in Ramona Company was $410,000. A) Assume Brankov Company owns 10% of the shares of Ramona Company. Brankov Company considers the investment to be available-for-sale securities. Show the effects of the transactions above on the accounts of Brankov Company using the balance sheet equation. B) Assume Brankov Company owns 25% of the shares of Ramona Company. Show the effects of the transactions above on the accounts of Brankov Company using the balance sheet equation.

in Ramona Company was $410,000. A) Assume Brankov Company owns 10% of the shares of Ramona Company. Brankov Company considers the investment to be available-for-sale securities. Show the effects of the transactions above on the accounts of Brankov Company using the balance sheet equation. B) Assume Brankov Company owns 25% of the shares of Ramona Company. Show the effects of the transactions above on the accounts of Brankov Company using the balance sheet equation.

Chapter8: Consolidated Tax Returns

Section: Chapter Questions

Problem 36P

Related questions

Question

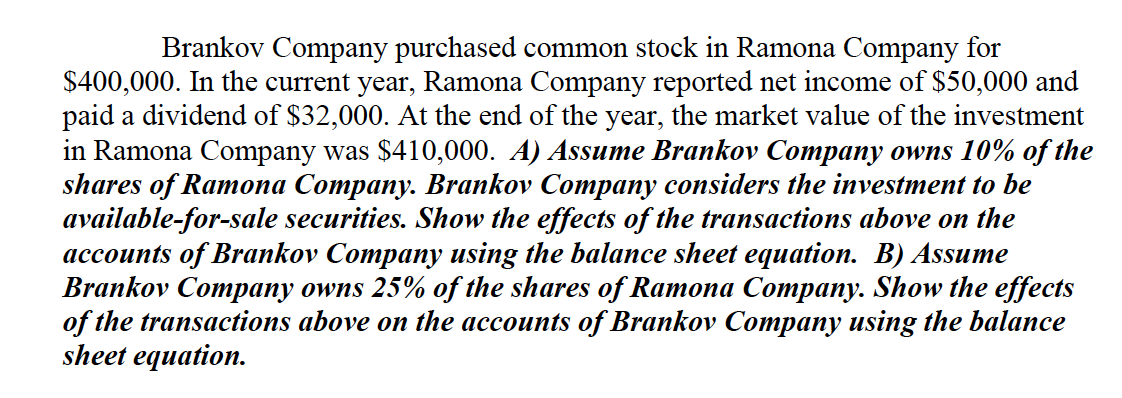

Transcribed Image Text:Brankov Company purchased common stock in Ramona Company for

$400,000. In the current year, Ramona Company reported net income of $50,000 and

paid a dividend of $32,000. At the end of the year, the market value of the investment

in Ramona Company was $410,000. A) Assume Brankov Company owns 10% of the

shares of Ramona Company. Brankov Company considers the investment to be

available-for-sale securities. Show the effects of the transactions above on the

accounts of Brankov Company using the balance sheet equation. B) Assume

Brankov Company owns 25% of the shares of Ramona Company. Show the effects

of the transactions above on the accounts of Brankov Company using the balance

sheet equation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning