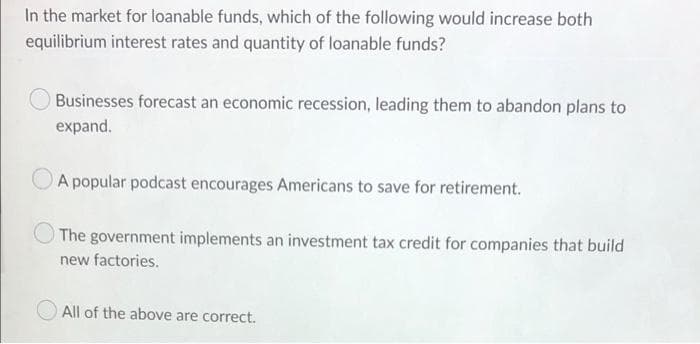

In the market for loanable funds, which of the following would increase both equilibrium interest rates and quantity of loanable funds? Businesses forecast an economic recession, leading them to abandon plans to expand. A popular podcast encourages Americans to save for retirement. The government implements an investment tax credit for companies that build new factories. O All of the above are correct.

In the market for loanable funds, which of the following would increase both equilibrium interest rates and quantity of loanable funds? Businesses forecast an economic recession, leading them to abandon plans to expand. A popular podcast encourages Americans to save for retirement. The government implements an investment tax credit for companies that build new factories. O All of the above are correct.

Chapter21: Financial Markets, Saving, And Investment

Section: Chapter Questions

Problem 6P

Related questions

Question

4

Transcribed Image Text:In the market for loanable funds, which of the following would increase both

equilibrium interest rates and quantity of loanable funds?

Businesses forecast an economic recession, leading them to abandon plans to

expand.

A popular podcast encourages Americans to save for retirement.

The government implements an investment tax credit for companies that build

new factories.

All of the above are correct.

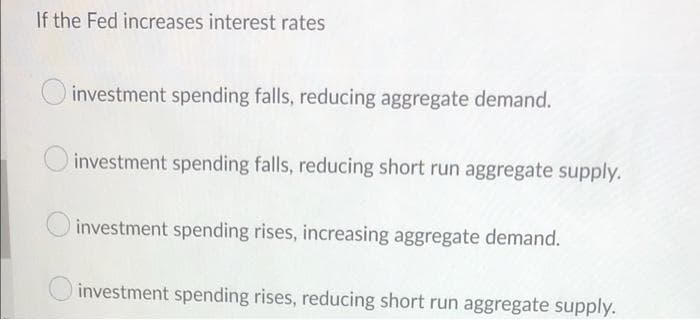

Transcribed Image Text:If the Fed increases interest rates

investment spending falls, reducing aggregate demand.

investment spending falls, reducing short run aggregate supply.

investment spending rises, increasing aggregate demand.

investment spending rises, reducing short run aggregate supply.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning