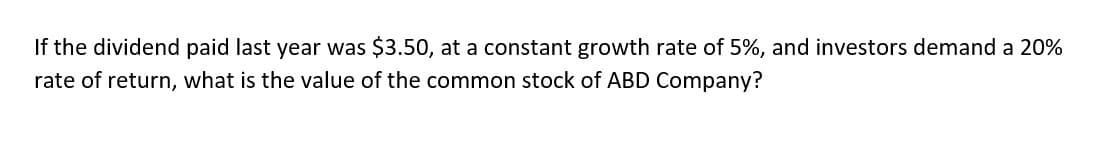

If the dividend paid last year was $3.50, at a constant growth rate of 5%, and investors demand a 20% rate of return, what is the value of the common stock of ABD Company?

Q: A government starts off with a total debt of $2.0 billion. In year one, the government runs a…

A: A nation's gross government debt (likewise called public debt, or sovereign debt[1]) is the monetary…

Q: 9. A consumer has the utility function u(x,y) = x+6y and the price of x is $1 and the price of y is…

A: In the utility function the alternate projects will give the ranking according to the utility to an…

Q: Taxes are costs, and, therefore, changes in tax rates can affect consumer prices, project lives, and…

A: A firm, project, or investment's future stream of payments is valued today using a method known as…

Q: A survey was conducted among four consumer-classes as to the relationship between the average price…

A:

Q: Consider each of the following deposit cash flow series. What will the final balance (future…

A: The future equivalent value of cash flows will be computed as the sum of the future value for all…

Q: Let's normalize Canadian GDP in 2005 to 100. Out of that, consumption was 70, investment was 20,…

A: The GDP annual average rate of change for a given country economy over a specific time period,…

Q: A survey was conducted among four consumer-classes as to the relationship between the average price…

A: Given, A survey was conducted among four consumer classesTo determine the relationship between…

Q: Table 1 Disposable Income $50,000 Consumption $40,000 Disposable Income $20,000 Table 2 Use the…

A: The Marginal propensity to consume measures the change in the consumption in response to the change…

Q: Suppose there are two goods, pizza and beverage. Suppose alp=5289, atp=911, alb=2508, atb=2172,…

A: The equilibrium wage is atp/alp + atb/alb. In this case, the equilibrium wage is atp/alp + atb/alb =…

Q: Which of the following items is included in GDP? the sale of stocks and bonds the sale of…

A: Items that are included in GDP are the one that are produced for final consumption in the specfiic…

Q: Total revenue increases of the price of the good A) rises and demand is elastic. B) rises and…

A: The elasticity of demand is the percentage change in quantity demanded divided by the percentage…

Q: Consider a budget line drawn with apples on the vertical axis and oranges on the horizontal axis.…

A: Initial Income = 100 Price of Apple = 5 Price of Orange = 10 Income decreases to 75

Q: Provide a brief (2-3 sentences), but detailed, definition/explanation/identification of each of the…

A: 1. The naturalist approach is a research perspective that emphasizes the role of natural selection…

Q: The table below shows the production possibilities in Mistania between 2014 and 2015. Using the…

A: “Production Possibility Curve is a curve which shows various combination of two goods that can be…

Q: Give me three examples of a normal good, luxury good and inferior good and tell me why ?

A: Three examples of normal goods are- Clothing, household appliances and food Staples. Normal goods…

Q: An IBD/TIPP poll conducted to learn about attitudes toward investment and retirement asked male and…

A: Since You have posted multiple subparts, as per the guidelines we can solve only the first three…

Q: In five years, P18,000 will be needed to pay for the retrofitting of the barangay hall. To generate…

A: Sum required in future = 18000 Total Time Period = 5 years Number of Annual Payments to be made = 3…

Q: The supply and demand for a computer in a store are given for two prices: for a price of $800, the…

A: The demand curve depicts the amount of items consumers will be willing to buy at each market price.…

Q: What is Money? What makes it useful? Explain its primary and derivative functions of Money

A: The world won't move without money, though that may sound dramatic. Of course, it will abruptly…

Q: If a corporation has $400 million in common stock, $200 million in preferred stock, and $500 million…

A: Given, It a corporation has common stock = $400 Million Preferred stock = $200 million Bonds =$500…

Q: Assuming the market equilibrium price for wheat is $5 per bushel, draw the total revenue and the…

A: In economics, total revenue refers to all proceeds from the sale of a specific amount of goods or…

Q: Given the following demand and supply equations: Demand Qd = 100 - 2P Supply QS = 10 + P 1.…

A: Equilibrium price is the price at which quantity demanded equals quantity supplied and the market…

Q: How does free trade bring up scenarios where businesses can compare employees from different…

A: Trade is the term used to describe the exchange of commodities and services between economies. Trade…

Q: The first design option needs a machine that has an estimated initial cost of P1,850,000. The…

A: The present worth of the machine is the discounted time value of money at a given interest rate.…

Q: What is present worth

A: We know that Investment is the process of adding to the stock of capital assets with the expectation…

Q: One of the primary causes of poverty in many developing nations is thought to be cattle mortality…

A: The distribution of limited resources to meet human consumers' needs can be referred to as…

Q: Consider an economy in which the consumption, investment and production functions are as follows. C…

A: Equilibrium in economy is achieved at the point where , aggregate demand equals aggregate…

Q: Economics question. Decision-making sciences include A. Economics and econometrics based on…

A: The study of managerial economics involves applying decision science techniques to economic theory.…

Q: fer to Figure 9-1. Relative to the no-trade situation, trade with the rest of the world results in…

A: In monetary economics, the no-trade hypothesis expresses that if. markets are in a condition of…

Q: 3. Carp, Inc. wants to evaluate two methods of packaging their products. Use an interest rate of 15%…

A: Particular A B First Cost 700000 1700000 O&M Cost 18000 29000 + Cost Gradient 900 750…

Q: 16. In the short run, the profit maximization for a firm in a perfectly competitive market would be:…

A: In the short-run, a perfectly competitive firm has an incentive to earn profit due to relatively…

Q: 16. In the short run, the profit maximization for a firm in a perfectly competitive market would be:…

A: A perfectly competitive market is a market structure consisting of a large number of firms and large…

Q: If the share of GDP used for capital goods is 0.09, the growth rate of productivity is 0.09, the…

A: Given, GDP Share for Capital Goods=0.09Growth Rate of Productivity=0.09Growth Rate of…

Q: e following table contains information about the wheat market: Price per Bushel (dollars)…

A: In economics, the quantity is taken on the x-axis and the price is taken on the y-axis. So the…

Q: The most frequently reported price index is O the personal consumption expenditure (PCE) deflator…

A: A price index (PI) determines how the prices change over a specific time frame, or in other words,…

Q: How much do you have to deposit now (with a second deposit in the amount of $600 at the end of the…

A: Year Cash Flow 0 a 1 -600 2 250 3 250 4 250 5 500 6 500 r = 5%

Q: An individual makes six annual deposits of $2,000 in a savings account that pays interest at a…

A: Given To solve the given problem, we need a cash flow diagram. There are six annual deposits of…

Q: 90 85 Price ០៣៩៣៩៥៩៦តៗទាវវគ 80 65 60 55 50 45 40 35 30 25 20 15 10 $75; Market for Laptop Chargers…

A: The maximum willing price for a good or service is referred to as the reservation price. It is…

Q: Market (inverse) demand for aluminum is given by P = 200 - 2Q. Market (inverse) supply for aluminum…

A: # Demand function : P = 200 - 2Q # Marginal Cost = 40 + 0.5Q # Marginal external cost = 1.5Q

Q: The constant price elasticity of demand for cigarettes has been estimated to be-0.5. To reduce…

A: In order to comprehend the burden and incidence of taxes, it's vital to understand both taxes and…

Q: Need help with this and please show me how do to do the graphs too, where to put the colors for…

A: Consumer surplus, also known as social surplus and consumer surplus, in economics, is the…

Q: Suppose that a small business sells 725 units of goods per month at $15 per unit. The unit cost of…

A: Revenue minus explicit costs minus opportunity cost can be used to determine an economic profit (or…

Q: 4. Which point represents underutilization? * A B OE O A&B O A, B,D,& F O C O A&D E Good X

A: A graph showing the possible manufacturing combinations of two items is known as a production…

Q: Consider the CEO of a company that sells coffee at small free standing shops around the country. The…

A: Elasticity is the responsiveness in one variable due to change in another variable.

Q: Disposable Income 2000 4000 6000 Saving Table 3 (Total) Consumption Autonomous Consumption Induced…

A: Disposable income refers to the net income which is available to a consumer to spend on goods and…

Q: Marvin has a COBD-Douglas utility function, 0.5 U=q₁ 110.59₂0 his income is Y = $700, and initially…

A: Consumer surplus. compensating variation and equivalent variation are the measures of consumer…

Q: How does a tradeoff exist between a clean environment and a higher level of income? Studies show…

A: When analyzing the relationship between clean environment and the level of Income, it can be said…

Q: 16. In the short run, the profit maximization for a firm in a perfectly competitive market would be:…

A: The market structure known as "perfect competition" refers to the one of a kind since it enables…

Q: Consider a government that raises money in a two-good economy by taxing good 1 at a rate of t per…

A: Given, Government raises money in a two-good economy by taxing good 1 at a rate of t per unitThe…

Q: What is the demand curve? Why does it slope downward?

A: Demand is defined as the volume of a good or service that customers buy at different prices during a…

Step by step

Solved in 3 steps

- On the advice of your uncle, you purchased 10 shares of a well-established U.S.-based corporate stock for $21 per share. After 1 quarter, you received $0.25 per share dividends each quarter for 2 years. At that point, the stock price had gone down in a short-term recession, so you purchased 10 more shares at $18 per share. The stock continued to pay 25¢ a share on all 20 shares. After 3 years (12 quarters), you decided to sell the stock since it had increased in market value to $24 per share. Make the following assumptions: (a) no commissions for the purchase or sale of the stock, (b) no government taxes on the dividends, and (c) quarterly compounding of the rate of return. What is the effective interest rate per year? The effective interest rate per year is %.Phil’s Flowers (PF) currently has 5,600,000 shares of stock outstanding that sell for $117 per share. Assuming no market imperfections or tax effects exist, what will be the total number of shares and the share price after each of the following? (Please consider each one independently). c) PF has a $2.50 cash dividend? (Step by step solutions )How is the M 2money stock measured in South Africa? List ALL the components

- If a firm earns $375 billion in profits for the year and they retain $218 billion, what is the percent dividend payout rate?assuming that the average duration of its $100 million of assets is four years, while the average duration of its $90 million of liabilities is three years, then a 5 percentage point increase in interest rates will cause the net worth of first national to increase by ______ % (negative if it is a decline) of the total original asset value.You are considering the purchase of a certain stock. You expect to own the stock for the next four years. The stock's current market price is $24.50, and you expect to sell it for $55 in four years. You also expect the stock to pay an annual dividend of $1.25 at the end of Year 1, $1.35 at the end of Year 2, $1.45 at the end of Year 3, and $1.55 at the end of Year 4. What is your expected return from this investment? Please show all the steps, including the equation(s).

- Which of the following conditions must hold true for the constant growth valuation formula to be useful and give meaningful results? The company’s growth rate needs to change as the company matures. The company’s stock cannot be a zero growth stock. The required rate of return, rss, must be greater than the long-run growth rate.The Duo Growth Company just paid a dividend of $1.00 per share. The dividend is expected to grow at a rate of 26% per year for the next three years and then to level off to 5% per year forever. You think the appropriate market capitalization rate is 21% per year. Required: a. What is your estimate of the intrinsic value of a share of the stock? Note: Use intermediate calculations rounded to 4 decimal places. Round your answer to 2 decimal places. b. If the market price of a share is equal to this intrinsic value, what is the expected dividend yield? Note: Use intermediate values rounded to 2 decimal places. Round your answer to 2 decimal places. c. What do you expect its price to be one year from now? Note: Use intermediate values rounded to 4 decimal places. Round your answer to 2 decimal places. d-1. What is the implied capital gain? Note: Use intermediate values rounded to 2 decimal places. Round your answer to 4 decimal places. d-2. Is the implied capital gain…Under-capitalization of a business entity causes:a) a situation when current assets are financed from long-term capital.b) a situation when long-term assets are financed from short term financial resources.c) a situation when the respective business entity is spending more capital than it is able to gain.d) a situation when long-term assets are financed from short term receivables.

- The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared? Group of answer choices.... $60,000. $20,000. $120,000. $100,000.According to the company’s ACT 2019, Act 992 of Ghana, it is mandatory for every registered company to organise an annual general meeting (AGM). The AGM shall be held not earlier than twenty one days after the annual reports which comprises the Financial statement, reports of the directors and auditors on the financial statements have been dispatched to shareholders and debenture holders of the company However, in recent times a number of investigations have been conducted by the department of Accounting and finance at Ghana Technology university college into the use made by shareholders of the annual reports of companies in which they have invested . Several of these research shows that the annual report is regarded as an important source of information for making decisions on equity investment. Other types of study indicate that the market price of the shares in companies does not react to in the short term to the publication of the company’s annual report Requires; How…Victor and Maria Hernandez Wonder About Investing Victor and Maria have decided to increase their contribution to their investment portfolio since Victor is now age 59 and thinking about retiring in five years. For years, they have followed a moderate-risk investment philosophy and put their money in suitable stocks, bonds, and mutual funds. The value of their portfolio is now $420,000, and this is in addition to their paid-for rental property, which is worth $300,000. They plan to invest about $12,000 every year for the next five years. Why should Victor and Maria consider buying common stock as an investment with the additional money? Why or why not? Maria bought a stock with a market price of $50 and a beta value of 1.9, what would be the likely price of an $12,000 investment after one year if the general market for stocks rose 5 percent? Round your answer to the nearest dollar. Do not round intermediate calculations. 3.What would the same investment be worth if the general…