In the graph you've just made, how does a tax on interest income influence the real interest rate and investment? A tax on interest income _______ loanable funds, which _______ the real interest rate and _______ investment. A. decreases the demand for; raises; decreases B. decreases the supply of; raises; decreases C. increases the supply of; lowers; increases D. increases the demand for; lowers; increases

In the graph you've just made, how does a tax on interest income influence the real interest rate and investment? A tax on interest income _______ loanable funds, which _______ the real interest rate and _______ investment. A. decreases the demand for; raises; decreases B. decreases the supply of; raises; decreases C. increases the supply of; lowers; increases D. increases the demand for; lowers; increases

Chapter20: Exchange Rates And The Macroeconomy

Section: Chapter Questions

Problem 3TY

Related questions

Question

In the graph you've just made, how does a tax on interest income influence the real interest rate and investment? A tax on interest income _______ loanable funds, which _______ the real interest rate and _______ investment.

A. decreases the

B. decreases the supply of; raises; decreases

C. increases the supply of; lowers; increases

D. increases the demand for; lowers; increases

Screenshot attached

thanks

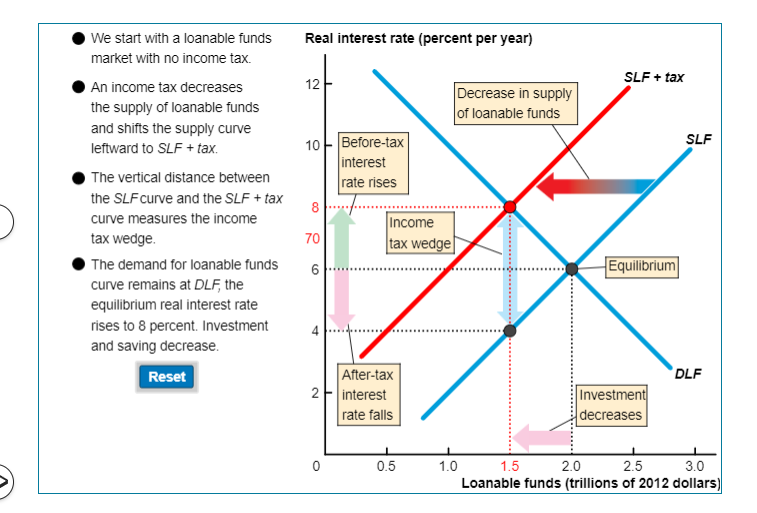

Transcribed Image Text:We start with a loanable funds

market with no income tax.

An income tax decreases

the supply of loanable funds

and shifts the supply curve

leftward to SLF + tax.

The vertical distance between

the SLF curve and the SLF + tax

curve measures the income

tax wedge.

The demand for loanable funds

curve remains at DLF, the

equilibrium real interest rate

rises to 8 percent. Investment

and saving decrease.

Reset

Real interest rate (percent per year)

12

10

8

70

6

2

0

Before-tax

interest

rate rises

Income

tax wedge

After-tax

interest

rate falls

0.5

Decrease in supply

of loanable funds

1.0

SLF + tax

Equilibrium

Investment

decreases

SLF

DLF

1.5

2.0

2.5

3.0

Loanable funds (trillions of 2012 dollars)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you