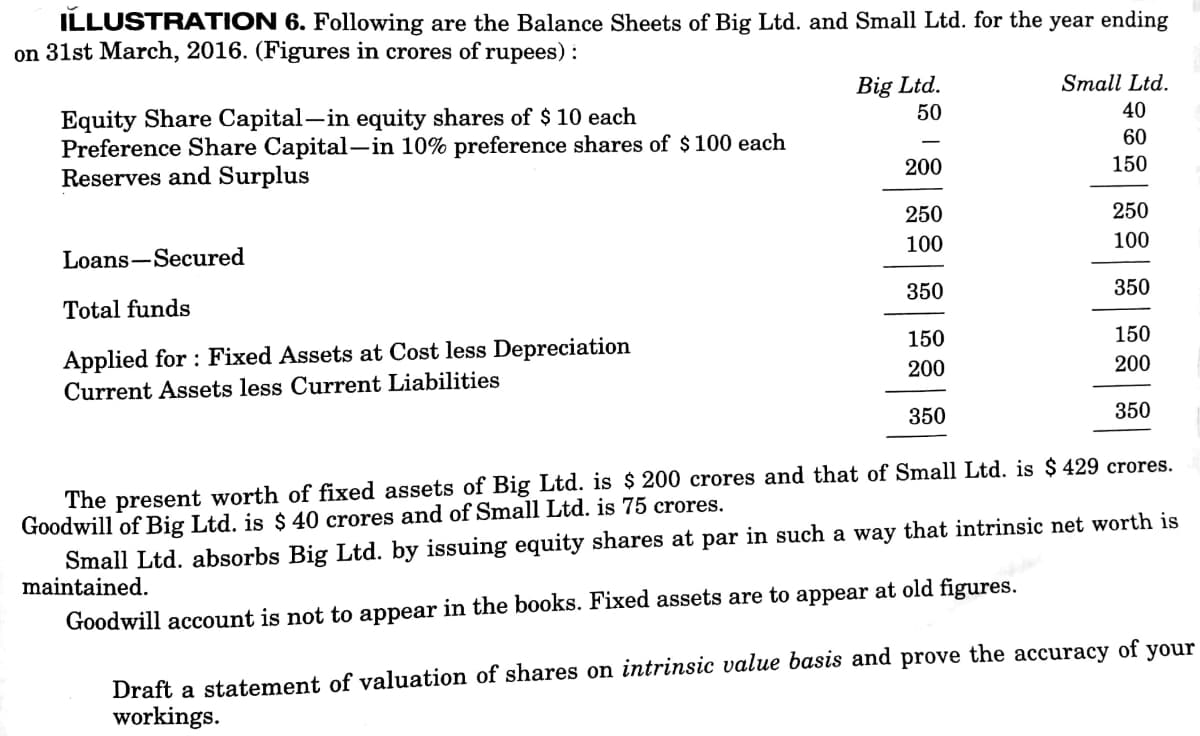

ILLUSTRATION 6. Following are the Balance Sheets of Big Ltd. and Small Ltd. for the year ending on 31st March, 2016. (Figures in crores of rupees) : Big Ltd. 50 Small Ltd. Equity Share Capital-in equity shares of $ 10 each Preference Share Capital-in 10% preference shares of $ 100 each Reserves and Surplus 40 60 200 150 250 250 Loans-Secured 100 100 Total funds 350 350 Applied for : Fixed Assets at Cost less Depreciation Current Assets less Current Liabilities 150 150 200 200 350 350 The present worth of fixed assets of Big Ltd. is $ 200 crores and that of Small Ltd. is $ 429 crores. Goodwill of Big Ltd. is $ 40 crores and of Small Ltd. is 75 crores. Small Ltd. absorbs Big Ltd. by issuing equity shares at par in such a way that intrinsic net worth is maintained. Goodwill account is not to appear in the books. Fixed assets are to appear at old figures. Draft a statement of valuation of shares on intrinsic value basis and prove the accuracy of workings. your

ILLUSTRATION 6. Following are the Balance Sheets of Big Ltd. and Small Ltd. for the year ending on 31st March, 2016. (Figures in crores of rupees) : Big Ltd. 50 Small Ltd. Equity Share Capital-in equity shares of $ 10 each Preference Share Capital-in 10% preference shares of $ 100 each Reserves and Surplus 40 60 200 150 250 250 Loans-Secured 100 100 Total funds 350 350 Applied for : Fixed Assets at Cost less Depreciation Current Assets less Current Liabilities 150 150 200 200 350 350 The present worth of fixed assets of Big Ltd. is $ 200 crores and that of Small Ltd. is $ 429 crores. Goodwill of Big Ltd. is $ 40 crores and of Small Ltd. is 75 crores. Small Ltd. absorbs Big Ltd. by issuing equity shares at par in such a way that intrinsic net worth is maintained. Goodwill account is not to appear in the books. Fixed assets are to appear at old figures. Draft a statement of valuation of shares on intrinsic value basis and prove the accuracy of workings. your

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 3QE: Following is the shareholders equity section of All-Wood Doors on a day a. Use the financial...

Related questions

Question

Transcribed Image Text:ILLUSTRATION 6. Following are the Balance Sheets of Big Ltd. and Small Ltd. for the year ending

on 31st March, 2016. (Figures in crores of rupees) :

Big Ltd.

50

Small Ltd.

Equity Share Capital-in equity shares of $ 10 each

Preference Share Capital-in 10% preference shares of $ 100 each

Reserves and Surplus

40

60

200

150

250

250

Loans-Secured

100

100

Total funds

350

350

Applied for : Fixed Assets at Cost less Depreciation

Current Assets less Current Liabilities

150

150

200

200

350

350

The present worth of fixed assets of Big Ltd. is $ 200 crores and that of Small Ltd. is $ 429 crores.

Goodwill of Big Ltd. is $ 40 crores and of Small Ltd. is 75 crores.

Small Ltd. absorbs Big Ltd. by issuing equity shares at par in such a way that intrinsic net worth is

maintained.

Goodwill account is not to appear in the books. Fixed assets are to appear at old figures.

Draft a statement of valuation of shares on intrinsic value basis and prove the accuracy of

workings.

your

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning