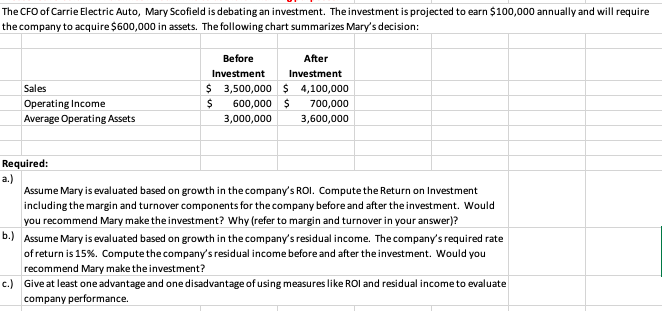

The CFO of Carrie Electric Auto, Mary Scofield is debating an investment. The investment is projected to earn $100,000 annually and will require the company to acquire $600,000 in assets. The following chart summarizes Mary's decision: Before After Investment Investment Sales $ 3,500,000 $ 4,100,000 Operating Income Average Operating Assets 600,000 $ 700,000 3,000,000 3,600,000 Required: a.) Assume Mary is evaluated based on growth in the company's ROI. Compute the Return on Investment including the margin and turnover components for the company before and after the investment. Would you recommend Mary make the investment? Why (refer to margin and turnover in your answer)? b.) Assume Mary is evaluated based on growth in the company's residual income. The company's required rate of return is 15%. Compute the company's residual income before and after the investment. Would you recommend Mary make the investment? c.) Give at least one advantage and one disadvantage of using measures like ROI and residual income to evaluate company performance.

The CFO of Carrie Electric Auto, Mary Scofield is debating an investment. The investment is projected to earn $100,000 annually and will require the company to acquire $600,000 in assets. The following chart summarizes Mary's decision: Before After Investment Investment Sales $ 3,500,000 $ 4,100,000 Operating Income Average Operating Assets 600,000 $ 700,000 3,000,000 3,600,000 Required: a.) Assume Mary is evaluated based on growth in the company's ROI. Compute the Return on Investment including the margin and turnover components for the company before and after the investment. Would you recommend Mary make the investment? Why (refer to margin and turnover in your answer)? b.) Assume Mary is evaluated based on growth in the company's residual income. The company's required rate of return is 15%. Compute the company's residual income before and after the investment. Would you recommend Mary make the investment? c.) Give at least one advantage and one disadvantage of using measures like ROI and residual income to evaluate company performance.

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 1P: Talbot Industries is considering launching a new product. The new manufacturing equipment will cost...

Related questions

Question

100%

Transcribed Image Text:The CFO of Carrie Electric Auto, Mary Scofield is debating an investment. The investment is projected to earn $100,000 annually and will require

the company to acquire $600,000 in assets. The following chart summarizes Mary's decision:

Before

After

Investment

Investment

Sales

$ 3,500,000 $ 4,100,000

Operating Income

600,000 $

700,000

Average Operating Assets

3,000,000

3,600,000

Required:

a.)

Assume Mary is evaluated based on growth in the company's ROI. Compute the Return on Investment

including the margin and turnover components for the company before and after the investment. Would

you recommend Mary make the investment? Why (refer to margin and turnover in your answer)?

b.) Assume Mary is evaluated based on growth in the company's residual income. The company's required rate

of return is 15%. Compute the company's residual income before and after the investment. Would you

recommend Mary make the investment?

c.) Give at least one advantage and one disadvantage of using measures like ROI and residual income to evaluate

company performance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning