If the interest rate is 3%, then the quantity of loanable funds supplied would be i pressure on the equilibrium interest rate. than the quantity demanded, putting

If the interest rate is 3%, then the quantity of loanable funds supplied would be i pressure on the equilibrium interest rate. than the quantity demanded, putting

Chapter21: Financial Markets, Saving, And Investment

Section: Chapter Questions

Problem 9P

Related questions

Question

100%

Transcribed Image Text:Given the information in the preceding tables, use the blue points (circle symbol) to plot the demand for loanable funds. Next, use the orange points

(square symbol) to plot the supply of loanable funds. Finally, use the black point (cross symbol) to indicate the equilibrium in this market.

?

INTEREST RATE (Percent)

• #

Market for Loanable Funds

25 50 35 100 125 150 175 200 225

QUANTITY OF LOANABLE FUNDS (Bilions of dollars)

Equilibrium

If the interest rate is 3%, then the quantity of loanable funds supplied would be

pressure on the equilibrium interest rate.

than the quantity demanded, putting

27

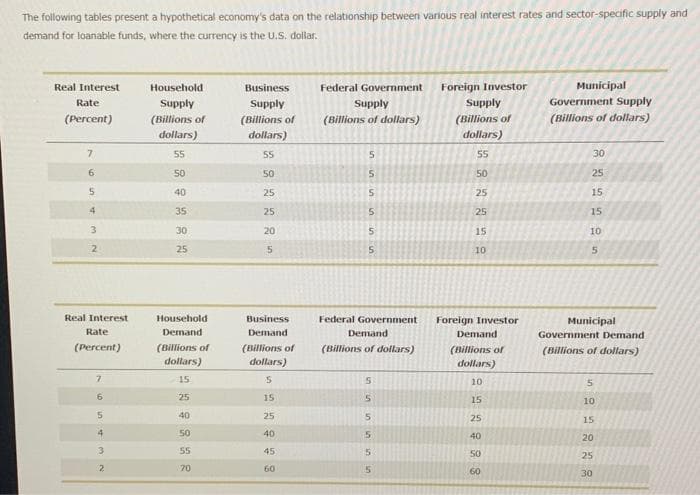

Transcribed Image Text:The following tables present a hypothetical economy's data on the relationship between various real interest rates and sector-specific supply and

demand for loanable funds, where the currency is the U.S. dollar.

Real Interest

Rate

(Percent)

7

6

5

43

2

Real Interest

Rate

(Percent)

7

6

5

3

2

Household

Supply

(Billions of

dollars)

55

50

40

35

30

25

Household

Demand

(Billions of

dollars)

15

25

40

50

55

70

Business

Supply

(Billions of

dollars)

55

50

25

25

20

in

Business

Demand

(Billions of

dollars)

5

15

25

40

45

60

Federal Government

Supply

(Billions of dollars)

ssssss

5

5

5

5

5

5

Federal Government

Demand

(Billions of dollars)

555555

Foreign Investor

Supply

(Billions of

dollars)

55

50

25

25

15

10

Foreign Investor

Demand

(Billions of

dollars)

24498

10

15

25

40

50

60

Municipal

Government Supply

(Billions of dollars)

30

25

15

15

10

5

Municipal

Government Demand

(Billions of dollars)

5

10

15

20

25

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning