manufactures and sells gas-powered electricity generators. It ase a new line of fuel injectors from either of two companies: AOC and annual savings estimates are available, but the sav ate is unreliable at this time. Use an AW analysis at MARR = 10 ar to determine if the selection between A and B changes wh timated savings varies as much as ±40% from the best estima so, at what percentage in the estimate? Use tabulated factors A B any cost, $ -54,000 -47,50

manufactures and sells gas-powered electricity generators. It ase a new line of fuel injectors from either of two companies: AOC and annual savings estimates are available, but the sav ate is unreliable at this time. Use an AW analysis at MARR = 10 ar to determine if the selection between A and B changes wh timated savings varies as much as ±40% from the best estima so, at what percentage in the estimate? Use tabulated factors A B any cost, $ -54,000 -47,50

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter11: Cash Flow Estimation And Risk Analysis

Section: Chapter Questions

Problem 8P: The Rodriguez Company is considering an average-risk investment in a mineral water spring project...

Related questions

Question

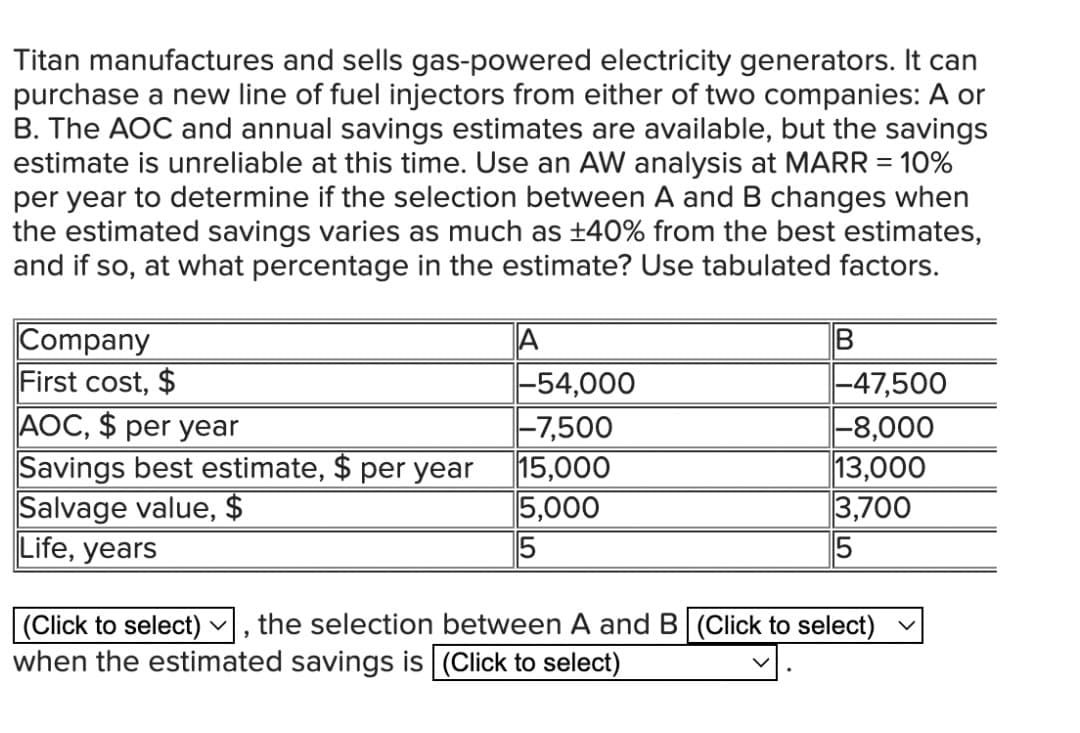

Transcribed Image Text:Titan manufactures and sells gas-powered electricity generators. It can

purchase a new line of fuel injectors from either of two companies: A or

B. The AOC and annual savings estimates are available, but the savings

estimate is unreliable at this time. Use an AW analysis at MARR = 10%

per year to determine if the selection between A and B changes when

the estimated savings varies as much as ±40% from the best estimates,

and if so, at what percentage in the estimate? Use tabulated factors.

A

B

Company

First cost, $

-54,000

-47,500

AOC, $ per year

-7,500

-8,000

Savings best estimate, $ per year

15,000

13,000

Salvage value, $

5,000

3,700

Life, years

5

(Click to select)

the selection between A and B (Click to select)

9

when the estimated savings is (Click to select)

V

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College