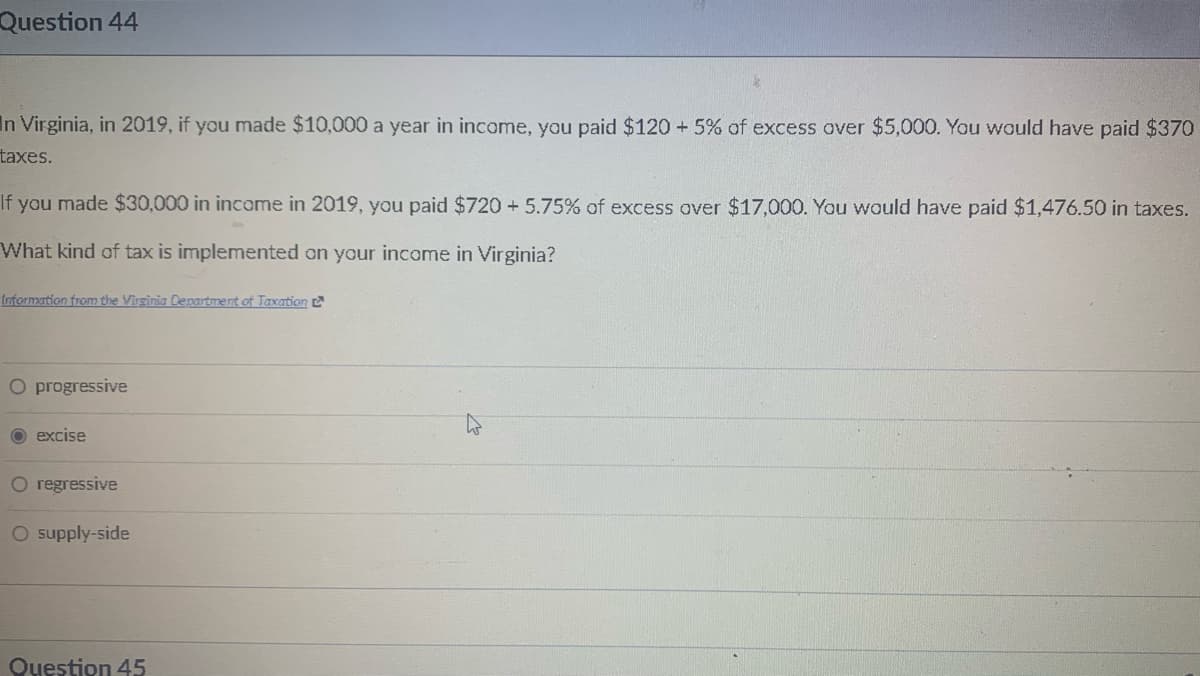

In Virginia, in 2019, if you made $10,000 a year in income, you paid $120 +5% of excess over $5,000. You would have paid $370 taxes. If you made $30,000 in income in 2019, you paid $720 +5.75% of excess over $17,000. You would have paid $1,476.50 in taxes. What kind of tax is implemented on your income in Virginia? Information from the Virginia Denartment of Taxation O progressive excise O regressive O supply-side Question 45

In Virginia, in 2019, if you made $10,000 a year in income, you paid $120 +5% of excess over $5,000. You would have paid $370 taxes. If you made $30,000 in income in 2019, you paid $720 +5.75% of excess over $17,000. You would have paid $1,476.50 in taxes. What kind of tax is implemented on your income in Virginia? Information from the Virginia Denartment of Taxation O progressive excise O regressive O supply-side Question 45

Principles of Microeconomics (MindTap Course List)

8th Edition

ISBN:9781305971493

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter12: The Design Of The Tax System

Section: Chapter Questions

Problem 2PA

Related questions

Question

Transcribed Image Text:Question 44

In Virginia, in 2019, if you made $10,000 a year in income, you paid $120 +5% of excess over $5,000. You would have paid $370

taxes.

If you made $30,000 in income in 2019, you paid $720 +5.75% of excess over $17,000. You would have paid $1,476.50 in taxes.

What kind of tax is implemented on your income in Virginia?

Information from the Virginia Department of Taxation

O progressive

O excise

O regressive

O supply-side

Question 45

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning