In 2018, several European couptries were faced with the problem of increasing intation At the same time, unemployment was low, which led to an inorease in real wages If the European central Bank (ECB) wanted to cut inflation, which of the following would do i? Explain your answer. (Check all that apply) OA. H the interest rate is decreased, money will become more expensive: therefore, infiation will eventualy get lower. OB. Ha Central Bank sols govemmental bonds, then the money in the economy is decreased and money gets more expensive countering infalion OC. if the required reserves ratio is decreased, banks wil have more money, leading to lower inflation OD. If the interest rate is increased, money will become more expensive: thorefore, infation will evertualy get lowet DE. Ifa Contral Bank sells govemmental bonds, then the money in the economy is increased and monny gnts more expersive courtering inflation

In 2018, several European couptries were faced with the problem of increasing intation At the same time, unemployment was low, which led to an inorease in real wages If the European central Bank (ECB) wanted to cut inflation, which of the following would do i? Explain your answer. (Check all that apply) OA. H the interest rate is decreased, money will become more expensive: therefore, infiation will eventualy get lower. OB. Ha Central Bank sols govemmental bonds, then the money in the economy is decreased and money gets more expensive countering infalion OC. if the required reserves ratio is decreased, banks wil have more money, leading to lower inflation OD. If the interest rate is increased, money will become more expensive: thorefore, infation will evertualy get lowet DE. Ifa Contral Bank sells govemmental bonds, then the money in the economy is increased and monny gnts more expersive courtering inflation

Brief Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781337091985

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter16: The Influence Of Monetary And Fiscal Policy On Aggregate Demand

Section: Chapter Questions

Problem 6CQQ

Related questions

Question

2

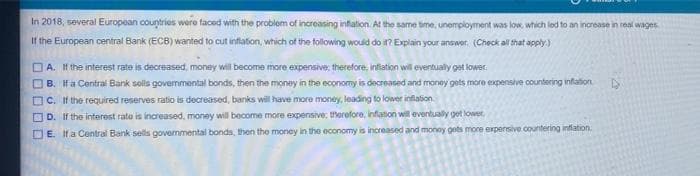

Transcribed Image Text:In 2018, several European countries wero faced with the problem of increasing intation At the same time, unemployment was low, which led to an increase in real wages

If the European central Bank (ECB) wanted to cut inflation, which of the following would do i? Explain your answor, (Check all that apply)

O A. If the interest rate is decreased, money will become more expensive, therefore, infiation will eventualy get lower.

B. Ifa Central Bank solls govermmental bonds, then the money in the economy is decreased and money gets more expensive countering infation

C. If the required reserves ratio is decreased, banks will have more money, leading to lower inflation

D. If the interest rate is increased, money will become more expensive: therefore, infation will eventualy get lower

DE. Ifa Central Bank sels governmental bonds, then the money in the economy is increased and monoy gets more expersive countering inflation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning