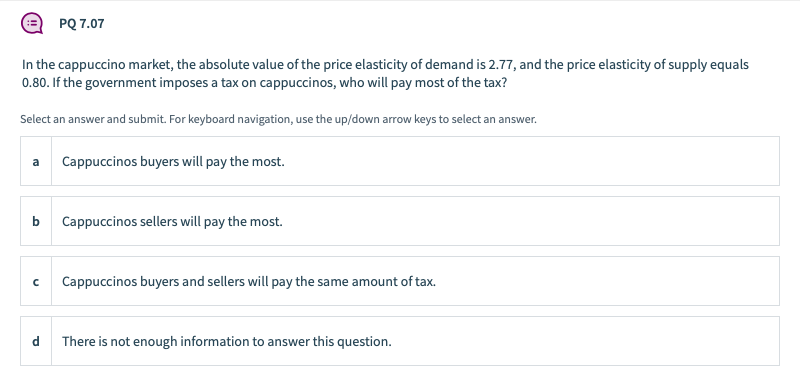

In the cappuccino market, the absolute value of the price elasticity of demand is 2.77, and the price elasticity of supply equals 0.80. If the government imposes a tax on cappuccinos, who will pay most of the tax? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Cappuccinos buyers will pay the most. b Cappuccinos sellers will pay the most. Cappuccinos buyers and sellers will pay the same amount of tax. d There is not enough information to answer this question.

In the cappuccino market, the absolute value of the price elasticity of demand is 2.77, and the price elasticity of supply equals 0.80. If the government imposes a tax on cappuccinos, who will pay most of the tax? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Cappuccinos buyers will pay the most. b Cappuccinos sellers will pay the most. Cappuccinos buyers and sellers will pay the same amount of tax. d There is not enough information to answer this question.

Chapter6: Elasticity

Section: Chapter Questions

Problem 11QP: Suppose you learned that the price elasticity of demand for wheat is 0.7 between the current price...

Related questions

Question

Transcribed Image Text:PQ 7.07

In the cappuccino market, the absolute value of the price elasticity of demand is 2.77, and the price elasticity of supply equals

0.80. If the government imposes a tax on cappuccinos, who will pay most of the tax?

Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer.

a

Cappuccinos buyers will pay the most.

b

Cappuccinos sellers will pay the most.

Cappuccinos buyers and sellers will pay the same amount of tax.

d.

There is not enough information to answer this question.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax