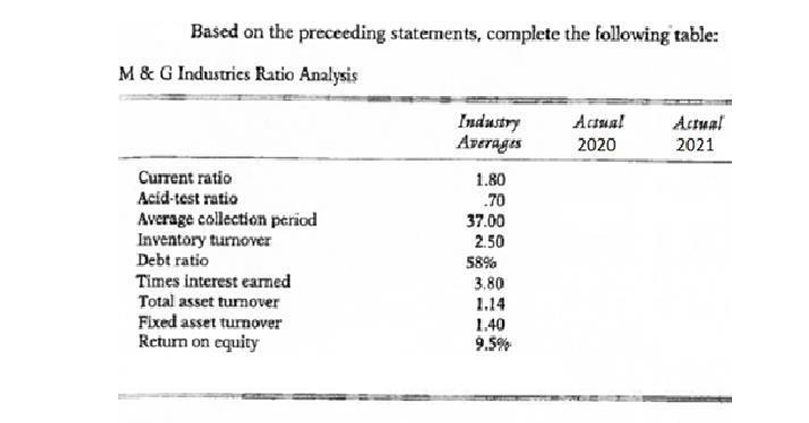

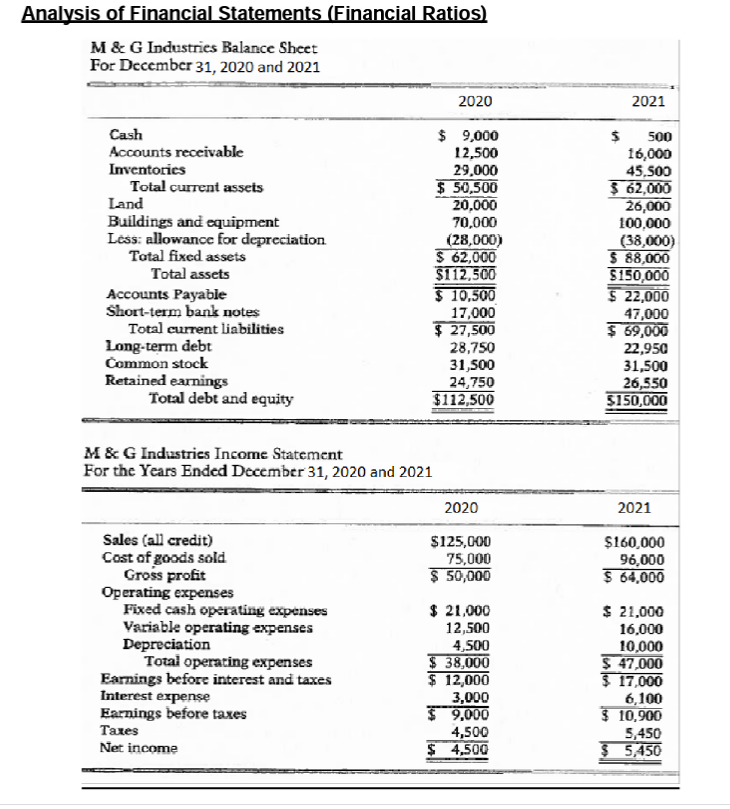

ratios listed on table a for each year (2020 & 2021): a. For each ratio includes the formula with math computes (2020 & 2021) b. . Fill M&G Industries Ratio Analysis Table A. (2020 & 2021) II. Perform the following Analysis: a. Explain each ratio results for 2021 only. b. Compare each ratio performance with the previous year results (compare 2021 results with 2020 results) c. Compare each Ratio results

Instructions:

I. Resolve the ratios listed on table a for each year (2020 & 2021):

a. For each ratio includes the formula with math computes (2020 & 2021)

b. . Fill M&G Industries Ratio Analysis Table A. (2020 & 2021)

II. Perform the following Analysis:

a. Explain each ratio results for 2021 only.

b. Compare each ratio performance with the previous year results (compare 2021 results with 2020 results)

c. Compare each Ratio results for 2021 with their respective Industry average.

III. Base on the previous results, evaluate and explain the Company financial position using the following questions:

1. How liquid is the firm?

2. Is management generating adequate operating profits on the firm’s assets?

3. How is the firm financing its assets?

4. Are the owners (stockholders) receiving an adequate

Step by step

Solved in 2 steps