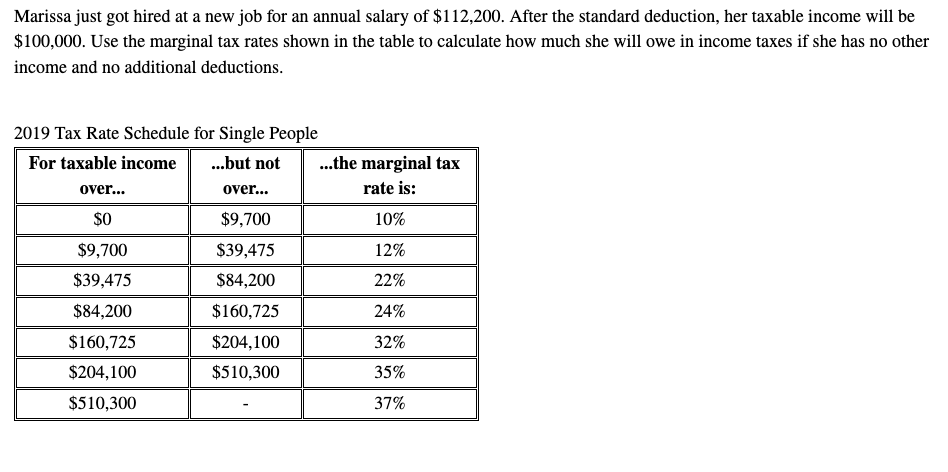

Marissa just got hired at a new job for an annual salary of $112,200. After the standard deduction, her taxable income will be $100,000. Use the marginal tax rates shown in the table to calculate how much she will owe in income taxes if she has no other income and no additional deductions. 2019 Tax Rate Schedule for Single People For taxable income .but not .the marginal tax over... over... rate is: $0 $9,700 10% $9,700 $39,475 12% $39,475 $84,200 22% $84,200 $160,725 24% $160,725 $204,100 32% $204,100 $510,300 35% $510,300 37%

Marissa just got hired at a new job for an annual salary of $112,200. After the standard deduction, her taxable income will be $100,000. Use the marginal tax rates shown in the table to calculate how much she will owe in income taxes if she has no other income and no additional deductions. 2019 Tax Rate Schedule for Single People For taxable income .but not .the marginal tax over... over... rate is: $0 $9,700 10% $9,700 $39,475 12% $39,475 $84,200 22% $84,200 $160,725 24% $160,725 $204,100 32% $204,100 $510,300 35% $510,300 37%

Chapter3: Economic Decision Makers

Section: Chapter Questions

Problem 3.10P

Related questions

Question

Transcribed Image Text:Marissa just got hired at a new job for an annual salary of $112,200. After the standard deduction, her taxable income will be

$100,000. Use the marginal tax rates shown in the table to calculate how much she will owe in income taxes if she has no other

income and no additional deductions.

2019 Tax Rate Schedule for Single People

For taxable income

.but not

.the marginal tax

over...

over...

rate is:

$0

$9,700

10%

$9,700

$39,475

12%

$39,475

$84,200

22%

$84,200

$160,725

24%

$160,725

$204,100

32%

$204,100

$510,300

35%

$510,300

37%

Transcribed Image Text:a. Marissa will pay $

in income taxes.

b. What share of her income would she be paying in taxes?

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Microeconomics: Principles & Policy

Economics

ISBN:

9781337794992

Author:

William J. Baumol, Alan S. Blinder, John L. Solow

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning