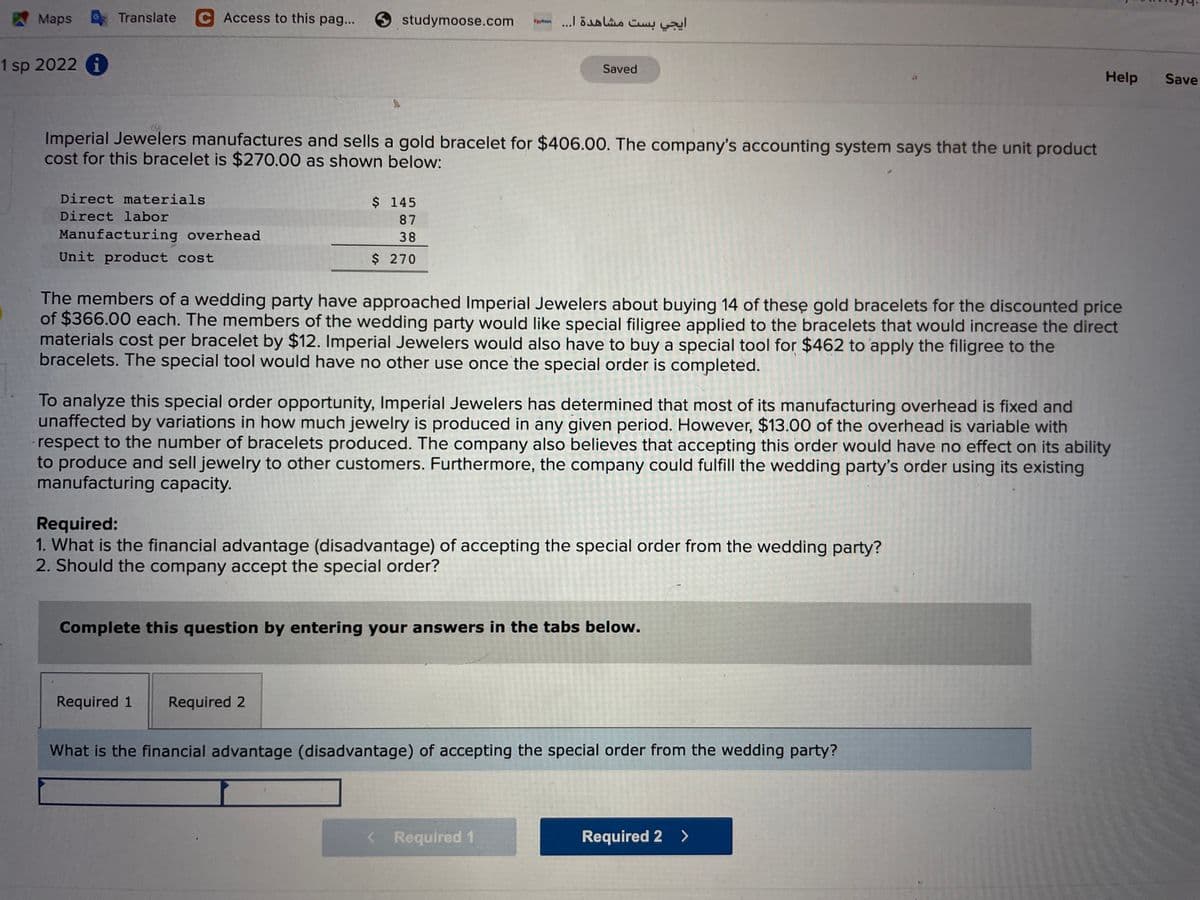

Imperial Jewelers manufactures and sells a gold bracelet for $406.00. The company's accounting system says that the unit product cost for this bracelet is $270.00 as shown below: Direct materials Direct labor $ 145 87 Manufacturing overhead Unit product cost 38 $ 270 The members of a wedding party have approached Imperial Jewelers about buying 14 of these gold bracelets for the discounted price of $366.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $12. Imperial Jewelers would also have to buy a special tool for $462 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $13.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing

Imperial Jewelers manufactures and sells a gold bracelet for $406.00. The company's accounting system says that the unit product cost for this bracelet is $270.00 as shown below: Direct materials Direct labor $ 145 87 Manufacturing overhead Unit product cost 38 $ 270 The members of a wedding party have approached Imperial Jewelers about buying 14 of these gold bracelets for the discounted price of $366.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct materials cost per bracelet by $12. Imperial Jewelers would also have to buy a special tool for $462 to apply the filigree to the bracelets. The special tool would have no other use once the special order is completed. To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and unaffected by variations in how much jewelry is produced in any given period. However, $13.00 of the overhead is variable with respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 2EA: Marx Corp. purchases 135 fax machines on credit from a manufacturer on April 7 at a price of $250...

Related questions

Question

Transcribed Image Text:Maps Translate

C Access to this pag...

9 studymoose.com

ایجي بست مشاهدة ا. . . ۲a

1 sp 2022 i

Saved

Help

Save

Imperial Jewelers manufactures and sells a gold bracelet for $406.00. The company's accounting system says that the unit product

cost for this bracelet is $270.00 as shown below:

Direct materials

$ 145

Direct labor

87

Manufacturing overhead

38

Unit product cost

$ 270

The members of a wedding party have approached Imperial Jewelers about buying 14 of these gold bracelets for the discounted price

of $366.00 each. The members of the wedding party would like special filigree applied to the bracelets that would increase the direct

materials cost per bracelet by $12. Imperial Jewelers would also have to buy a special tool for $462 to apply the filigree to the

bracelets. The special tool would have no other use once the special order is completed.

To analyze this special order opportunity, Imperial Jewelers has determined that most of its manufacturing overhead is fixed and

unaffected by variations in how much jewelry is produced in any given period. However, $13.00 of the overhead is variable with

respect to the number of bracelets produced. The company also believes that accepting this order would have no effect on its ability

to produce and sell jewelry to other customers. Furthermore, the company could fulfill the wedding party's order using its existing

manufacturing capacity.

Required:

1. What is the financial advantage (disadvantage) of accepting the special order from the wedding party?

2. Should the company accept the special order?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

What is the financial advantage (disadvantage) of accepting the special order from the wedding party?

<Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning