$ 3,990

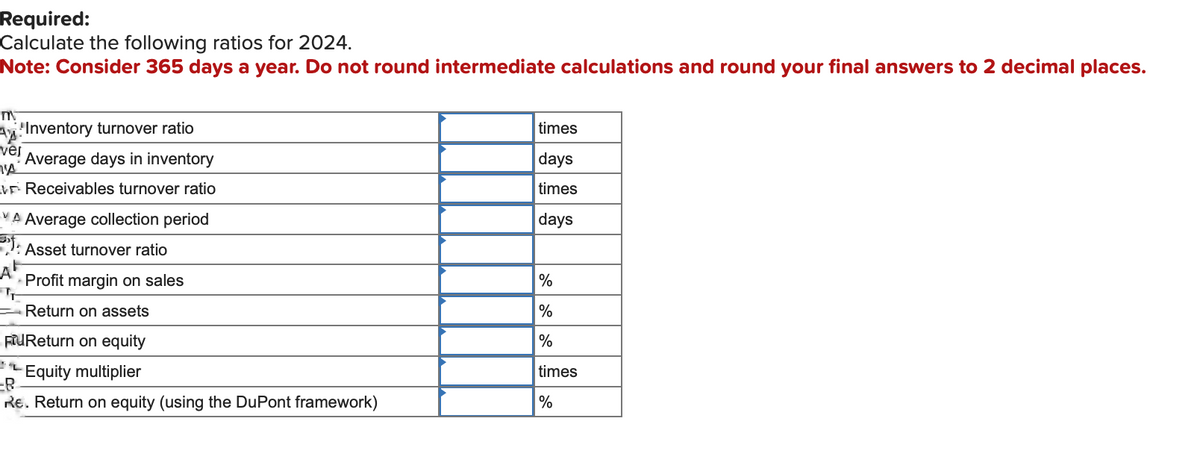

Required:

Calculate the following ratios for 2024.

Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2

decimal places.

Transcribed Image Text:Required:

Calculate the following ratios for 2024.

Note: Consider 365 days a year. Do not round intermediate calculations and round your final answers to 2 decimal places.

m

Inventory turnover ratio

Average days in inventory

vej

'A

V Receivables turnover ratio

VA Average collection period

Asset turnover ratio

Profit margin on sales

Return on assets

FUReturn on equity

Equity multiplier

B

Re. Return on equity (using the DuPont framework)

times

days

times

days

%

%

%

times

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning