Imajor tax cuts 1800 tincreases 500 1600 -avg pretax income of Top 1% avg pretax income of 1400 Top 5% 400 --avg pretax income of Top 10% 1200 -avg. pretax income of Highest Quintile ag pretax income of 1000 All Quintiles 300 Avg federal taes paid by Top 1% 800 *Avg federal taxes paid by Top 5% 600 -Avg. federal taxes paid by Top 10% Avg. federal taxes paid by Highest Quintile 400 100 Avg federal taxes paid by All Quintiles 200 190 1 192 19 1 7 200 2001 2002 20 2004 200s 2006 20 2000 1964 15 19 1 2000 2000 2000 2000 2000 osson years mert 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 g pta nconef Tae 1% s pa ncomeof Tap s tacomeof Tap 10 s peta income oighet Que s pta incomeAQes Ag der padby Tap Aug teders padby Tap Ag der pady Top 10% Aug der pedby Hghest Qune 6 370 22332 5500 S18S S14S S S8 6473 S S04 7314 s211 572 8226 7415 40S 79 330 98126 16 |348 2369 227 238O 2506 2747 259 443 3052 sE 2 45 047 3303 s 343 7 44 12 167 145 11 144 17 204 23 200 1e 2 2305 201 2330 2314 2376 2 270 275 30s 4 S4 1 27 269 7e 20 3745 1403 1367 147 1347 192 2124 2s 1 1as 2 2 14 a 2 247 27 25 213 23 2101 34 613 e11 0s 613 640 e56 4 0 ne 16 08 ee 08 11 20 47 12 03 42 a 2 42 06 a 2034 1793 5 32 2 7 27 222 2734 2475 26 2214 272 275 E 17 45 792 729 S1 S13 2 445 457 S04 S11 S7S 99 645 27 603 S4 26 662 745 3 859 4 S75 101 3 91 795 E 999 1042 1052 18730 423 43 49 es33 20 4 716 726 M 70 2 S19 72 2 7 10 4 1231 1340 e3 1534 1332 1202 122 39462 67 410 4194 9 e4 413 5 456 171 S29 $24 75 avg. pre-tax income in thousands ofS avg. tax payments in thousands of $

Imajor tax cuts 1800 tincreases 500 1600 -avg pretax income of Top 1% avg pretax income of 1400 Top 5% 400 --avg pretax income of Top 10% 1200 -avg. pretax income of Highest Quintile ag pretax income of 1000 All Quintiles 300 Avg federal taes paid by Top 1% 800 *Avg federal taxes paid by Top 5% 600 -Avg. federal taxes paid by Top 10% Avg. federal taxes paid by Highest Quintile 400 100 Avg federal taxes paid by All Quintiles 200 190 1 192 19 1 7 200 2001 2002 20 2004 200s 2006 20 2000 1964 15 19 1 2000 2000 2000 2000 2000 osson years mert 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 g pta nconef Tae 1% s pa ncomeof Tap s tacomeof Tap 10 s peta income oighet Que s pta incomeAQes Ag der padby Tap Aug teders padby Tap Ag der pady Top 10% Aug der pedby Hghest Qune 6 370 22332 5500 S18S S14S S S8 6473 S S04 7314 s211 572 8226 7415 40S 79 330 98126 16 |348 2369 227 238O 2506 2747 259 443 3052 sE 2 45 047 3303 s 343 7 44 12 167 145 11 144 17 204 23 200 1e 2 2305 201 2330 2314 2376 2 270 275 30s 4 S4 1 27 269 7e 20 3745 1403 1367 147 1347 192 2124 2s 1 1as 2 2 14 a 2 247 27 25 213 23 2101 34 613 e11 0s 613 640 e56 4 0 ne 16 08 ee 08 11 20 47 12 03 42 a 2 42 06 a 2034 1793 5 32 2 7 27 222 2734 2475 26 2214 272 275 E 17 45 792 729 S1 S13 2 445 457 S04 S11 S7S 99 645 27 603 S4 26 662 745 3 859 4 S75 101 3 91 795 E 999 1042 1052 18730 423 43 49 es33 20 4 716 726 M 70 2 S19 72 2 7 10 4 1231 1340 e3 1534 1332 1202 122 39462 67 410 4194 9 e4 413 5 456 171 S29 $24 75 avg. pre-tax income in thousands ofS avg. tax payments in thousands of $

Chapter11: Managing Aggregate Demand: Fiscal Policy

Section: Chapter Questions

Problem 1DQ

Related questions

Question

QUESTION 1

-

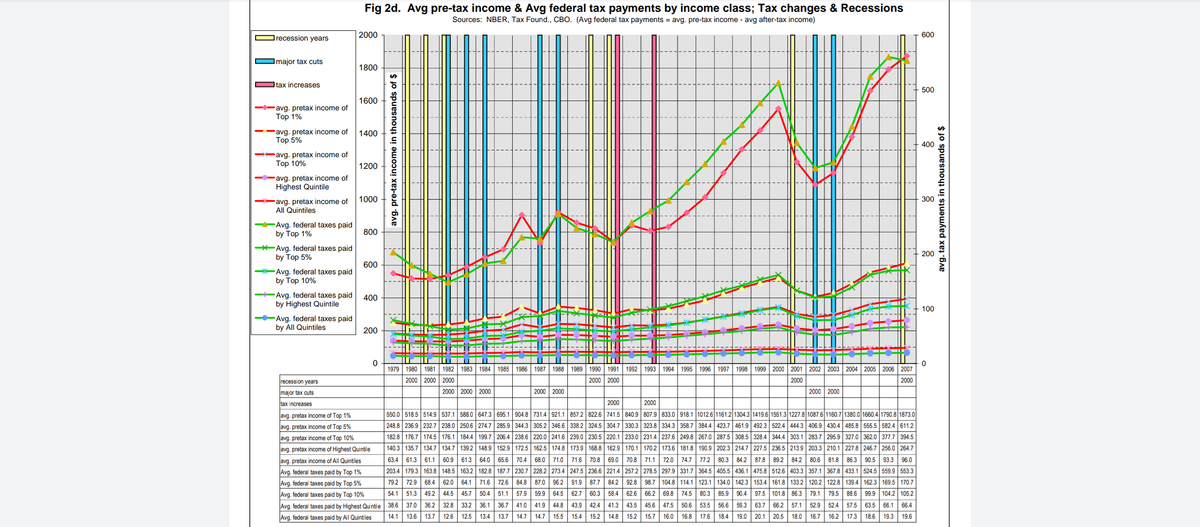

01. Referring to Fig 2d and the attached table, determine whether average pre-tax income of the top 10%, top 5%, top 1% of households by income has increased or decreased in the recession years of 1980-81, 1990-91, and 2001 (as compared to immediately prior year).Increaseddecreased

Transcribed Image Text:Fig 2d. Avg pre-tax income & Avg federal tax payments by income class; Tax changes & Recessions

Sources: NBER, Tax Found., CBO. (Avg federal tax payments = avg. pre-tax income - avg after-tax income)

recession years

2000

600

Imajor tax cuts

1800

Itax increases

500

1600

-avg. pretax income of

Top 1%

--avg. pretax income of

Top 5%

1400

400

-avg. pretax income of

Top 10%

1200

-avg. pretax income of

Highest Quintile

1000

300

-avg. pretax income of

All Quintiles

-Avg. federal taxes paid

by Top 1%

800

Avg. federal taxes paid

by Top 5%

200

600

Avg. federal taxes paid

by Top 10%

Avg. federal taxes paid

by Highest Quintile

400

100

-Avg. federal taxes paid

by All Quintiles

200

1979

1980

1981

1982

1983

1984

1985

1986 1987

1988

1989 1990 1991

1992

1993

1994 1995

1996 1997

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007

recession years

2000 2000 | 2000

2000 2000

2000

2000

major tax cuts

2000 2000 2000

2000 2000

2000 2000

tax increases

2000

2000

avg. pretax income of Top 1%

550.0 518.5 514.9 537.1 588.0 647.3 695.1 904.8 731.4 921.1 857.2 822.6 741.5 840.9 807.9 833.0 918.1 1012.6 1161.2 1304.3 1419.6 1551.3 1227.8 1087.6|1160.7| 1380.0|1660.4 1790.8 1873.0

avg. pretax income

5%

248.8 236.9 232.7 238.0 250.6 274.7 285.9 344.3 305.2 346.6 338.2 324.5 304.7 330.3 323.8 334.3 358.7 384.4 423.7 461.9 492.3 522.4 444.3 406.9 430.4 485.8 555.5 582.4 611.2

182.8 176.7 174.5 176.1 184.4 199.7 206.4 238.6 220.0 241.6 239.0 230.5 220.1 233.0 231.4 237.6 249.8 267.0 287.5 308.5 328.4 344.4 303.1 283.7 295.9 327.0 362.0 377.7 394.5

avg. pretax income of Top 10%

avg. pretax income of Highest Quintile

140.3 135.7 134.7 134.7 139.2 148.9 152.9 172.5 162.5 174.8 173.9 168.8 162.9 170.1 170.2 173.6 181.8 190.9 202.3 214.7 227.5 236.5 213.9 203.3 210.1 227.8 246.7 256.0 264.7

avg. pretax income of All Quintiles

63.4 61.3 | 61.1 60.9 | 61.3

64.0 65.6| 70.4 68.0 71.0 71.6 70.8 69.0 | 70.8 | 71.1| 72.0 74.7 77.2 80.3 84.2 87.8 89.2 | 84.2 | 80.6 81.8 86.3 90.5 93.3 96.0

Avg. federal taxes paid by Top 1%

203.4 179.3 163.8 148.5 163.2 182.8 187.7 230.7 228.2 273.4 247.5 236.6 221.4 257.2 278.5 297.9 331.7 364.5 405.5 436.1 475.8 512.6 403.3 357.1 367.8 433.1 524.5 559.9 553.3

Avg. federal taxes paid by Top 5%

79.2 72.9 68.4 62.0 64.1

71.6 72.6 84.8 87.0 96.2 91.9 | 87.7 84.2 92.8 98.7 104.8 114.1 123.1 134.0 142.3 153.4 161.8 133.2 120.2 122.8 139.4 162.3 169.5 170.7

Avg. federal taxes paid by Top 10%

54.1

51.3

49.2 | 44,5 45,7

50.4 51.1| 57.9

59.9

64.5

62.7 60,3

58.4 62.6

66.2 69.8 74.5 80.3

85.9 90,4 97.5

101.8 86.3 79.1

79.5 88.6 99.9 104.2 105.2

Avg. federal taxes paid by Highest Quintile 38.6 37.0 | 36.2 | 32.8 33.2

36.1 36.7 41.0

41.9

44.8

43.9 42.4 41.3

43.5

45.6 47.5 50.6

53.5 56.6 59.3 63.7

66.2 | 57.1 52.9

52.4 57.5

63.5 66.1| 66.4

Avg. federal taxes paid by All Quintiles

14.1

13.6

13.7

12.6

12.5

13.4 13.7 14.7 14.7

15.5

15.4 15.2 14.8

15.2

15.7

16.0 16.8 17.6

18.4 19.0 20.1

20.5

18.0 16.7

16.2

17.3

18.6

19.3 19.6

avg. pre-tax income in thousands of $

avg. tax payments in thousands of $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax