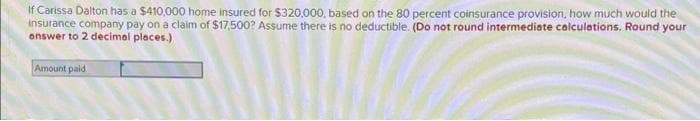

If Carissa Dalton has a $410,000 home insured for $320,000, based on the 80 percent coinsurance provision, how much would the Insurance company pay on a claim of $17,500? Assume there is no deductible. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Amount paid

If Carissa Dalton has a $410,000 home insured for $320,000, based on the 80 percent coinsurance provision, how much would the Insurance company pay on a claim of $17,500? Assume there is no deductible. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Amount paid

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 21CE

Related questions

Question

Transcribed Image Text:If Carissa Dalton has a $410,000 home insured for $320,000, based on the 80 percent coinsurance provision, how much would the

Insurance company pay on a claim of $17,500? Assume there is no deductible. (Do not round intermediate calculations. Round your

answer to 2 decimal places.)

Amount paid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT