If Castle View currently does not have any initial working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

If Castle View currently does not have any initial working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter11: Current Liabilities And Payroll

Section: Chapter Questions

Problem 11.5BPR: Payroll accounts and year-end entries The following accounts, with the balances indicated, appear in...

Related questions

Question

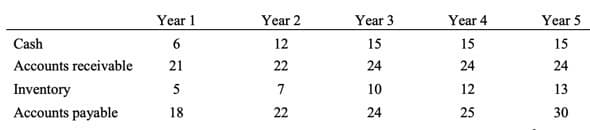

Castle View Games would like to invest in a division to develop software for a soon to-be-released video game console. To evaluate this decision, the firm first attempts to project the

If Castle View currently does not have any initial working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment.

Transcribed Image Text:Year 1

Year 2

Year 3

Year 4

Year 5

Cash

6

12

15

15

15

Accounts receivable

21

22

24

24

24

Inventory

5

7

10

12

13

Accounts payable

18

22

24

25

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning