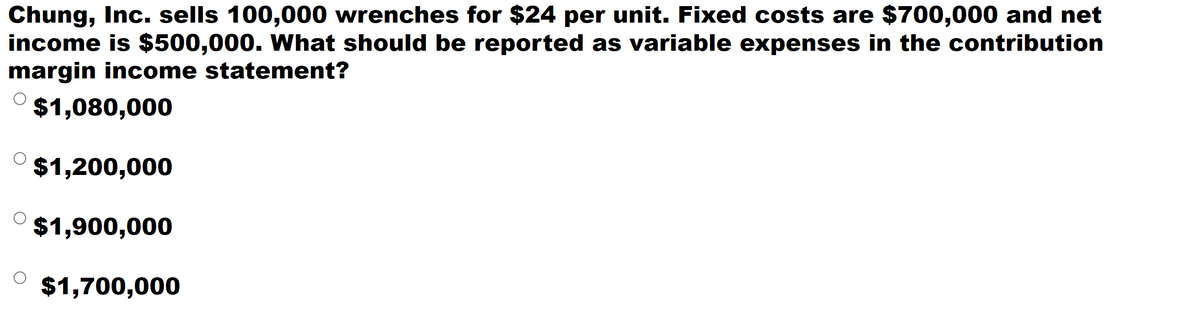

income is $500,000. What should be reported as variable expenses in the contribution margin income statement? $1,080,000 O $1,200,000 $1,900,000 $1,700,000

Q: Oxnard Industries produces a product that requires 2.6 pounds of materials per unit. The allowance…

A: Solution... Standard quantity used = 2.60 pounds Allowances for wastage = 0.30 pounds…

Q: Ralph's Services Adjusted Trial Bal. at Dec. 31/07 Debit Credit Cash $4,300 Accts. Receivable 1,400…

A:

Q: Which of the following woulg not be considered an internal user of accounting data for Apple?…

A: Internal user means the person within the organization and uses the accounting data for decision…

Q: Accounting Tamar Company manufactures a single product in two departments: Forming and Assembly.…

A: The total cost of producing a product, including raw materials and operating costs, is detailed in a…

Q: Bruin Corporation's contribution margin ratio is 75% and its fixed monthly expenses are $45,000.…

A: Description: Contribution margin amount = Sales amount x Contribution margin ratio. Multiplying…

Q: 4. Why should persons interested in reading financial reports of governments and not-for-profit…

A: GASB stands for Governmental Accounting Standards Boards. It is an independent and private sector…

Q: On the break-even chart you can see the three variants of the break-even points. Name the items…

A: The breakeven chart is one which shows the total revenue equals the total cost incurred by the…

Q: what are total budgeted costs

A: Budgets are the estimates or forecasts to be made for future period. Budgeted costs means forecasted…

Q: Explain the term ‘vicarious liability’ and recommend four steps employers can take to meet their…

A: The liabilities mean the state for which someone is personally liable. In simple words, liability is…

Q: The entry to close Dividends would be a. debit Retained Earnings, $2,500, credit Dividends, $2,500…

A: Journal entries refers to the official book of a company which is used to record the day to day…

Q: Which of the following statements regarding a business segment Is false? Multiple Choice A business…

A: Business Segment: It refers to that division of a company that is distinguished by its product; or…

Q: 3.3 Calculate Ms. N. Zama's net salary for the week. The following information is in respect of…

A:

Q: Comparative Balance Sheet December 31, 2020 and 2019 Increase (Decrease) 2020 2019 Amount Percent…

A: Horizontal analysis is a kind of financial statement analysis which is used to compare the data of…

Q: Purvis Manufacturing, which produces a single product, has prepared the following standard cost…

A: The variance is the difference between standard data of production and actual costs incurred for…

Q: Saleem Enterprises is a graphic design company. The accountant needs to prepare the relative journal…

A: A journal entry is a form of accounting entry that is used to report a business transaction in a…

Q: Diane Baumah, a professional artist with AGI in excess of $65,000, made the following donations.…

A: GIVEN Diane Bauman, a professional artist with AGI in excess of $65,000, made the following…

Q: Jennifer Corp.'s defined benefit pension plan had an amendment as of January 1, 2019, that…

A: Defined pension benefit plan is the one under which a specific sum of money is provided to the…

Q: Energy Products Company produces a gasoline additive, Gas Gain. This product increases engine…

A: Variance analysis is defined as the deviations study under which the actual behavior and planned…

Q: Project manager focus on duties and responsibilities while project leader put the right people on…

A: Project managers are in charge of projects from initiation to close, making sure the work gets done…

Q: ere 2,200 units in ending work in process inventory that were 100% complete with regard to material…

A: Solution: Equivalent units represents the portion of work done on a physical unit. These are used to…

Q: avel allowance- 2000 Insurance - 980

A: Given as, Fixed vs variable ratio- 70:30Ctc - 24LBasic- 50%Hra- 22%Da - 12%Travel allowance-…

Q: On January 1, $925,000, 5-year, 10% bonds, were issued for $897,250. Interest is paid semiannually…

A:

Q: When closing income statement accounts having debit balances, which of the following accounts will…

A: In Income Statement expenses has debit balance and Revenue has credit balance. The detailed…

Q: A truck can be purchased for $55,000. Annual O&M costs are expected to increase by $1,800 every…

A: A) Replacement Interval Optimal (1) Equivalent estimated cost of a new machine- a)New machine cost =…

Q: Analysis of Multiple Produc Alo Company produces commercial printers. One is the regular model, a…

A: Break even point is the point where the company has no profit or loss . Thus the contribution margin…

Q: only need total budgeted assets

A: Budgeted assets are those assets which are estimated or forecasted to held for future period of…

Q: Under SSARS the hierarchy in terms of the level of service provided and degree of comfort the…

A: SSARS is an acronym which stands for the statements on standards for accounting and review services,…

Q: ive me answer within 30 min pl

A: According to IAS -16 interest payments made should be expensed in the profit and loss A/C the…

Q: 28,890 Determine the net income (loss) for the period. a. Net income $4,212 Ob. Net loss $4,212 Oc.…

A: Net income is calculated after deducting all the expenses from all the income during the current…

Q: pales Jariable expenses

A: In this question, we have to find out the return on assets. ROA is a financial ratio that tells us…

Q: True or false At the end of the month, the schedule of accounts payable (a list of ending amounts…

A: When goods are purchased on credit then there will be Accounts Payables. These are current…

Q: Question 24 What Securities Act requires a listed company to file an annual report on Form 10K?…

A: A 10-K is a thorough report on a publicly traded company's financial performance that is required by…

Q: FASB update of Entertainment-Films-Other Assets-Film Costs No 2019-02 provides that unamortized film…

A: GIVEN FASB update of Entertainment-Films-Other Assets-Film Costs No 2019-02 provides that…

Q: The interrelationship of business means that all areas of business (including marketing, finance,…

A: Business normally means buying and selling of goods or providing services. Business includes various…

Q: Jaez Corporation is in the process of going through a reorganization. As of December 31, 2020, the…

A:

Q: The following information is provided regarding a company's pension plan: Service cost $640,000…

A: Interest on projected benefit obligation = Projected benefit obligation, Jan. 1 × Interest cost =…

Q: A building with an appraisal value of $132,331 is made available at an offer price of $151,729. The…

A: Note payable is a liability posted to the balance sheet of the company that has to be repaid within…

Q: Your Company sells exercise bikes for $675 each. The following cost formula relates to last year's…

A: Net income is the amount remaining after reducing all the costs and expenses from the sales revenue.…

Q: Edwards Corporation used the following data to evaluate their current operating system. The company…

A: Description: Static budget variance of variable costs: Deduction of Budgeted Variable costs from…

Q: Markus Company’s common stock sold for $4.50 per share at the end of this year. The company paid a…

A: The operating cycle can be defined as the time taken by the company to buy inventories, sell the…

Q: s online recruitment industry trends:

A: Recruitment refers to the process of searching, finding, or hiring the best suitable candidate for…

Q: Discuss the role of International Accounting Standards Board(IASB) in bringing harmonization of…

A: Harmonization is the process of bringing nations' accounting standards and practices closer…

Q: Rosie's Company has three products, P1, P2, and P3. The maximum Rosie's can sell is 85,000 units of…

A: Limiting factor is a constraint which limits the production level based on the shortage of the…

Q: On January 1, 2018, Kefauver Company purchased a piece of equipment for $375,000. The equipment had…

A: 1. Depreciation Expenses - Depreciation Expenses are the expense incurred on the wear and tear of…

Q: our mother invested ₱18,000 in government securities that yield 6% annually for two years.

A: This is a question of Compound Interest: Compound interest (or compounding interest) is the interest…

Q: our Company has two products: A and B. The company uses activity-based costing. The estimated total…

A: Under Activity based costing system, cost is assigned to each activity based on their actual…

Q: Report the total amount paid including par (all coupons and par, total dollar value)

A: Calculations :

Q: SportsWorld purchased equipment costing $10,000. The equipment has a residual value of $1,000, and…

A: Depreciation is charged on assets using various methods. The method of depreciation is dependent on…

Q: For MACRS, goodwill has what useful life

A: MACRS is an acronym and stands for the modified accelerated cost recovery system is a method of…

Q: In the preparation of the worksheet of a merchandising business, the ending balance of the…

A: Merchandise inventory is the current assets, goods purchased or manufactured with the purpose of…

Step by step

Solved in 2 steps

- Kerr Manufacturing sells a single product with a selling price of $600 with variable costs per unit of $360. The companys monthly fixed expenses are $72,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of January when they will sell 500 units. How many units will Kerr need to sell in order to realize a target profit of $120,000? What dollar sales will Kerr need to generate in order to realize a target profit of $120,000? Construct a contribution margin income statement for the month of June that reflects $600,000 in sales revenue for Kerr Manufacturing.Marlin Motors sells a single product with a selling price of $400 with variable costs per unit of $160. The companys monthly fixed expenses are $36,000. What is the companys break-even point in units? What is the companys break-even point in dollars? Prepare a contribution margin income statement for the month of November when they will sell 130 units. How many units will Marlin need to sell in order to realize a target profit of $48,000? What dollar sales will Marlin need to generate in order to realize a target profit of $48.000? Construct a contribution margin income statement for the month of February that reflects $200,000 in sales revenue for Marlin Motors.Maple Enterprises sells a single product with a selling price of $75 and variable costs per unit of $30. The companys monthly fixed expenses are $22,500. What is the companys break-even point in units? What is the companys break-even point in dollars? Construct a contribution margin income statement for the month of September when they will sell 900 units. How many units will Maple need to sell in order to reach a target profit of $45,000? What dollar sales will Maple need in order to reach a target profit of $45,000? Construct a contribution margin income statement for Maple that reflects $150,000 in sales volume.

- Delta Co. sells a product for $150 per unit. The variable cost per unit is $90 and fixed costs are $15,250. Delta Co.s tax rate is 36% and the company wants to earn $44,000 after taxes. What would be Deltas desired pre-tax income? What would be break-even point in units to reach the income goal of $44,000 after taxes? What would be break-even point in sales dollars to reach the income goal of $44000 after taxes? Create a contribution margin income statement to show that the break-even point calculated in B, generates the desired after-tax income.Markson and Sons leases a copy machine with terms that include a fixed fee each month plus acharge for each copy made. Markson made 9,000 copies and paid a total of $480 in January. In April, they paid $320 for 5,000 copies. What is the variable cost per copy if Markson uses the high-low method to analyze costs?Olivian Company wants to earn 420,000 in net (after-tax) income next year. Its product is priced at 275 per unit. Product costs include: Variable selling expense is 14 per unit; fixed selling and administrative expense totals 290,000. Olivian has a tax rate of 40 percent. Required: 1. Calculate the before-tax profit needed to achieve an after-tax target of 420,000. 2. Calculate the number of units that will yield operating income calculated in Requirement 1 above. (Round to the nearest unit.) 3. Prepare an income statement for Olivian Company for the coming year based on the number of units computed in Requirement 2. 4. What if Olivian had a 35 percent tax rate? Would the units sold to reach a 420,000 target net income be higher or lower than the units calculated in Requirement 3? Calculate the number of units needed at the new tax rate. (Round dollar amounts to the nearest dollar and unit amounts to the nearest unit.)

- If a company has fixed costs of $6.000 per month and their product that sells for $200 has a contribution margin ratio of 30%, how many units must they sell in order to break even? A. 100 B. 180 C. 200 D. 2,000Suppose that a company is spending 60,000 per year for inspecting, 30,000 for purchasing, and 40,000 for reworking products. A good estimate of nonvalue-added costs would be a. 70,000. b. 130,000. c. 40,000. d. 90,000. e. 100,000.Starling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200

- Company A wants to earn $5,000 profit in the month of January. If their fixed costs are $10,000 and their product has a per-unit contribution margin of $250, how many units must they sell to reach their target income? A.20 B. 40 C. 60 D. 120A company sells small motors as a component part to automobiles. The Model 101 motor sells for $850 and has per-unit variable costs of $400 associated with its production. The company has fixed expenses of $90,000 per month. In August, the company sold 425 of the Model 101 motors. A. Calculate the contribution margin per unit for the Model 101. B. Calculate the contribution margin ratio of the Model 101. C. Prepare a contribution margin income statement for the month of August.Polaris Inc. manufactures two types of metal stampings for the automobile industry: door handles and trim kits. Fixed cost equals 146,000. Each door handle sells for 12 and has variable cost of 9; each trim kit sells for 8 and has variable cost of 5. Required: 1. What are the contribution margin per unit and the contribution margin ratio for door handles and for trim kits? 2. If Polaris sells 20,000 door handles and 40,000 trim kits, what is the operating income? 3. How many door handles and how many trim kits must be sold for Polaris to break even? 4. CONCEPTUAL CONNECTION Assume that Polaris has the opportunity to rearrange its plant to produce only trim kits. If this is done, fixed costs will decrease by 35,000, and 70,000 trim kits can be produced and sold. Is this a good idea? Explain.