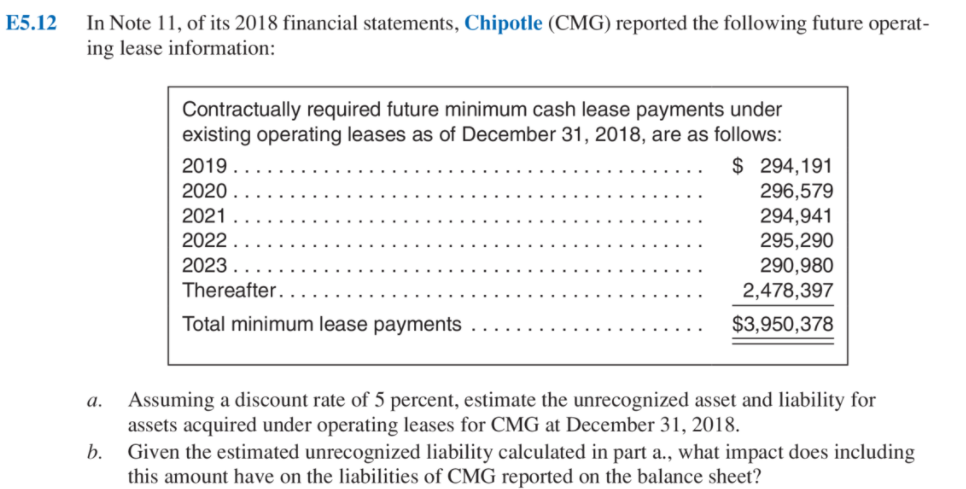

In Note 11, of its 2018 financial statements, Chipotle (CMG) reported the following future operat- ing lease information: Contractually required future minimum cash lease payments under existing operating leases as of December 31, 2018, are as follows: $ 294,191 296,579 2019. . 2020. 2021 294,941 295,290 290,980 2,478,397 2022 . 2023... Thereafter. Total minimum lease payments $3,950,378 Assuming a discount rate of 5 percent, estimate the unrecognized asset and liability for assets acquired under operating leases for CMG at December 31, 2018. Given the estimated unrecognized liability calculated in part a., what impact does including this amount have on the liabilities of CMG reported on the balance sheet? b.

In Note 11, of its 2018 financial statements, Chipotle (CMG) reported the following future operat- ing lease information: Contractually required future minimum cash lease payments under existing operating leases as of December 31, 2018, are as follows: $ 294,191 296,579 2019. . 2020. 2021 294,941 295,290 290,980 2,478,397 2022 . 2023... Thereafter. Total minimum lease payments $3,950,378 Assuming a discount rate of 5 percent, estimate the unrecognized asset and liability for assets acquired under operating leases for CMG at December 31, 2018. Given the estimated unrecognized liability calculated in part a., what impact does including this amount have on the liabilities of CMG reported on the balance sheet? b.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 17MCQ: Which of the following statements regarding the new accounting rules, which take effect in 2019, for...

Related questions

Question

Transcribed Image Text:In Note 11, of its 2018 financial statements, Chipotle (CMG) reported the following future operat-

ing lease information:

E5.12

Contractually required future minimum cash lease payments under

existing operating leases as of December 31, 2018, are as follows:

$ 294,191

296,579

294,941

295,290

2019

2020 .

2021

2022

290,980

2,478,397

2023

Thereafter.

Total minimum lease payments

$3,950,378

a. Assuming a discount rate of 5 percent, estimate the unrecognized asset and liability for

assets acquired under operating leases for CMG at December 31, 2018.

b. Given the estimated unrecognized liability calculated in part a., what impact does including

this amount have on the liabilities of CMG reported on the balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning