Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product: (Attached table) When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Using Excel (this will save you time and effort) answer the following: Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV. Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required rate of return. Compute the NPV. Management thinks that if they can spend another $10,000 on advertising each of the next 4 years (at the end of the year), it will cause sales volume to increase by 10% for each of the next 4 years. (Assume all cash flows occur at the end of the year) Compute NPV using a 15% cost of capital.

Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product: (Attached table) When the project concludes in four years the working capital will be released for investment elsewhere within the company. Required: Using Excel (this will save you time and effort) answer the following: Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV. Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required rate of return. Compute the NPV. Management thinks that if they can spend another $10,000 on advertising each of the next 4 years (at the end of the year), it will cause sales volume to increase by 10% for each of the next 4 years. (Assume all cash flows occur at the end of the year) Compute NPV using a 15% cost of capital.

Chapter10: Project Cash Flows And Risk

Section: Chapter Questions

Problem 3PROB

Related questions

Question

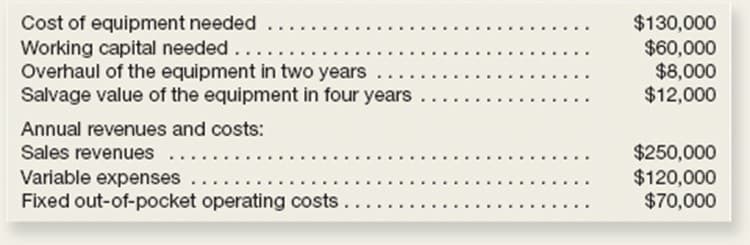

Oakmont Company has an opportunity to manufacture and sell a new product for a four-year period. After careful study, Oakmont estimated the following costs and revenues for the new product:

(Attached table)

When the project concludes in four years the working capital will be released for investment elsewhere within the company.

Required: Using Excel (this will save you time and effort) answer the following:

- Oakmont’s cost of capital is 15%, and management does not feel it should have any adjustment for risk, compute the NPV.

- Same situation as (a), but management does feel this project does possess a greater than average risk, so 19% should be the required

rate of return . Compute the NPV. - Management thinks that if they can spend another $10,000 on advertising each of the next 4 years (at the end of the year), it will cause sales volume to increase by 10% for each of the next 4 years. (Assume all cash flows occur at the end of the year) Compute NPV using a 15% cost of capital.

Transcribed Image Text:Cost of equipment needed

Working capital needed

Overhaul of the equipment in two years

Salvage value of the equipment in four years

$130,000

$60,000

$8,000

$12,000

..

Annual revenues and costs:

Sales revenues

Variable expenses....

Fixed out-of-pocket operating costs

$250,000

$120,000

$70,000

Expert Solution

Step 1

Net present value

The variance of the cash inflows (PV) and cash outflows (PV) over time.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

- Management thinks that, while all of the assumptions about cash flows are the same, but rather than a four-year life, the product will have a six-year life (the salvage of the equipment will also remain the same at end of 6 years as what was estimated for 4 years). Using a 19% required

rate of return , compute theNPV .

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub