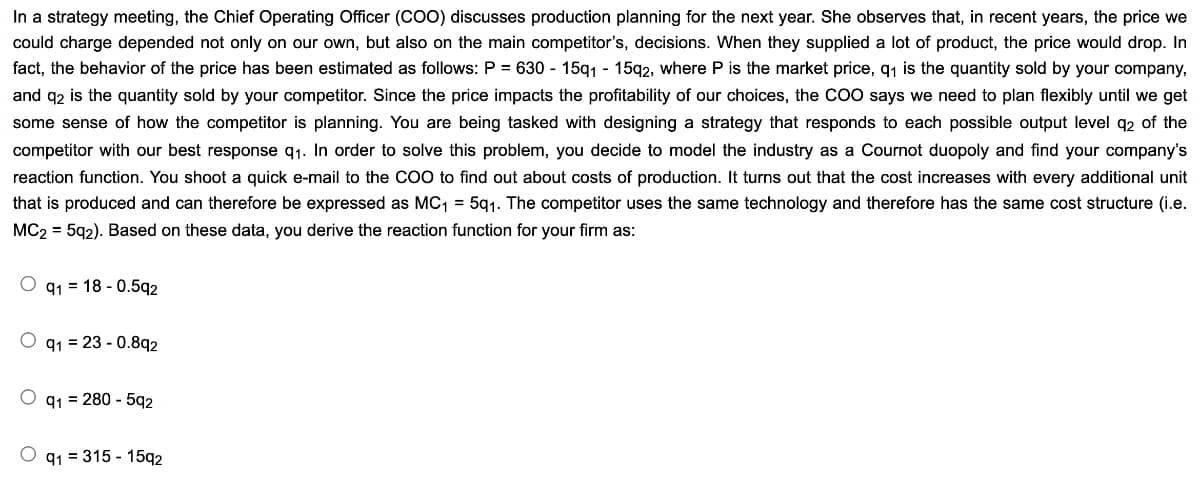

In a strategy meeting, the Chief Operating Officer (COO) discusses production planning for the next year. She observes that, in recent years, the price we could charge depended not only on our own, but also on the main competitor's, decisions. When they supplied a lot of product, the price would drop. In fact, the behavior of the price has been estimated as follows: P = 630 - 15q1 - 15q2, where P is the market price, q₁ is the quantity sold by your company, and q2 is the quantity sold by your competitor. Since the price impacts the profitability of our choices, the COO says we need to plan flexibly until we get some sense of how the competitor is planning. You are being tasked with designing a strategy that responds to each possible output level q2 of the competitor with our best response q₁. In order to solve this problem, you decide to model the industry as a Cournot duopoly and find your company's reaction function. You shoot a quick e-mail to the COO to find out about costs of production. It turns out that the cost increases with every additional unit that is produced and can therefore be expressed as MC₁ = 5q1. The competitor uses the same technology and therefore has the same cost structure (i.e. MC2 5q2). Based on these data, you derive the reaction function for your firm as:

In a strategy meeting, the Chief Operating Officer (COO) discusses production planning for the next year. She observes that, in recent years, the price we could charge depended not only on our own, but also on the main competitor's, decisions. When they supplied a lot of product, the price would drop. In fact, the behavior of the price has been estimated as follows: P = 630 - 15q1 - 15q2, where P is the market price, q₁ is the quantity sold by your company, and q2 is the quantity sold by your competitor. Since the price impacts the profitability of our choices, the COO says we need to plan flexibly until we get some sense of how the competitor is planning. You are being tasked with designing a strategy that responds to each possible output level q2 of the competitor with our best response q₁. In order to solve this problem, you decide to model the industry as a Cournot duopoly and find your company's reaction function. You shoot a quick e-mail to the COO to find out about costs of production. It turns out that the cost increases with every additional unit that is produced and can therefore be expressed as MC₁ = 5q1. The competitor uses the same technology and therefore has the same cost structure (i.e. MC2 5q2). Based on these data, you derive the reaction function for your firm as:

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

1

Transcribed Image Text:In a strategy meeting, the Chief Operating Officer (COO) discusses production planning for the next year. She observes that, in recent years, the price we

could charge depended not only on our own, but also on the main competitor's, decisions. When they supplied a lot of product, the price would drop. In

fact, the behavior of the price has been estimated as follows: P = 630-15q1 - 15q2, where P is the market price, q₁ is the quantity sold by your company,

and q2 is the quantity sold by your competitor. Since the price impacts the profitability of our choices, the COO says we need to plan flexibly until we get

some sense of how the competitor is planning. You are being tasked with designing a strategy that responds to each possible output level q2 of the

competitor with our best response q₁. In order to solve this problem, you decide to model the industry as a Cournot duopoly and find your company's

reaction function. You shoot a quick e-mail to the COO to find out about costs of production. It turns out that the cost increases with every additional unit

that is produced and can therefore be expressed as MC₁ = 5q1. The competitor uses the same technology and therefore has the same cost structure (i.e.

MC2 = 5q2). Based on these data, you derive the reaction function for your firm as:

Oq118 -0.592

O q1 23-0.892

Oq1= 280 - 592

91 = 315 - 1592

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education