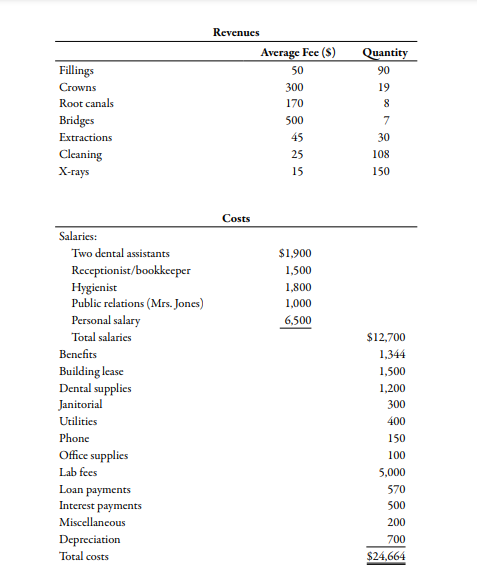

Revenues Average Fee ($) Quantity Fillings 50 90 Crowns 300 19 Root canals 170 8 Bridges 500 7 Extractions 45 30 Cleaning X-rays 25 108 15 150 Costs Salaries: Two dental assistants $1,900 Receptionist/bookkeeper Hygienist Public relations (Mrs. Jones) 1,500 1,800 1,000 Personal salary 6,500 Total salaries $12,700 Benefits 1,344 Building lease Dental supplies Janitorial 1,500 1,200 300 Utilities 400 Phone 150 Office supplies 100 Lab fees 5,000 570 Loan payments Interest payments 500 Miscellancous 200 Depreciation Total costs 700 $24,664

Dr. Roger Jones is a successful dentist but is experiencing recurring financial difficulties. For

example, Dr. Jones owns his office building, which he leased to the professional corporation that

housed his dental practice. (He owns all shares in the corporation.) After the corporation’s failure to pay payroll taxes for the past 6 months, however, the Internal Revenue Service is threatening to impound the business and sell its assets. Also, the corporation has had difficulty paying

its suppliers, owing one of them over $200,000 plus interest. In the past, Dr. Jones had borrowed

money on the equity in either his personal residence or his office building, but he has grown

weary of these recurring problems and has hired a local consultant for advice.

According to the consultant, the financial difficulties facing Dr. Jones have been caused by

the absence of proper planning and control. Budgetary control is sorely needed. The following

financial information is available for a typical month:

Benefits include Dr. Jones’s share of social security and a health insurance premium for

all employees. Although all revenues billed in a month are not collected, the cash flowing

into the business is approximately equal to the month’s billings because of collections from

prior months. The office is open Monday through Thursday from 9:00 a.m. to 4:00 p.m. and

on Friday from 9:00 a.m. to 12:30 p.m. A total of 32 hours are worked each week. Additional

hours could be worked, but Dr. Jones is reluctant to do so because of other personal endeavors

that he enjoys.

Dr. Jones has noted that the two dental assistants and receptionist are not fully utilized. He

estimates that they are busy about 65 to 70% of the time. His wife spends about 5 hours each

week on a monthly newsletter that is sent to all patients. She also maintains a birthday list and

sends cards to patients on their birthdays.

Dr. Jones recently attended an informational seminar designed to teach dentists how to

increase their revenues. An idea from that seminar persuaded him to invest in promotion and

public relations (the newsletter and the birthday list).

Required:

1. Prepare a monthly

2. Using the cash budget prepared in Requirement 1 and the information given in the

case, recommend actions to solve Dr. Jones’s financial problems. Prepare a cash budget that reflects these recommendations and demonstrates to him that the problems can

be corrected. Do you think that he will accept your recommendations? Do any of the

behavioral principles discussed in the chapter have a role in this type of setting? Explain.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 5 images