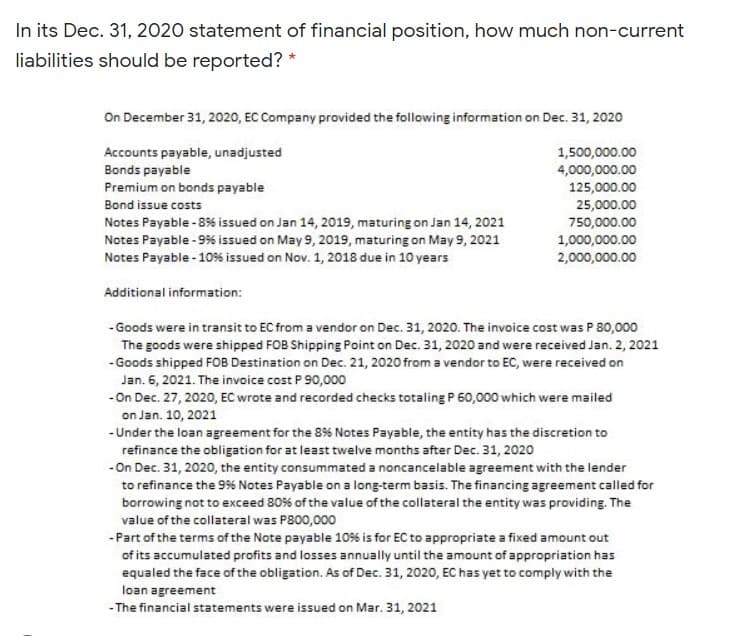

In its Dec. 31, 2020 statement of financial position, how much non-current liabilities should be reported? * On December 31, 2020, EC Company provided the following information on Dec. 31, 2020 Accounts payable, unadjusted Bonds payable Premium on bonds payable 1,500,000.00 4,000,000.00 125,000.00 Bond issue costs Notes Payable - 8% issued on Jan 14, 2019, maturing on Jan 14, 2021 Notes Payable -9% issued on May 9, 2019, maturing on May 9, 2021 Notes Payable -10% issued on Nov. 1, 2018 due in 10 years Additional information: -Goods were in transit to EC from a vendor on Dec. 31, 2020. The invoice cost was P 80,000 The goods were shipped FOB Shipping Point on Dec. 31, 2020 and were received Jan. 2, 2021 -Goods shipped FOB Destination on Dec. 21, 2020 from a vendor to EC, were received on Jan. 6, 2021. The invoice cost P 90,000 -On Dec. 27, 2020, EC wrote and recorded checks totaling P 60,000 which were mailed on Jan. 10, 2021 25,000.00 750,000.00 1,000,000.00 2,000,000.00 -Under the loan agreement for the 8% Notes Payable, the entity has the discretion to refinance the obligation for at least twelve months after Dec. 31, 2020 -On Dec. 31, 2020, the entity consummated a noncancelable agreement with the lender to refinance the 9% Notes Payable on a long-term basis. The financing agreement called for borrowing not to exceed 80% of the value of the collateral the entity was providing. The value of the collateral was P800,000 - Part of the terms of the Note payable 10% is for EC to appropriate a fixed amount out of its accumulated profits and losses annually until the amount of appropriation has equaled the face of the obligation. As of Dec. 31, 2020, EC has yet to comply with the loan agreement -The financial statements were issued on Mar. 31, 2021

In its Dec. 31, 2020 statement of financial position, how much non-current liabilities should be reported? * On December 31, 2020, EC Company provided the following information on Dec. 31, 2020 Accounts payable, unadjusted Bonds payable Premium on bonds payable 1,500,000.00 4,000,000.00 125,000.00 Bond issue costs Notes Payable - 8% issued on Jan 14, 2019, maturing on Jan 14, 2021 Notes Payable -9% issued on May 9, 2019, maturing on May 9, 2021 Notes Payable -10% issued on Nov. 1, 2018 due in 10 years Additional information: -Goods were in transit to EC from a vendor on Dec. 31, 2020. The invoice cost was P 80,000 The goods were shipped FOB Shipping Point on Dec. 31, 2020 and were received Jan. 2, 2021 -Goods shipped FOB Destination on Dec. 21, 2020 from a vendor to EC, were received on Jan. 6, 2021. The invoice cost P 90,000 -On Dec. 27, 2020, EC wrote and recorded checks totaling P 60,000 which were mailed on Jan. 10, 2021 25,000.00 750,000.00 1,000,000.00 2,000,000.00 -Under the loan agreement for the 8% Notes Payable, the entity has the discretion to refinance the obligation for at least twelve months after Dec. 31, 2020 -On Dec. 31, 2020, the entity consummated a noncancelable agreement with the lender to refinance the 9% Notes Payable on a long-term basis. The financing agreement called for borrowing not to exceed 80% of the value of the collateral the entity was providing. The value of the collateral was P800,000 - Part of the terms of the Note payable 10% is for EC to appropriate a fixed amount out of its accumulated profits and losses annually until the amount of appropriation has equaled the face of the obligation. As of Dec. 31, 2020, EC has yet to comply with the loan agreement -The financial statements were issued on Mar. 31, 2021

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 17E: Interest-Bearing and Non-Interest-Bearing Notes On December 11, 2019, Hooper Inc. made a credit sale...

Related questions

Question

a. P 5,490,000

b. P 5,540,000

c. P 5,850,000

d. P 7,850,000

Transcribed Image Text:In its Dec. 31, 2020 statement of financial position, how much non-current

liabilities should be reported? *

On December 31, 2020, EC Company provided the following information on Dec. 31, 2020

Accounts payable, unadjusted

1,500,000.00

4,000,000.00

125,000.00

25,000.00

750,000.00

1,000,000.00

2,000,000.00

Bonds payable

Premium on bonds payable

Bond issue costs

Notes Payable - 856s issued on Jan 14, 2019, maturing on Jan 14, 2021

Notes Payable - 9% issued on May 9, 2019, maturing on May 9, 2021

Notes Payable - 10% issued on Nov. 1, 2018 due in 10 years

Additional information:

-Goods were in transit to EC from a vendor on Dec. 31, 2020. The invoice cost was P 80,000

The goods were shipped FOB Shipping Point on Dec. 31, 2020 and were received Jan. 2, 2021

- Goods shipped FOB Destination on Dec. 21, 2020 from a vendor to EC, were received on

Jan. 6, 2021. The invoice cost P 90,000

- On Dec. 27, 2020, EC wrote and recorded checks totaling P 60,000 which were mailed

on Jan. 10, 2021

-Under the loan agreement for the 8% Notes Payable, the entity has the discretion to

refinance the obligation for at least twelve months after Dec. 31, 2020

-On Dec. 31, 2020, the entity consummated a noncancelable agreement with the lender

to refinance the 9% Notes Payable on a long-term basis. The financing agreement called for

borrowing not to exceed 80% of the value of the collateral the entity was providing. The

value of the collateral was P800,000

-Part of the terms of the Note payable 10% is for EC to appropriate a fixed amount out

of its accumulated profits and losses annually until the amount of appropriation has

equaled the face of the obligation. As of Dec. 31, 2020, EC has yet to comply with the

loan agreement

- The financial statements were issued on Mar. 31, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College