In the realization process for a partnership if an asset is sold for more than book value that is recorded in the accounting records, select the statement that correctly describes this transaction.

In the realization process for a partnership if an asset is sold for more than book value that is recorded in the accounting records, select the statement that correctly describes this transaction.

Chapter15: Partnership Accounting

Section: Chapter Questions

Problem 10MC: How does a newly formed partnership handle the contribution of previously depreciated assets? A....

Related questions

Question

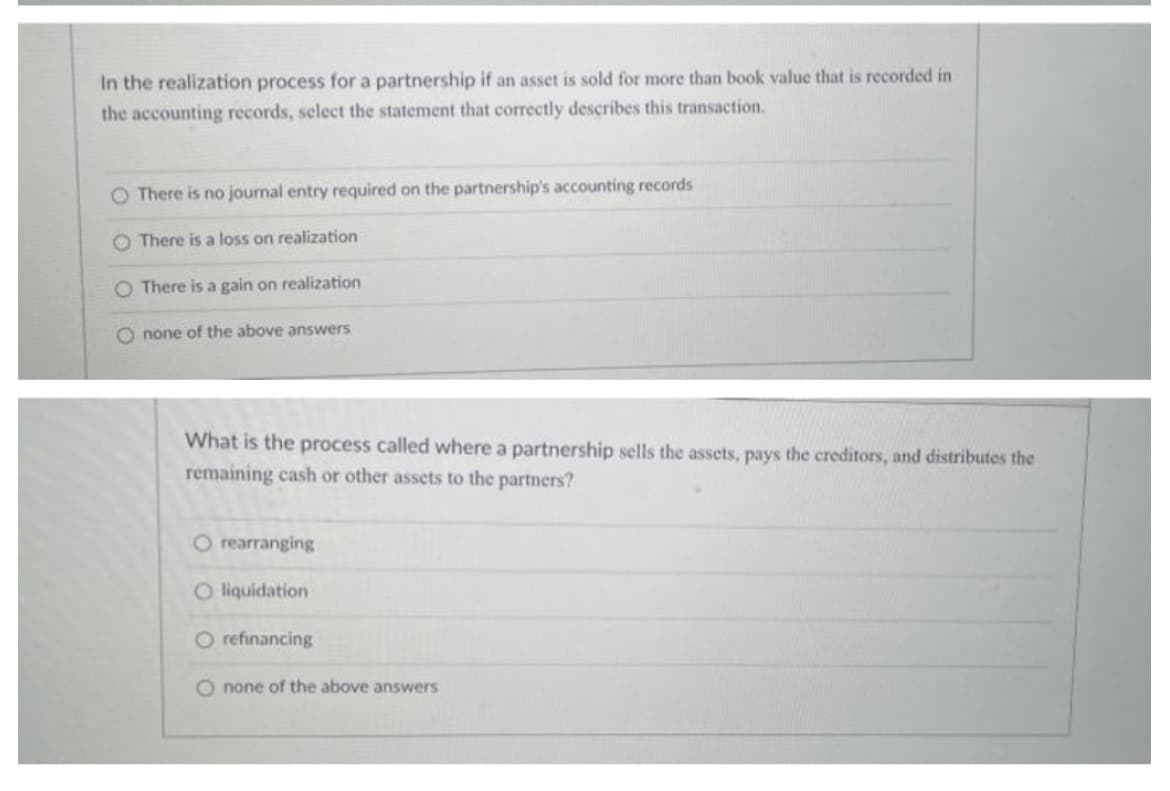

Transcribed Image Text:In the realization process for a partnership if an asset is sold for more than book value that is recorded in

the accounting records, select the statement that correctly describes this transaction.

O There is no journal entry required on the partnership's accounting records

O There is a loss on realization

O There is a gain on realization

O none of the above answers

What is the process called where a partnership sells the assets, pays the creditors, and distributes the

remaining cash or other assets to the partners?

O rearranging

O liquidation

O refinancing

O none of the above answers

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College