(ii) The company has two deliver trucks and uses the units of production method to compute the depreciation charges. One of the trucks was purchased for $800,000 on August 1, 2018, and is recognized as truck A. The other which is recognized as truck B was purchased for $1,100,000 on October 1, 2020. The expected useful life of both truck is ten (10) years or 120,000 miles. And the residual value on both trucks is $200,000. In the 2018/2019 financial year truck A drove 12,000 miles, 18,000 miles in 2019/2020, and 21,000 miles in 2020/2021. Truck B drove 8,000 miles in 2020/2021. (iv) Wages earned by employees NOT yet paid amounted to 23,050 at July 31, 2021. (v) A physical count of inventory at July 31, 2021 reveals $165,070 worth of inventory on hand. (vi) At July 31, 2021 $105,000 of the previously unearned sales revenue had been earned. (vii) The aging of the Accounts Receivable schedule at July 31, 2021 indicated that the estimated uncollectible on account receivable should be $29,050. REQUIRED: (A-F) a) Prepare the necessary adjusting journal entries on July 31, 2021. [Narrations are not required] b) Prepare Columbus Ltd multiple-step income statement for the year ended July 31, 2021. c) Prepare Columbus Ltd statement of owner's equity for the year ended July 31, 2021.

(ii) The company has two deliver trucks and uses the units of production method to compute the depreciation charges. One of the trucks was purchased for $800,000 on August 1, 2018, and is recognized as truck A. The other which is recognized as truck B was purchased for $1,100,000 on October 1, 2020. The expected useful life of both truck is ten (10) years or 120,000 miles. And the residual value on both trucks is $200,000. In the 2018/2019 financial year truck A drove 12,000 miles, 18,000 miles in 2019/2020, and 21,000 miles in 2020/2021. Truck B drove 8,000 miles in 2020/2021. (iv) Wages earned by employees NOT yet paid amounted to 23,050 at July 31, 2021. (v) A physical count of inventory at July 31, 2021 reveals $165,070 worth of inventory on hand. (vi) At July 31, 2021 $105,000 of the previously unearned sales revenue had been earned. (vii) The aging of the Accounts Receivable schedule at July 31, 2021 indicated that the estimated uncollectible on account receivable should be $29,050. REQUIRED: (A-F) a) Prepare the necessary adjusting journal entries on July 31, 2021. [Narrations are not required] b) Prepare Columbus Ltd multiple-step income statement for the year ended July 31, 2021. c) Prepare Columbus Ltd statement of owner's equity for the year ended July 31, 2021.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter11: Work Sheet And Adjusting Entries

Section: Chapter Questions

Problem 1PA: The trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as...

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

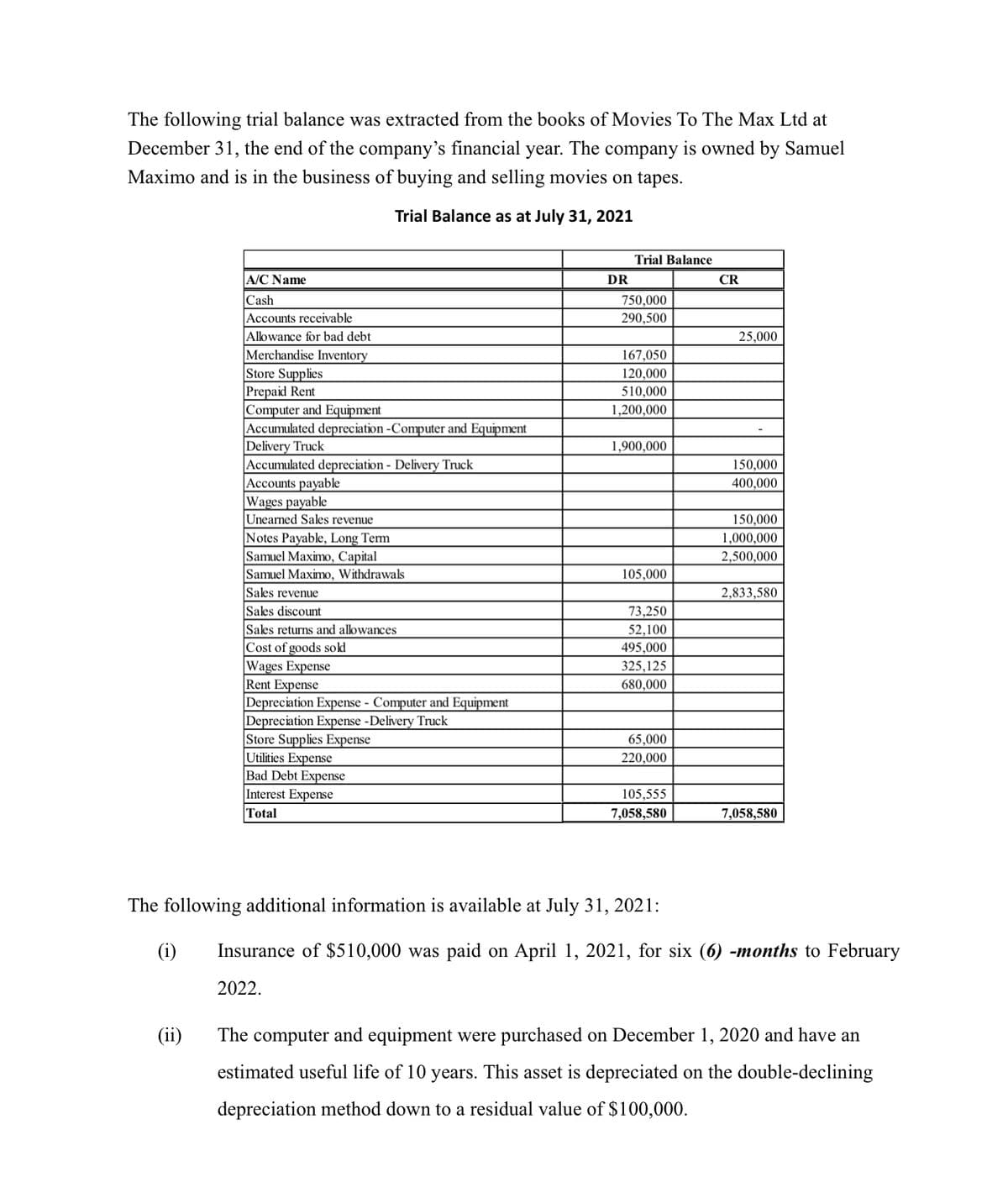

Transcribed Image Text:The following trial balance was extracted from the books of Movies To The Max Ltd at

December 31, the end of the company's financial year. The company is owned by Samuel

Maximo and is in the business of buying and selling movies on tapes.

Trial Balance as at July 31, 2021

Trial Balance

A/C Name

DR

CR

Cash

Accounts receivable

Allowance for bad debt

Merchandise Inventory

Store Supplies

Prepaid Rent

|Computer and Equipment

|Accumulated depreciation -Computer and Equipment

Delivery Truck

|Accumulated depreciation - Delivery Truck

|Accounts payable

Wages payable

Unearned Sales revenue

750,000

290,500

25,000

167,050

120,000

510,000

1,200,000

1,900,000

150,000

400,000

150,000

Notes Payable, Long Term

Samuel Maximo, Capital

Samuel Maximo, Withdrawals

1,000,000

2,500,000

105,000

Sales revenue

2,833,580

Sales discount

73,250

Sales returns and allowances

Cost of goods sokd

Wages Expense

Rent Expense

Depreciation Expense - Computer and Equipment

Depreciation Expense -Delivery Truck

Store Supplies Expense

|Utilities Expense

Bad Debt Expense

Interest Expense

Total

52,100

495,000

325,125

680,000

65,000

220,000

105,555

7,058,580

7,058,580

The following additional information is available at July 31, 2021:

(i)

Insurance of $510,000 was paid on April 1, 2021, for six (6) -months to February

2022.

(ii)

The computer and equipment were purchased on December 1, 2020 and have an

estimated useful life of 10 years. This asset is depreciated on the double-declining

depreciation method down to a residual value of $100,000.

![(iii)

The company has two deliver trucks and uses the units of production method to

compute the depreciation charges. One of the trucks was purchased for $800,000 on

August 1, 2018, and is recognized as truck A. The other which is recognized as truck

B was purchased for $1,100,000 on October 1, 2020. The expected useful life of

both truck is ten (10) years or 120,000 miles. And the residual value on both trucks is

$200,000. In the 2018/2019 financial year truck A drove 12,000 miles, 18,000 miles

in 2019/2020, and 21,000 miles in 2020/2021. Truck B drove 8,000 miles in

2020/2021.

(iv)

Wages earned by employees NOT yet paid amounted to 23,050 at July 31, 2021.

(v)

A physical count of inventory at July 31, 2021 reveals $165,070 worth of inventory

on hand.

(vi)

At July 31, 2021 $105,000 of the previously unearned sales revenue had been

earned.

(vii)

The aging of the Accounts Receivable schedule at July 31, 2021 indicated that the

estimated uncollectible on account receivable should be $29,050.

REQUIRED: (A-F)

а)

Prepare the necessary adjusting journal entries on July 31, 2021. [Narrations are not

required]

b)

Prepare Columbus Ltd multiple-step income statement for the year ended July 31, 2021.

c)

Prepare Columbus Ltd statement of owner's equity for the year ended July 31, 2021.

d)

Prepare Columbus Ltd classified balance sheet at July 31, 2021.

e)

Prepare the closing entries

f)

Prepare the post-closing trial balance](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F099adb52-7f28-4b31-b5b1-4b1a0870993f%2Fb665662d-1c1c-44f3-b567-c14abaefcdd1%2Frw1hlrk_processed.jpeg&w=3840&q=75)

Transcribed Image Text:(iii)

The company has two deliver trucks and uses the units of production method to

compute the depreciation charges. One of the trucks was purchased for $800,000 on

August 1, 2018, and is recognized as truck A. The other which is recognized as truck

B was purchased for $1,100,000 on October 1, 2020. The expected useful life of

both truck is ten (10) years or 120,000 miles. And the residual value on both trucks is

$200,000. In the 2018/2019 financial year truck A drove 12,000 miles, 18,000 miles

in 2019/2020, and 21,000 miles in 2020/2021. Truck B drove 8,000 miles in

2020/2021.

(iv)

Wages earned by employees NOT yet paid amounted to 23,050 at July 31, 2021.

(v)

A physical count of inventory at July 31, 2021 reveals $165,070 worth of inventory

on hand.

(vi)

At July 31, 2021 $105,000 of the previously unearned sales revenue had been

earned.

(vii)

The aging of the Accounts Receivable schedule at July 31, 2021 indicated that the

estimated uncollectible on account receivable should be $29,050.

REQUIRED: (A-F)

а)

Prepare the necessary adjusting journal entries on July 31, 2021. [Narrations are not

required]

b)

Prepare Columbus Ltd multiple-step income statement for the year ended July 31, 2021.

c)

Prepare Columbus Ltd statement of owner's equity for the year ended July 31, 2021.

d)

Prepare Columbus Ltd classified balance sheet at July 31, 2021.

e)

Prepare the closing entries

f)

Prepare the post-closing trial balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College