Journalize the entries in the partnership accounts for (a) Barton's investment and (b) Fallows's investment. If an amount box does not require an entry, leave it blank.

Journalize the entries in the partnership accounts for (a) Barton's investment and (b) Fallows's investment. If an amount box does not require an entry, leave it blank.

Chapter14: Choice Of Business Entity—operations And Distributions

Section: Chapter Questions

Problem 47P

Related questions

Question

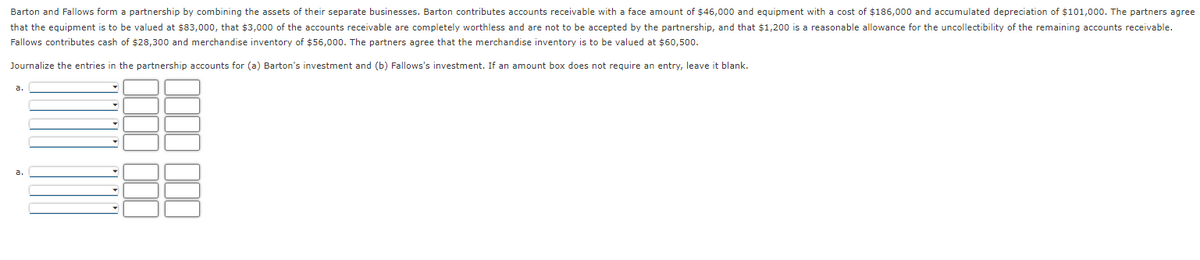

Transcribed Image Text:Barton and Fallows form a partnership by combining the assets of their separate businesses. Barton contributes accounts receivable with a face amount of $46,000 and equipment with a cost of $186,000 and accumulated depreciation of $101,000. The partners agree

that the equipment is to be valued at $83,000, that $3,000 of the accounts receivable are completely worthless and are not to be accepted by the partnership, and that $1,200 is a reasonable allowance for the uncollectibility of the remaining accounts receivable.

Fallows contributes cash of $28,300 and merchandise inventory of $56,000. The partners agree that the merchandise inventory is to be valued at $60,500.

Journalize the entries in the partnership accounts for (a) Barton's investment and (b) Fallows's investment. If an amount box does not require an entry, leave it blank.

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning