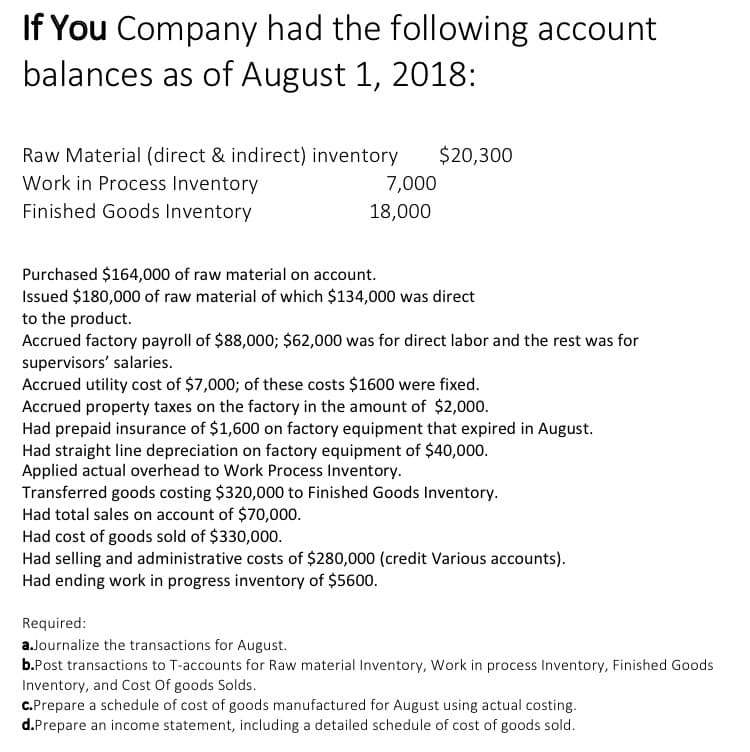

If You Company had the following account balances as of August 1, 2018: Raw Material (direct & indirect) inventory $20,300 Work in Process Inventory 7,000 Finished Goods Inventory 18,000 Purchased $164,000 of raw material on account. Issued $180,000 of raw material of which $134,000 was direct to the product. Accrued factory payroll of $88,000; $62,000 was for direct labor and the rest was for supervisors' salaries. Accrued utility cost of $7,000; of these costs $1600 were fixed. Accrued property taxes on the factory in the amount of $2,000. Had prepaid insurance of $1,600 on factory equipment that expired in August. Had straight line depreciation on factory equipment of $40,000. Applied actual overhead to Work Process Inventory. Transferred goods costing $320,000 to Finished Goods Inventory. Had total sales on account of $70,000. Had cost of goods sold of $330,000. Had selling and administrative costs of $280,000 (credit Various accounts). Had ending work in progress inventory of $5600. Required: a.Journalize the transactions for August. b.Post transactions to T-accounts for Raw material Inventory, Work in process Inventory, Finished Goods Inventory, and Cost Of goods Solds. C.Prepare a schedule of cost of goods manufactured for August using actual costing. d.Prepare an income statement, including a detailed schedule of cost of goods sold.

If You Company had the following account balances as of August 1, 2018: Raw Material (direct & indirect) inventory $20,300 Work in Process Inventory 7,000 Finished Goods Inventory 18,000 Purchased $164,000 of raw material on account. Issued $180,000 of raw material of which $134,000 was direct to the product. Accrued factory payroll of $88,000; $62,000 was for direct labor and the rest was for supervisors' salaries. Accrued utility cost of $7,000; of these costs $1600 were fixed. Accrued property taxes on the factory in the amount of $2,000. Had prepaid insurance of $1,600 on factory equipment that expired in August. Had straight line depreciation on factory equipment of $40,000. Applied actual overhead to Work Process Inventory. Transferred goods costing $320,000 to Finished Goods Inventory. Had total sales on account of $70,000. Had cost of goods sold of $330,000. Had selling and administrative costs of $280,000 (credit Various accounts). Had ending work in progress inventory of $5600. Required: a.Journalize the transactions for August. b.Post transactions to T-accounts for Raw material Inventory, Work in process Inventory, Finished Goods Inventory, and Cost Of goods Solds. C.Prepare a schedule of cost of goods manufactured for August using actual costing. d.Prepare an income statement, including a detailed schedule of cost of goods sold.

Chapter5: Process Costing

Section: Chapter Questions

Problem 4PA: During March, the following costs were charged to the manufacturing department: $14886 for...

Related questions

Question

100%

Transcribed Image Text:If You Company had the following account

balances as of August 1, 2018:

Raw Material (direct & indirect) inventory

$20,300

Work in Process Inventory

7,000

Finished Goods Inventory

18,000

Purchased $164,000 of raw material on account.

Issued $180,000 of raw material of which $134,000 was direct

to the product.

Accrued factory payroll of $88,000; $62,000 was for direct labor and the rest was for

supervisors' salaries.

Accrued utility cost of $7,000; of these costs $1600 were fixed.

Accrued property taxes on the factory in the amount of $2,000.

Had prepaid insurance of $1,600 on factory equipment that expired in August.

Had straight line depreciation on factory equipment of $40,000.

Applied actual overhead to Work Process Inventory.

Transferred goods costing $320,000 to Finished Goods Inventory.

Had total sales on account of $70,000.

Had cost of goods sold of $330,000.

Had selling and administrative costs of $280,000 (credit Various accounts).

Had ending work in progress inventory of $5600.

Required:

a.Journalize the transactions for August.

b.Post transactions to T-accounts for Raw material Inventory, Work in process Inventory, Finished Goods

Inventory, and Cost Of goods Solds.

C.Prepare a schedule of cost of goods manufactured for August using actual costing.

d.Prepare an income statement, including a detailed schedule of cost of goods sold.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 13 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning