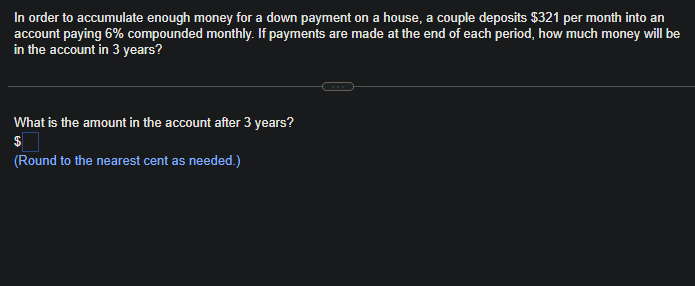

In order to accumulate enough money for a down payment on a house, a couple deposits $321 per month into an account paying 6% compounded monthly. If payments are made at the end of each period, how much money will be in the account in 3 years? What is the amount in the account after 3 years? $ (Round to the nearest cent as needed.)

In order to accumulate enough money for a down payment on a house, a couple deposits $321 per month into an account paying 6% compounded monthly. If payments are made at the end of each period, how much money will be in the account in 3 years? What is the amount in the account after 3 years? $ (Round to the nearest cent as needed.)

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 14PROB

Related questions

Question

Transcribed Image Text:In order to accumulate enough money for a down payment on a house, a couple deposits $321 per month into an

account paying 6% compounded monthly. If payments are made at the end of each period, how much money will be

in the account in 3 years?

What is the amount in the account after 3 years?

$

(Round to the nearest cent as needed.)

Expert Solution

Concept:

The future value of an ordinary annuity is the value of a series of equal payments made at regular intervals at some point in the future. It represents the value of the payments in the future, taking into account the effect of compounding interest. The formula for calculating the future value of an ordinary annuity is:

FV = PMT * [(1 + r)^n - 1] / r

Where:

- FV = future value

- PMT = payment amount

- r = interest rate

- n = number of payments or periods

In other words, the future value of an ordinary annuity represents the amount that a series of equal payments will grow to after a certain number of periods, given a specified interest rate. This formula can be used to calculate the future value of a savings plan, investment, or retirement plan, among other applications.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning