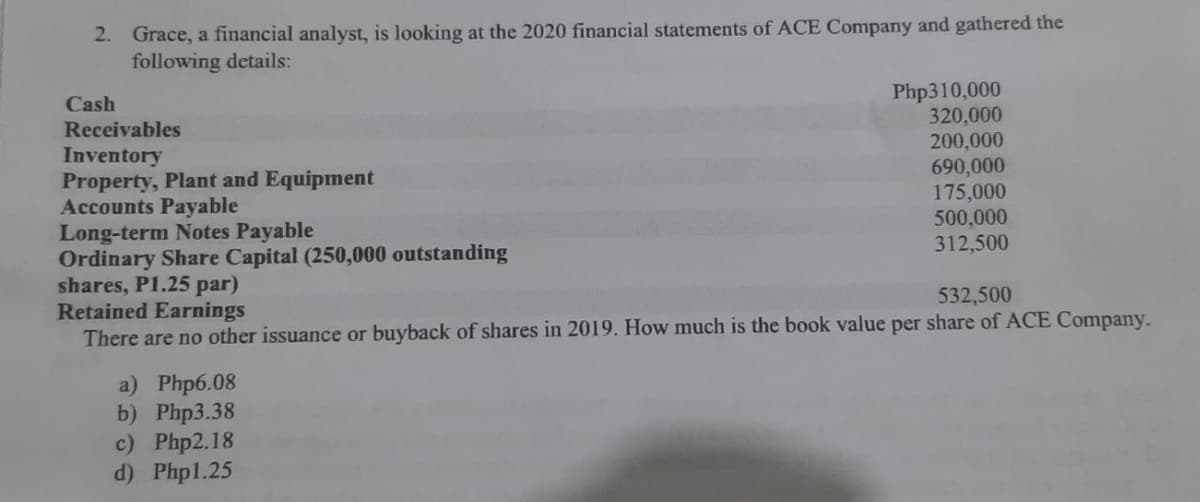

2. Grace, a financial analyst, is looking at the 2020 financial statements of ACE Company and gathered the following details: Php310,000 320,000 200,000 690,000 175,000 500,000 312,500 Cash Receivables Inventory Property, Plant and Equipment Accounts Payable Long-term Notes Payable Ordinary Share Capital (250,000 outstanding shares, P1.25 par) 532,500

2. Grace, a financial analyst, is looking at the 2020 financial statements of ACE Company and gathered the following details: Php310,000 320,000 200,000 690,000 175,000 500,000 312,500 Cash Receivables Inventory Property, Plant and Equipment Accounts Payable Long-term Notes Payable Ordinary Share Capital (250,000 outstanding shares, P1.25 par) 532,500

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 17P: Athenian Venues Inc. just reported the following selected portion of its financial statements for...

Related questions

Question

100%

Transcribed Image Text:2. Grace, a financial analyst, is looking at the 2020 financial statements of ACE Company and gathered the

following details:

Php310,000

320,000

200,000

690,000

175,000

500,000

312,500

Cash

Receivables

Inventory

Property, Plant and Equipment

Accounts Payable

Long-term Notes Payable

Ordinary Share Capital (250,000 outstanding

shares, P1.25 par)

Retained Earnings

There are no other issuance or buyback of shares in 2019. How much is the book value per share of ACE Company.

532,500

a) Php6.08

b) Php3.38

c) Php2.18

d) Phpl.25

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning