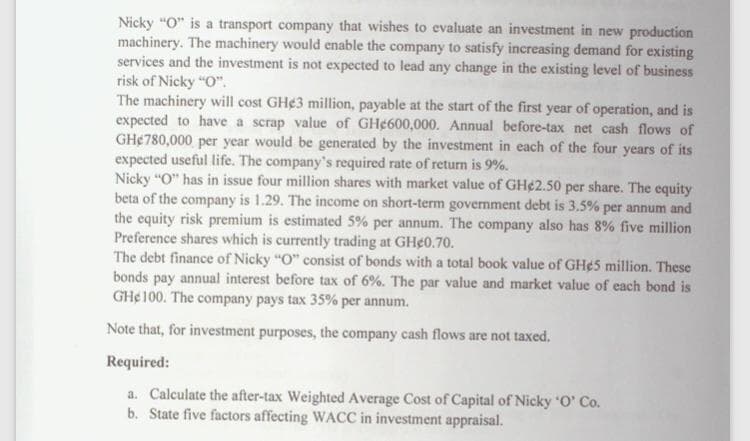

Nicky "O" is a transport company that wishes to evaluate an investment in new production machinery. The machinery would enable the company to satisfy increasing demand for existing services and the investment is not expected to lead any change in the existing level of business risk of Nicky "O". The machinery will cost GH¢3 million, payable at the start of the first year of operation, and is expected to have a scrap value of GH¢600,000. Annual before-tax net cash flows of GH¢780,000 per year would be generated by the investment in each of the four years of its expected useful life. The company's required rate of return is 9%. Nicky "O" has in issue four million shares with market value of GH¢2.50 per share. The equity beta of the company is 1.29. The income on short-term government debt is 3.5% per annum and the equity risk premium is estimated 5% per annum. The company also has 8% five million Preference shares which is currently trading at GH¢0.70. The debt finance of Nicky "O" consist of bonds with a total book value of GH¢S million. These bonds pay annual interest before tax of 6%. The par value and market value of each bond is GH¢100. The company pays tax 35% per annum. Note that, for investment purposes, the company cash flows are not taxed. Required: a. Calculate the after-tax Weighted Average Cost of Capital of Nicky 'O' Co. b. State five factors affecting WACC in investment appraisal.

Nicky "O" is a transport company that wishes to evaluate an investment in new production machinery. The machinery would enable the company to satisfy increasing demand for existing services and the investment is not expected to lead any change in the existing level of business risk of Nicky "O". The machinery will cost GH¢3 million, payable at the start of the first year of operation, and is expected to have a scrap value of GH¢600,000. Annual before-tax net cash flows of GH¢780,000 per year would be generated by the investment in each of the four years of its expected useful life. The company's required rate of return is 9%. Nicky "O" has in issue four million shares with market value of GH¢2.50 per share. The equity beta of the company is 1.29. The income on short-term government debt is 3.5% per annum and the equity risk premium is estimated 5% per annum. The company also has 8% five million Preference shares which is currently trading at GH¢0.70. The debt finance of Nicky "O" consist of bonds with a total book value of GH¢S million. These bonds pay annual interest before tax of 6%. The par value and market value of each bond is GH¢100. The company pays tax 35% per annum. Note that, for investment purposes, the company cash flows are not taxed. Required: a. Calculate the after-tax Weighted Average Cost of Capital of Nicky 'O' Co. b. State five factors affecting WACC in investment appraisal.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 17P: The Perez Company has the opportunity to invest in one of two mutually exclusive machines that will...

Related questions

Question

Question 1

Transcribed Image Text:Nicky "O" is a transport company that wishes to evaluate an investment in new production

machinery. The machinery would enable the company to satisfy increasing demand for existing

services and the investment is not expected to lead any change in the existing level of business

risk of Nicky "O".

The machinery will cost GH¢3 million, payable at the start of the first year of operation, and is

expected to have a scrap value of GH¢600,000. Annual before-tax net cash flows of

GH¢780,000 per year would be generated by the investment in each of the four years of its

expected useful life. The company's required rate of return is 9%.

Nicky "O" has in issue four million shares with market value of GH¢2.50 per share. The cquity

beta of the company is 1.29. The income on short-term government debt is 3.5% per annum and

the equity risk premium is estimated 5% per annum. The company also has 8% five million

Preference shares which is currently trading at GH¢0.70.

The debt finance of Nicky "O" consist of bonds with a total book value of GH¢5 million. These

bonds pay annual interest before tax of 6%. The par value and market value of each bond is

GH¢100. The company pays tax 35% per annum.

Note that, for investment purposes, the company cash flows are not taxed.

Required:

a. Calculate the after-tax Weighted Average Cost of Capital of Nicky O' Co.

b. State five factors affecting WACC in investment appraisal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning